Alamos Gold (TSX: AGI) has extended the life of mine of the Island Gold project to 12 years. The update follows the completion of a base case life of mine plan for the project, which integrates the recently acquired Magino project into the mix.

The plan formally brings together the Island Gold and Magino assets to establish a base case for the operation, with Alamos expecting it to “become one of the largest, lowest-cost, and most profitable gold mines” in the country.

A subsequent expansion study is expected to be released in Q4.

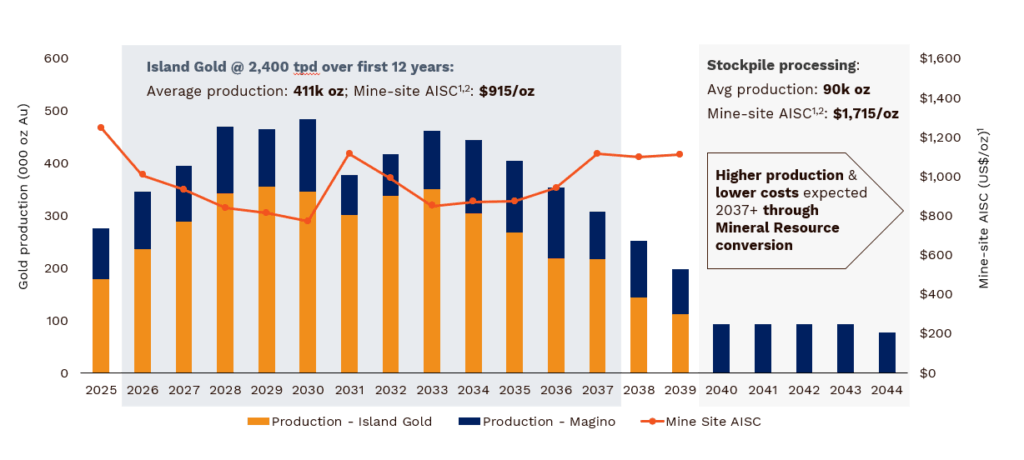

Under the base case scenario, Island Gold is expected to produce 411,000 ounce of gold annually over the next twelve years, starting in 2026. The figure compares to 2025 guidance, which calls for production of between 275,000 and 300,000 ounces at the mine, with the production increase a result of the completion of a phase 3 expansion. Cash costs over that time frame are expected to amount to $581 per ounce, while all in sustaining costs are expected to come in at $915 an ounce over the initial 12 years.

But that twelve year operating timeline is only a portion of the total life of mine left at Island Gold, with the base case scenario calling for the operation to remain viable for at least the next 20 years. Over that time frame, average annual production is expected to come in at 306,000 ounces, with cash costs of $699 an ounce and all in sustaining costs of $1,003 an ounce.

That 20 year estimate is based on mineral resource of 6.3 million ounces at 2.23 g/t gold, and does not factor in mineral resources. Broken out, Island Gold is estimated to contain 4.1 million ounces at 10.85 g/t gold, while Magino is expected to contain 2.2 million ounces at 0.91 g/t.

In terms of capital requirements, the life of mine plan calls for growth capital of $453 million, with the bulk of that to be spent over the next two years as part of a phase 3+ expansion. Sustaining capital is pegged at $1,808 million over the life of mine.

The figures overall lead to a net present value of $4.5 billion for the Island Gold project, based on a gold price of $2,400 an ounce and a 5% discount rate. That figure rises to $6.7 billion at $3,300 an ounce gold.

That base case is built on long-term milling rates of 12,400 tonnes per day, with the expansion study to be released later this year to examine the potential to increase milling to 18,000 to 20,000 tpd. That study will also include an updated reserve estimate, which is expected to see a portion of current resources moved to the reserve category.

“This is a first look at an operation with significant upside potential which we expect to detail in an Expansion Study later this year. We expect this to include a larger Mineral Reserve through ongoing Mineral Resource conversion, and a potential further expansion up to 20,000 tonnes per day, supporting an even larger, more valuable, and profitable operation,” commented John A. McCluskey, CEO of Alamos Gold.

Alamos Gold last traded at $36.36 on the TSX.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.