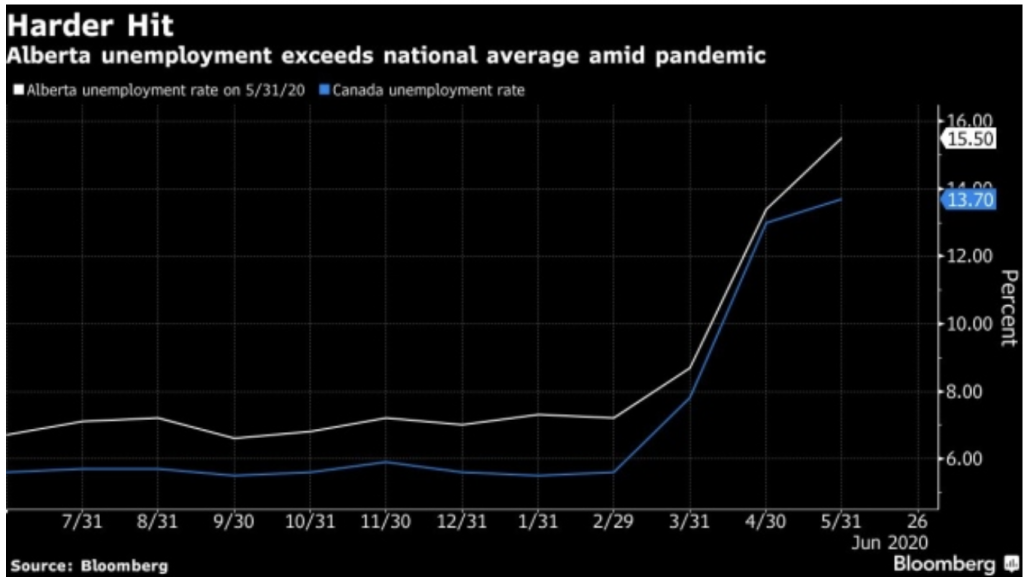

Despite the continued rise in coronavirus cases, the Alberta government has started the economic recovery process as a means of getting out of the coronavirus-induced financial slump. However, in the wake of increased borrowing during the pandemic, the province’s government is now facing an inconvenient setback. The US-based credit rating agency Fitch Ratings has downgraded Alberta’s rating from AA to AA-.

According to Fitch, the credit rating degradation comes amid a sudden spike in government borrowing as a means of softening the negative economic impacts stemming from the coronavirus pandemic. In addition to the debt already accumulated from the initial economic fallout, the forthcoming recovery borrowing will increase Alberta’s debt relative to that of GDP levels. Thus, the resulting debt-to-GDP ratio would no longer coincide with an AA credit rating.

In the meantime, Alberta’s government unveiled a series of plans to jumpstart the economy and begin the post-COVID-19 recovery process. On Monday, the province’s premier Jason Kenny announced an additional $1 billion towards infrastructure, which goes on top of the already pledged $9 billion for building roads, healthcare facilities, and schools. The increase in government spending is meant to stimulate short-run employment.

In addition, Alberta’s Conservative government is planning to reduce corporate income taxes from 12% to 8% as a means of stimulating business growth and make investing in the province more attractive. Alberta’s oil industry for example has been struggling to remain afloat in wake of global oil price wars coupled with a fall in crude oil demand due to the pandemic.

Information for this briefing was found via Bloomberg and CBC News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.