Aleafia Health (TSX: AH) has seen its revenues decline 49% on a quarter over quarter basis. The company this morning reported its third quarter financial results, posting revenues of just $5.0 million and a net loss of $19.8 million for the period ended September 30, 2020. The significant decline in revenue was blamed on lack of available product to sell – despite having $36.9 million worth of inventory at the end of the second quarter.

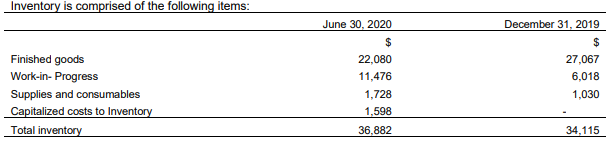

Speaking to the revenues, CEO Geoffrey Benic stated, “With respect to the most recent quarter, the successful sale of our entire 2019 outdoor crop was completed earlier in the year, which led to a significant sequential decline in cannabis revenue, due to lack of available product.” This statement somewhat contradicts the financial statements however, given that at the end of the second quarter the company had total inventory of $36.9 million, of which $22.1 million was classified as finished goods.

Gross profits before fair value adjustments in the third quarter amounted to $0.7 million during the quarter, with operating expenses hitting $11.2 million. Expenses largely consisted of general and administrative expenses of $4.0 million, followed by amortization and depreciation of $3.3 million and wages and benefits of $1.9 million.

Other expenses meanwhile included $3.1 million in interest expenses. Overall the company posted a net loss of $19.8 million for the three month period.

Looking to the balance sheet, the company posted a cash position of $34.6 million, down from $45.4 million in the prior quarter. Inventory meanwhile fell from that $36.9 million figure to $19.3 million, while biological assets climbed from $2.2 million to $17.4 million. Total current assets overall declined from $116.0 million to $101.0 million over the three month period.

Accounts payable meanwhile rose significantly, climbing from $16.5 million to $25.3 million. Convertible debt also rose, climbing to $23.5 million from $22.7 million. Total current liabilities overall came in at $49.6 million, compared to $41.3 million in the prior period.

The company has highlighted that it anticipates the fourth quarter to post significant revenue gains, with $16 million in contracted cannabis sales currently in its pipeline. A majority of that figure is expected to be sold in the fourth quarter.

Aleafia Health last traded at $0.55 on the TSX.

Information for this briefing was found via Sedar and Aleafia Health. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.