On October 21 after the close, Altus Midstream Company (NASDAQ: ALTM), an energy company which owns minority stakes in four natural gas, natural gas liquids and oil pipelines — two of which are underpinned by very attractive, long-term take-or-pay contracts — as well as a midstream gas business, announced it will combine with a larger, similarly positioned private company, BCP Raptor Holdco LP.

The stock market rejected the transaction, sending the stock price of Altus down 17% on October 22 and interrupting a huge one-year run in the stock, despite its solid strategic rationale and the resultant pro forma free cash flow (or distributable cash flow) of perhaps US$10 per Altus share.

The Altus share price decline could create an interesting entry point into a company with strong, predictable cash flows and which pays a US$6.00 annual dividend (equivalent to an 9.7% dividend yield at the current share price) readily supported by these cash flows. If Altus were a member of the S&P 500, it would carry the highest dividend yield in the index.

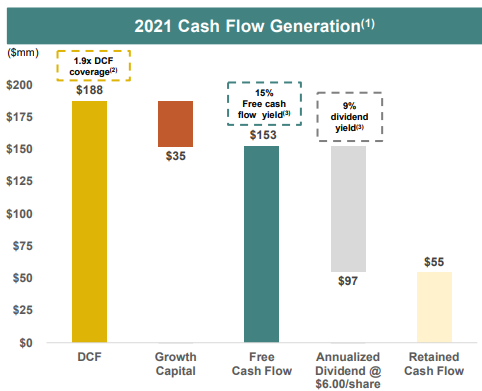

Altus rose from the US$10 level in the early fall of 2020 to just over US$90 a few days ago largely on the basis of its initiating a US$1.50 quarterly dividend program in early November. The move was a surprise to the markets, as many small midstream/pipeline companies retain a large portion of their cash generation to fund growth projects.

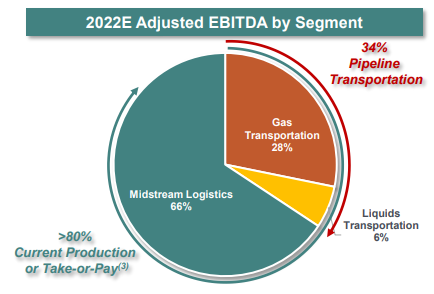

Altus, on the other hand, decided to distribute about two-thirds of its projected free cash flow primarily because of the certainty of its operating cash flow, about 75% of which comes from ownership stakes in heavily contracted pipelines. The company still chose to retain around a third of its free cash flow, providing itself a margin of safety.

As Altus posted solid results in 4Q 2020, 1Q 2021, and 2Q 2021 and continued to pay the US$1.50 quarterly dividend, investors, who are starved for yield in this essentially zero interest rate investment world, bid the stock up to a temporary high in the low-US$90’s and the yield down to 6.6%. Presumably, those same investors were dissatisfied that the merger transaction the company announced on October 21 was not a sale of the company at a significant premium.

According to the transaction with BCP Raptor, Altus will issue 50 million shares to the private company in exchange for its midstream assets and pipeline ownership stakes. The deal brings total shares outstanding for the pro forma company to about 66.5 million, and the pro forma company’s expected enterprise value (EV) to around US$9 billion. The merger is expected to close in 1Q 2022, subject to regulatory approvals.

Management estimates pro forma 2022 adjusted EBITDA will be around US$800 – US$850 million, more than 80% of which stems from pipeline take-or-pay contracts and current midstream production levels. In addition, capital expenditure requirements are modest. All this seems to imply that the resulting 10-11x EV/EBITDA valuation is reasonable. Perhaps more importantly, management committed to maintaining the US$6.00 annual dividend through 2023 and to target annual dividend increases of 5% or more thereafter.

The key point is, based on the solid projected pro forma financials and investors’ continuing need to find “safe” dividend yield plays, Altus’s current dividend yield is too high, and the stock seems likely to be bid higher, bringing its required yield back down perhaps to the low 7% range. If the market were to require the company’s dividend yield to be 7.5%, not the current 8.8%, Altus’ resultant share price would be US$80.

A marked economic downturn could cause the pro forma company’s midstream earnings to turn lower. The cash flow contributions from ownership in pipeline stakes (about 35% of the pro forma company’s projected cash flows) are unlikely to be affected unless a downturn were especially severe.

It appears that Altus shares overreacted to an announced merger agreement that did not fit the precise transaction terms some investors expected. The downturn was likely assisted by stop loss orders, as the trading volume on October 22 was muted, only 320,000 shares. There simply seemed to be no buyers that day. It seems reasonable that Altus shares could gradually retrace much of these losses over the next month.

Altus Midstream Company last traded at US$61.82 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.