Amazon (NASDAQ: AMZN) CEO Andy Jassy’s strategic financial moves this earnings season have garnered widespread praise from investors. The company achieved robust revenue growth in its core e-commerce business while effectively reducing spending.

During his two-year tenure, Jassy has brought a pragmatic approach to Amazon’s operations, resulting in significant changes. He made tough decisions, including firing 27,000 employees, vowing to maintain headcount stability, and reevaluating numerous projects initiated during Jeff Bezos’s leadership.

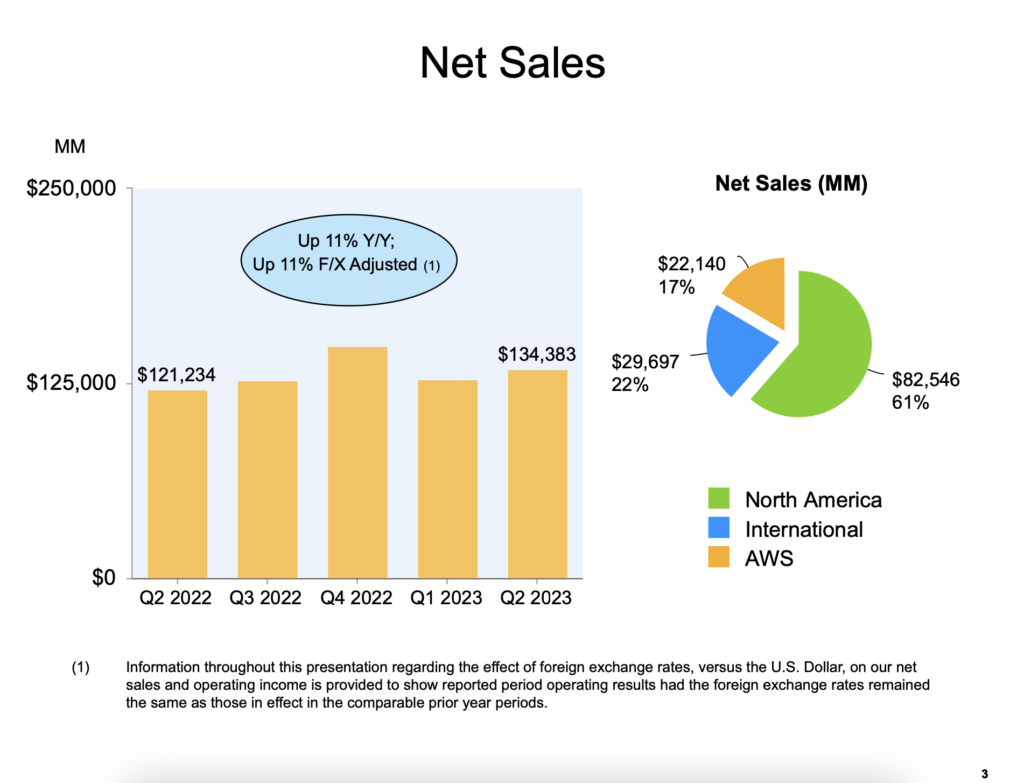

In the recently announced second-quarter results, Amazon’s revenue increased by 11% to $134.4 billion, exceeding expectations, compared to Q1 2023’s $127.4 billion and Q2 2022’s $121.2 billion.

The projected net sales for Q3 2023 are estimated to fall within the range of $138.0 billion to $143.0 billion. This represents a growth rate of approximately 9% to 13% compared to the same quarter in 2022. The provided guidance takes into account the potential positive influence of around 120 basis points due to foreign exchange rates.

The company’s shares surged by approximately 8.8% in premarket trading on Friday.

The company’s strategic cost-cutting efforts proved fruitful, with operating expenses rising at the slowest rate since at least 2012. Operating income more than doubled to $7.7 billion in the quarter compared to last year’s $3.3 billion.

The anticipated operating income for Q3 2023 is estimated to range from $5.5 billion to $8.5 billion, a notable increase compared to the $2.5 billion achieved in the third quarter of 2022.

Amazon, $AMZN, just reported operating income of $7.7 billion, a massive 62% above expectations.

— The Kobeissi Letter (@KobeissiLetter) August 3, 2023

Did Amazon just cancel the recession? pic.twitter.com/30QAYOOyRR

In March, Amazon announced layoffs for around 9,000 workers, following a previously announced series of layoffs that began in November, during which over 18,000 staff across the company’s retail, recruiting, devises and human resources businesses were let go.

With the recession fears subsiding and improved consumer sentiment about the economy and their prospects, Jassy is now planning to reinvest in the business. Amazon aims to strengthen its core online retail operations by doubling the number of facilities capable of same-day order delivery. Additionally, the company is revamping its grocery operation to offer fresh food delivery to customers without Prime subscriptions and better integrate its Fresh and Whole Foods Market chains.

Online stores’ sales rose by 4% to $53 billion, while the cloud business, a major contributor to the company’s operating profit, surpassed expectations and showed signs of stabilization.

The company is increasingly generating revenue from services and advertising provided to independent merchants on its platform. Advertising sales rose by 22% to $10.7 billion, and seller services revenue jumped by 18% to $32.3 billion in the quarter. Chief Financial Officer Brian Olsavsky highlighted that independent merchants’ products represented 60% of all sales on the platform, contributing significantly to the growth of seller-services revenue.

Amazon reported a net income of $6.8 billion, compared to last year’s loss of $2.0 billion. The bottomline translates to 65 cents per share in the second quarter, surpassing market expectations of 35 cents. This marks a significant improvement from the previous year when the company faced losses of 20 cents per share due to a slump in its investment in electric truck maker Rivian Automotive.

“We continued lowering our cost to serve in our fulfillment network, while also providing Prime customers with the fastest delivery speeds we’ve ever recorded,” Jassy said in a statement.

While there were concerns about Amazon Web Services (AWS), the cloud business still performed well, surpassing Wall Street’s revenue expectations. AWS has been investing in generative artificial intelligence products, and despite some analysts claiming Amazon is behind its competitors, the company believes the race has only just begun.

Looking ahead, Amazon faces potential challenges as the Federal Trade Commission is expected to file an antitrust lawsuit against the company, which could take years to resolve.

Information for this briefing was found via The New York Times, Bloomberg, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.