It was around this time last year that we were all gawking at Amazon’s (NASDAQ: AMZN) impressive growth trends during the pandemic, as Covid-19-related lockdowns forced an unprecedented amount of consumers and businesses to make the shift to e-commerce.

With Covid-19 infections rampant throughout 2020, consumers reverted to online shopping in an effort to avoid brick-and-mortar retail stores, which served as a positive advancement for Amazon. Moreover, Amazon’s Web Services also saw its revenue sharply accelerate, amid a surge in demand for various internet services, such as gaming, videostreaming, and work-from-home software.

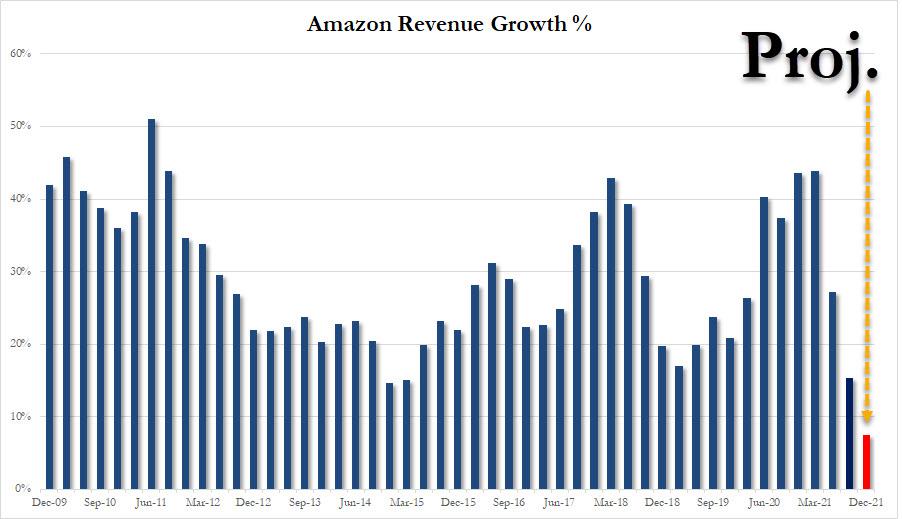

However, with the increased availability of vaccines, businesses began to reopen for in-person shopping, and employees were able to return to physical offices, suggesting that the sharp growth in e-commerce witnessed at the height of the pandemic may not be permanent. With that in mind, investors were not anticipating Amazon to achieve even more impressive figures than last year, but consensus estimates still called for a sales growth of 16.3% to $111.81 billion in the third quarter 2021, and an earnings-per-share of $8.96.

But boy, were they wrong! Amazon’s net sales only rose 15.3% year-over-year to $110.8 billion, with its EPS sharply falling from $12.37 to $6.12. The company’s operating income stood at $4.85 billion, a stark 22% downgrade from last year, and a major miss on estimates calling for $5.62 billion. The e-commerce giant’s net sales from online stores also failed to meet estimates calling for $51.53 billion, instead only rising 3.3% from the third quarter in 2020 to $49.94 billion.

But the trainwreck of an earnings report didn’t stop there: Amazon also unexpectedly slashed its guidance, as even the high-end of expectations failed to meet sell side consensus. According to the e-commerce giant, the fourth quarter will see net sales between $130 billion to $149 billion, missing Wall Street’s forecasts calling for $141.62 billion. Similarly, Amazon’s guidance with respect to operating income is pencilled to fall between $0 billion and $3 billion, which is far worse compared to estimates calling for $7.44 billion. Amazon attributed the less-than-dismal figures to the accumulation of billions of dollars in additional costs before the end of the year.

Amazon’s new CEO Andy Jassy, who recently took control of the reins after billionaire Jeff Bezos stepped down to pursue his space travel ambitions, warned that the upcoming quarter would indeed be ugly. “In the fourth quarter, we expect to incur several billion dollars of additional costs in our Consumer business as we manage through labor supply shortages, increased wage costs, global supply chain issues, and increased freight and shipping costs,” he said. “It’ll be expensive for us in the short term, but it’s the right prioritization for our customers and partners.”

The bad news kept piling on: Amazon’s operating margins slumped from 6.8% in the second quarter to a mere 4.4% between July and and September, marking the lowest level since March 2018. Indeed, rapidly rising prices are eroding at Amazon’s profits, as fulfillment costs grew 26%, marketing expenses were up nearly 50%, and technology and content jumped 31%.

However, not the entirety of the earnings report was all that grim, because the company’s AWS segment saw sales increase 39% from the third quarter of last year to $16.11 billion, against expectations calling for sales of $15.4 billion. In the meantime, Amazon continued to increase its workforce after a slight decline in the first three months of the year, as its number of employees hit a new record of 1.468 million in the third quarter.

Following the earnings report, Amazon’s shares were sent tumbling after hours by nearly 5%.

Information for this briefing was found via Amazon and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.