AMC was up ~15% in early morning trading after it announced that they have raised $230.5 million by selling 8.5 million shares to hedge fund Mudrick Capital Management. This brings their total amount raised via the sale of shares to $900 million, which doesn’t include the ongoing at-the-market offering.

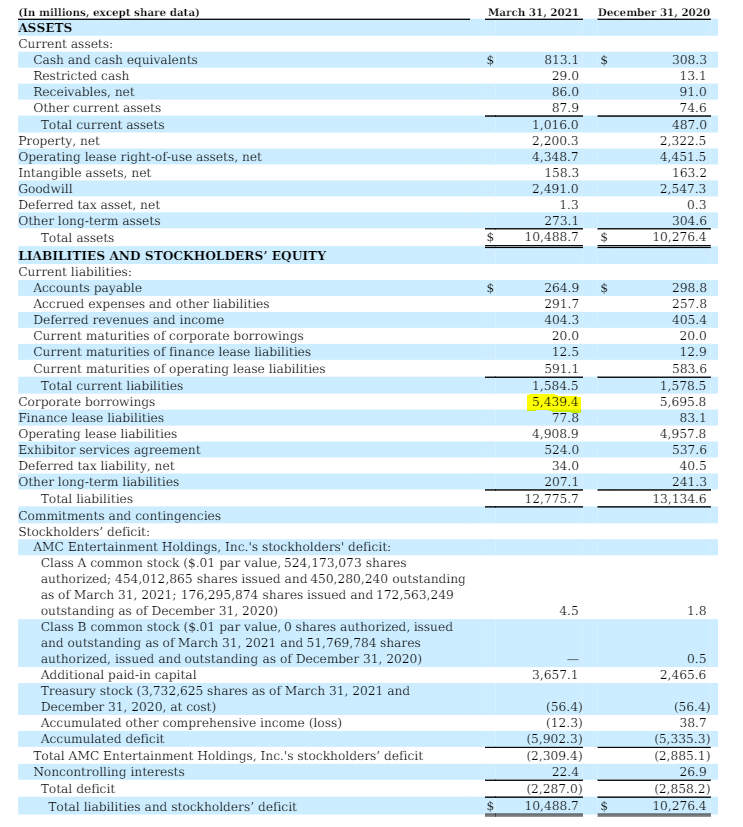

AMC says that they will be using this cash for the “pursuit of value creating acquisitions of additional theatre leases, as well as investments to enhance the consumer appeal of AMC’s existing theatres,” as well as potentially to buy back some of their $5.5 billion in debt.

The raise was conducted at $27.12 a share, which was $1 higher or a ~4% premium than what AMC was trading at on the 28th but it appears those shares are now in the money. It was reported by Bloomberg that Mudrick had made roughly $200 million on its AMC and GME stake back in February.

AMC Entertainment last traded at $29.29 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.