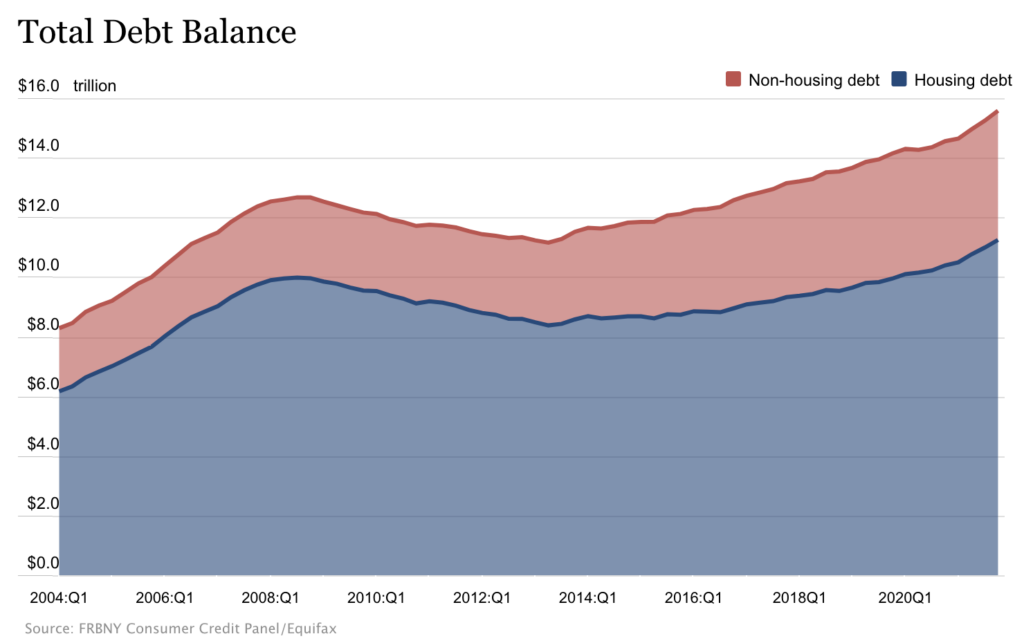

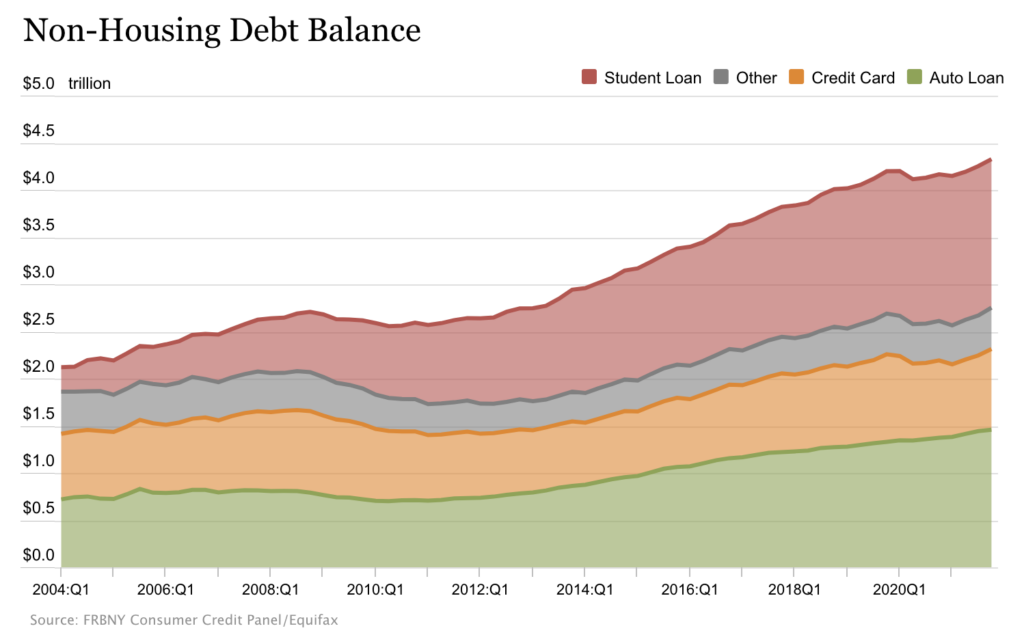

Consumers across America embarked on unprecedented shopping sprees last year, causing total household debt to jump by $1 trillion— the sharpest increase in nearly 15 years.

According to the Federal Reserve Bank of New York’s latest Household Debt and Credit Report, total household debt in the US ballooned to $15.58 trillion last year— the most since 2007, as consumers rushed to buy real estate and vehicles. Mortgage balances accounted for majority of the increase, rising by $258 billion in just the fourth quarter of last year. For the entirety of 2021, consumers borrowed about $4.5 trillion in mortgages, the largest such amount since 1999.

The second-biggest component of household debt were vehicle loans, which rose $181 billion in the final three months of 2021; however, the increase was largely due to Americans purchasing more costly cars, rather than a higher quantity of cars. The report attributes the increase in car-loan borrowing to skyrocketing prices for vehicles, as carmakers faced global supply chain disruptions and semiconductor shortages.

Many American households last year faced substantial financial hardships, with inflation levels reaching 7% in December— the biggest jump in prices in almost 40 years. To make matters worse, median income slumped 3%, forcing consumers to pay even more for basic necessities, such as food and energy.

Information for this briefing was found via the Federal Reserve Bank of New York. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.