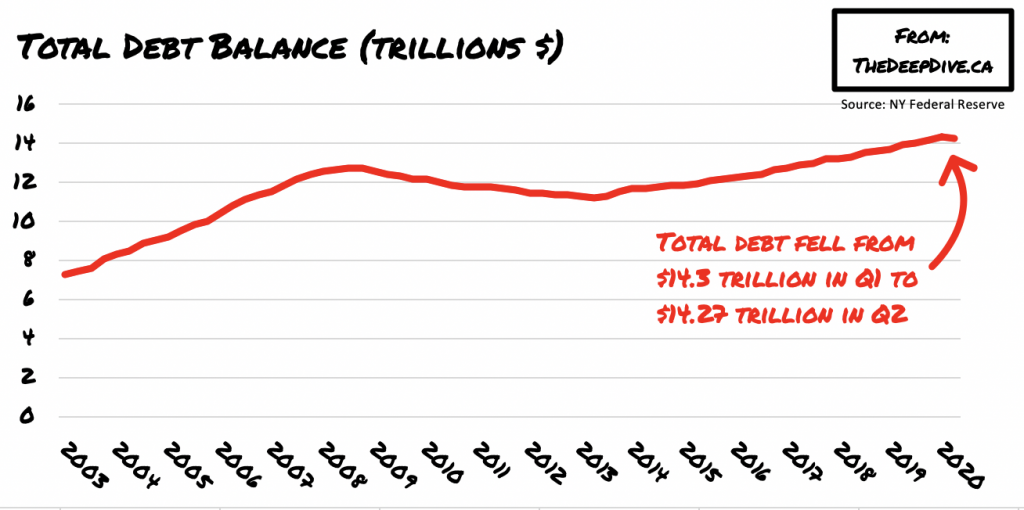

While the coronavirus pandemic forced businesses across the US to shut their doors and millions of Americans to stay at home, total spending suffered a decline, causing credit card balances to fall for the first time in 6 years.

According to data compiled by the New York Federal Reserve, American’s credit card balances dropped by a record $76 billion between April and June. In the second quarter of 2020, total household debt fell by 0.2% to $14.27 trillion; according to the NY Fed’s analysts, such a sudden decline is highly unusual during the spring season – the last time something like this happened was during the Great Recession.

However, not all debt was the subject of reductions amid the pandemic. Mortgage balances increased as many homeowners took advantage of record-low interest rates to refinance their homes. Student loan debt also declined, but at a lower pace as payments on federally-funded loans were put on hold when the CARES Act was imposed.

Albeit the record crop in household debt may come as positive news to some, it also suggests that the economic recovery may not be progressing as swiftly as anticipated. Given that America’s economy is heavily reliant on consumer spending, the reduction in credit card usage amid the federal government’s rampant stimulus spending could further impede the speed of the recovery from the recession.

Information for this briefing was found via NY Federal Reserve. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.