The Bank of Canada is sounding the alarm on the impact of rising interest rates on Canadian households, and the growing stress it’s projecting on the country’s financial system.

A sharp and relatively unexpected rise in interest rates has significantly increased costs for households across Canada, which could turn into the economy’s Achilles heel should a recession transpire. In particular, the central bank is concerned that “elevated interest rates and declining house prices have reduced the financial flexibility of many households.” Indeed, in response to increased mortgage servicing costs, many have turned to credit card debt to the point that it’s surpassing pre-pandemic levels.

Bank of Canada Governor Tiff Macklem stated the transition to higher interest rates poses risks, and vigilance is necessary throughout the transition. Indeed, the median debt service ratio of homeowners— which measures the proportion of household gross income used for mortgage debt repayments, rose to 19% in 2022. Around 30% of new mortgages have households allocating an average of at least 25% of their income to their payments.

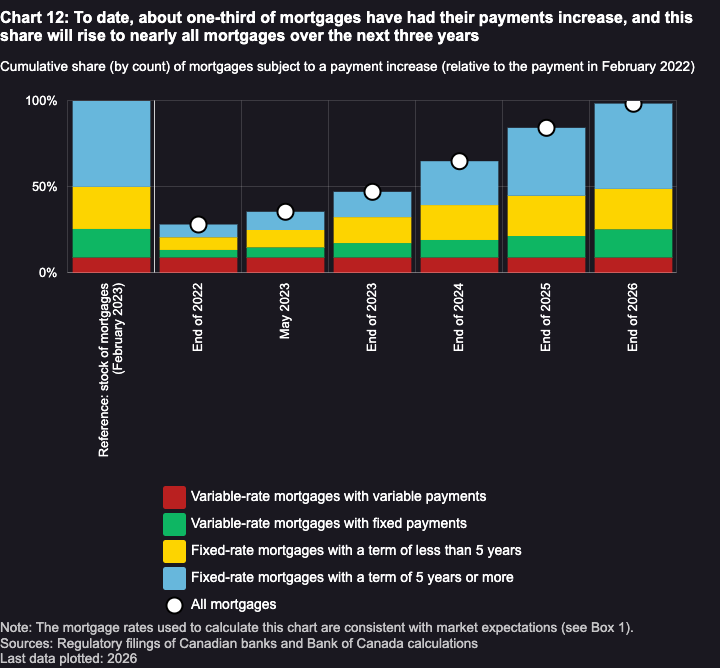

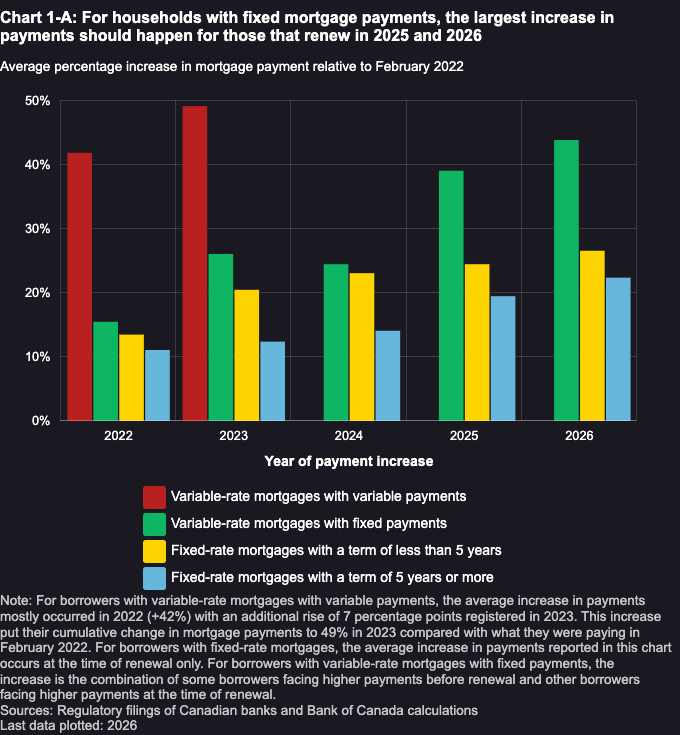

Mortgage payments have increased for one-third of borrowers since February 2022, and all mortgage payments are projected to rise come the 2025/26 renewal year. The surge in costs will primarily affect households with fixed-rate mortgages, whose payments will increase by 20-25% in 2025 or 2026. Borrowers with fixed payments will see a 40% increase, while variable rate holders have already experienced a 50% increase over the past year.

The bank expresses concern over Canadians’ ability to manage their debts during this transition, especially those who bought into the housing market during the COVID-19 pandemic’s pricing peak. Meanwhile, to help mitigate the impact of rising monthly payments, an increasing number of homeowners are extending their mortgage amortization period past 25 years; the proportion of mortgages with an amortization period over 25 years has risen from 34% in 2019 to 46% in 2022.

While the Bank of Canada did not exclude the possibility of increasing its policy rate last month, inflation has continued to rise contrary to expectations. Despite these challenges, Macklem maintains that inflation is decreasing but notes that further effort is needed to reach the 2% target. With inflation risks becoming more apparent, experts suggest that the central bank may be compelled to increase rates again, possibly on June 7.

“The Bank of Canada will likely be forced into hiking rates on June 7 because the upside risks to its inflation projection are materializing and the downside risks have begun to fade,” Monex Canada foreign exchange analyst Jay Zhao-Murray told CTV News.

Information for this briefing was found via the Bank of Canada, CTV News, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.