On February 9, American Lithium Corp. (TSXV: LI), which plans to develop the TLC Lithium Project in the state of Nevada, announced it had reached a friendly agreement to buy Plateau Energy Metals Inc. (TSXV: PLU) for a stated value of $120 million. The valuation represents a 72% premium to Plateau’s volume weighted average price (VWAP) over the previous 20 trading days.

Plateau shareholders will receive a combination of American Lithium stock and warrants for their shares, and will ultimately own 21% of all American Lithium shares outstanding. The merger is expected to close in May 2021.

The transaction is a testament to the tremendous enthusiasm in the market for almost any business related to electric vehicles (EVs) and lithium in particular. Lithium is a key material in most EV batteries; it is used in the anode, cathode, separator, and electrolyte components of a battery.

Plateau owns undeveloped lithium and uranium projects in southeastern Peru. According to a preliminary economic assessment (PEA) released in February 2020, Plateau’s high-grade lithium carbonate Falchani Project does have an impressive US$1.55 billion net present value, which is based on the current market price of lithium carbonate at US$12,000 per tonne and an 8% discount rate. However, the required initial capital expenditures are projected to be US$587 million. Given the size of this outlay, the project is not expected to be producing for many years.

Despite the near- and intermediate-term dilution that American Lithium shareholders will suffer from the issuance of shares and warrants to complete the transaction, as well as the prospect of no cash flow from Peruvian assets for some time, American Lithium’s stock has jumped 20% on the news. In turn, its stock market value has jumped around $75 million, equivalent to about 60% of the price it paid to acquire Plateau.

Plateau’s Macusani Uranium Project does not appear to be a key factor in the merger calculus. American Lithium has stated it will decide what to do with that property to maximize shareholder value after the merger closes. Bloomberg has reported that American Lithium plans to spin off the uranium assets.

American Lithium’s Key Asset – the 100%-Owned TLC Lithium Project

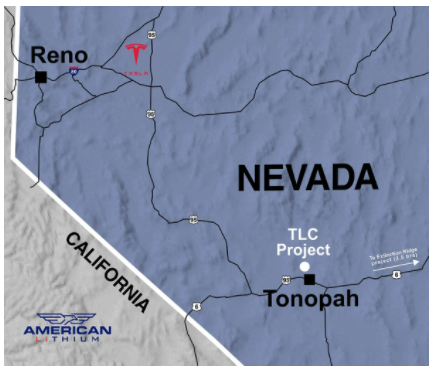

The TLC Project is a lithium sedimentary asset deposit on a 4,000-acre land claim located near Tonapah, Nevada, and about a three-hour drive from Tesla’s planned battery Gigafactory. TLC contains an estimated 5.37 million tonnes of lithium carbonate, on a combined measured and indicated basis. (There are three types of lithium deposits: brine, pegmatite and sedimentary. Pegmatite deposits generally have the highest lithium concentrations, while brine and sedimentary have lower cash production costs per tonne.)

American Lithium hopes to release a PEA on the TLC Project around mid-year 2021.

American Lithium Has Controlled Its Costs Well

A pre-revenue company, American Lithium has limited its operating cash flow shortfall to about $1.5 million per quarter over the last five quarters. Its cash balance, around $5.5 million as of November 30, 2020, should cover its cash burn for a few additional quarters, but the company will likely have to raise cash via an equity sale sometime in the next six months.

| (in thousands of Canadian $, except for shares outstanding) | 3Q FY21 | 2Q FY21 | 1Q FY21 | 4Q FY20 | 3Q FY19 |

| Operating Income | ($6,142) | ($3,580) | ($856) | ($1,616) | ($391) |

| Operating Cash Flow | ($1,548) | ($3,668) | ($721) | ($999) | ($313) |

| Cash – Period End | $5,487 | $6,684 | $955 | $805 | $213 |

| Debt – Period End | $1,342 | $0 | $35 | $35 | $35 |

| Shares Outstanding (Millions) | 117.0 | 115.0 | 85.4 | 81.0 | 68.4 |

The large risk here for lithium producers is it is possible that EV makers could eventually decide that traditional nickel-manganese-cobalt batteries are preferable to those with a heavy lithium content and no cobalt or nickel (even though cobalt production is decidedly unfriendly to the environment). In that case, a lithium miner like American Lithium would be disadvantaged.

Stocks of lithium development companies, including American Lithium, continue to rally, mirroring the recent ascent of the underlying lithium metal. American Lithium’s purchase of Plateau will likely not generate incremental cash flow for some time, but if EV battery demand proves to be as robust as forecasted, American Lithium could potentially develop the Falchani Peruvian project in the future – despite the large capex requirements.

American Lithium Corp. is trading at $3.67 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.