FULL DISCLOSURE: This is sponsored content for American Potash.

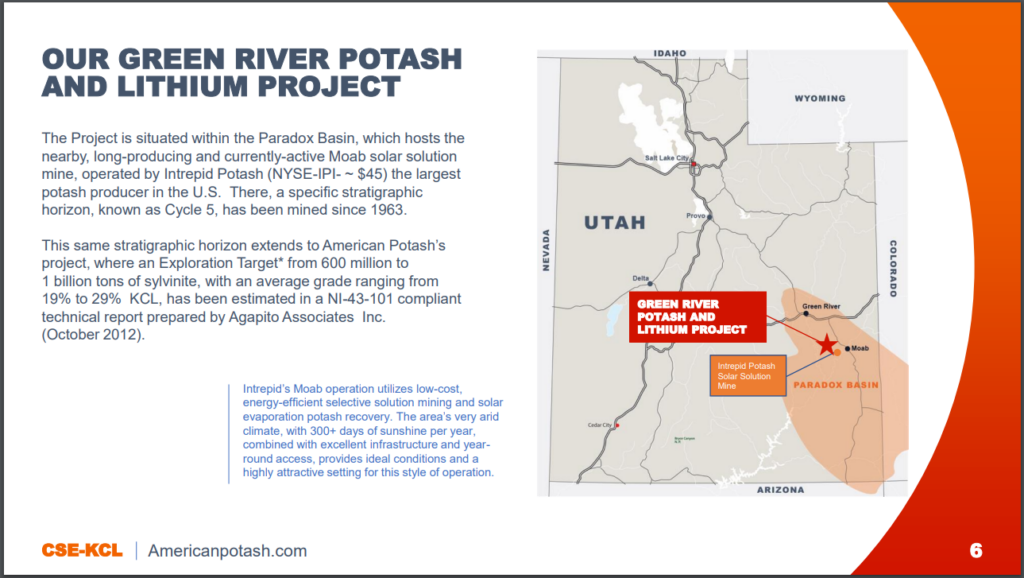

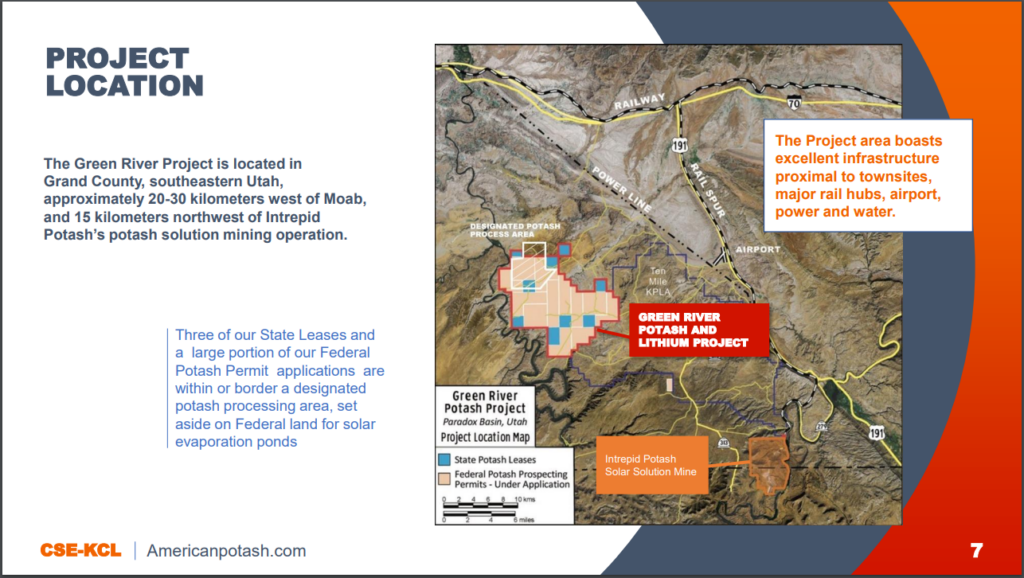

American Potash Corp (CSE: KCL) has received permits from the Utah Division of Oil Gas and Mining to drill test three of its mineral leases within its Green River Potash and Lithium Project, which is found in the Paradox Basin of Utah.

The permits received enable American Potash to test for potash, lithium, as well as other brine salts that might exist. Drilling is permitted to depths of up to 9,400 feet (2,865 metres), which will enable data to be collected from multiple potash and lithium brine horizons that are known to exist based on nearby historical oil and gas wells.

American Lithium has proposed three wells are to be drilled, referring to them as Duma Point (S2), Mineral Springs (S36), and Ten Mile (S16). The wells are said to be spaced widely, which will enable a large area of influence for estimating potential resources for both potash and lithium.

“Securing these drill permits to test for lithium and potash on our state minerals leases is a key milestone on our path to develop the Green River Potash and Lithium Project, particularly given the challenges explorers face trying to obtain permits for drilling on federal lands. We believe that results from our planned drilling program could reveal a substantial resource for both lithium and potash underlying our project in this part of the Paradox Basin,” commented CEO Jonathan George.

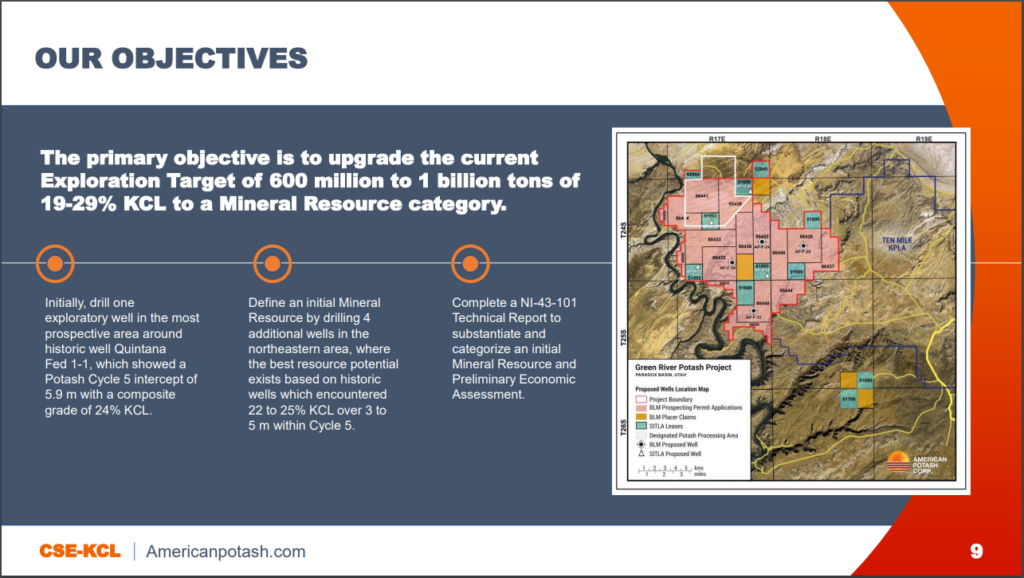

American Potash has indicated it intends to test for lithium, bromine, and boron to define an initial resource for each, while it intends to expand its current potash exploration target of 600 million to 1 billion tonnes of sylvinite grading 19% – 29% KCL to a NI 43-101 resource that can be used as part of a preliminary economic assessment.

This exploration target figure was provided by Agapito Associates under a technical report, which was modelled using gamma-log data from 33 historical gas and oil wells within and near the project area. Historical wells in the region include the Shell Quintana Fed 1-1 oil well, which is found less than a half mile east of the first proposed well under the drill program, which intersected 24.3% gamma-log equivalent KCL over 5.9 metres, along with numerous brine horizons.

Historical wells in the region are also reported to have intersected up to 500 ppm lithium, 6,100 ppm bromine, and 1,260 ppm boron.

Anson Resources, who operates the Green River Lithium Project found immediately north of American Potash, meanwhile reports an exploration target of 2.0 billion to 2.6 billion tonnes of brine, which is estimated to contain 200,000 to 390,000 tonnes of lithium and 3.2 to 7.0 million tonnes of bromine.

American Potash’s Green River Potash and Lithium project consists of eleven state of Utah mineral and minerals salt leases, which covers over 7,000 acres, as well as 128 federal lithium brine claims that cover 2,650 acres. The property is also in the final stages of acquiring 11 federal potash exploration permits that cover a 25,000 acres.

American Potash last traded at $0.06 on the CSE.

FULL DISCLOSURE: American Potash is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of American Potash. The author has been compensated to cover American Potash on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.