Americans are rapidly losing confidence in the country’s real estate market, as high inflation and subsequent rising mortgage rates send both buyers and sellers to the sidelines.

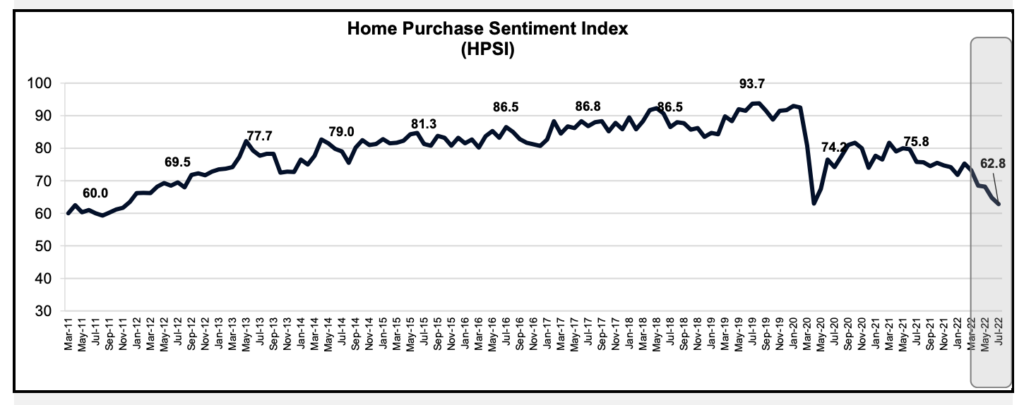

Fannie Mae’s monthly Home Purchase Sentiment Index slumped two points to 62.8 last month, and is down 13 points from July 2021— the lowest since 2011. Comparatively, the index hit a record-high of 93.7 during the pre-pandemic summer of 2019. The survey gathers consumers’ views on buying and selling conditions, labour market concerns, changes in household income, as well as their outlook on home prices and mortgage rates.

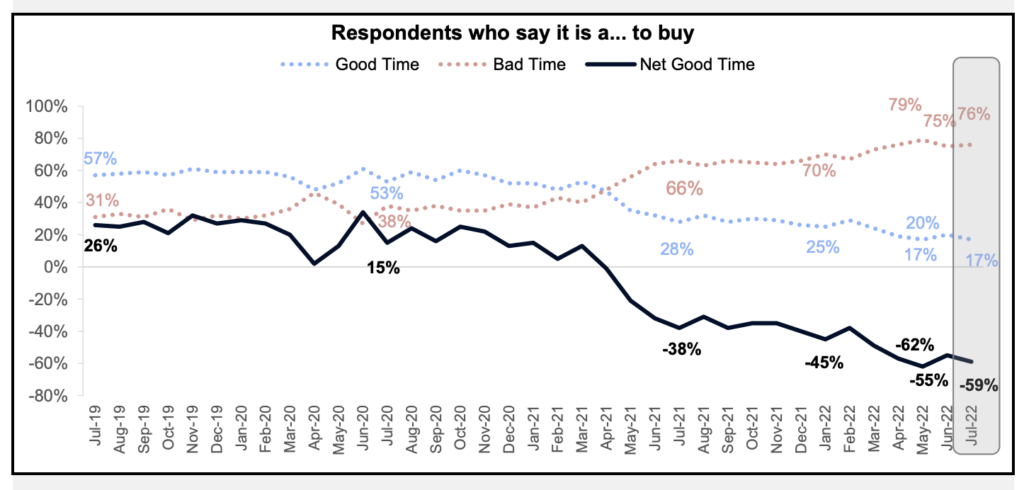

Only 17% of the respondents surveyed in July said it is an opportune time to purchase a home, down from 20% in the month prior. Likewise, the proportion of sellers who believe it’s a good time to list a property fell from 76% in May to 67% last month. “Unfavourable mortgage rates have been increasingly cited by consumers as a top reason behind the growing perception that it’s a bad time to buy, as well as sell, a home,” wrote Fannie Mae senior vice president and chief economist Doug Duncan.

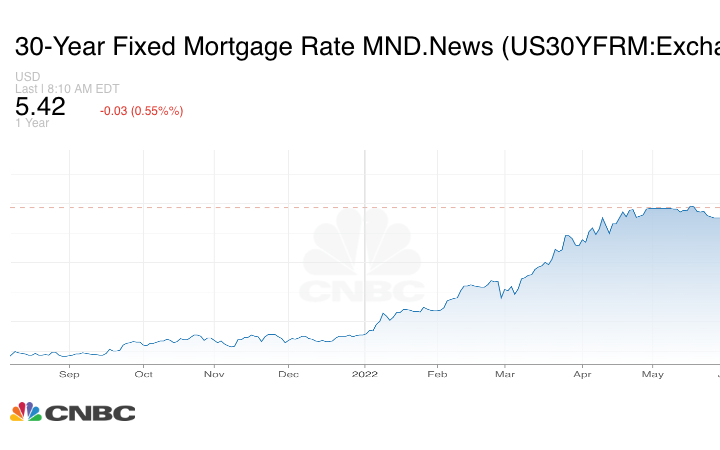

At the beginning of 2022, the average 30-year mortgage rate stood at approximately 3%, and then steadily began to rise to 6% in June, before moderating to just above 5% at the time of writing. The survey found that only 6% of Americans believe mortgage rates will decline, while 67% think borrowing costs will continue increasing. At the same time, a declining proportion of consumers think home prices will increase, with the share of those expecting prices to drop rising from 27% to 30% in July.

“With home price growth slowing, and projected to slow further, we believe consumer reaction to current housing conditions is likely to be increasingly mixed: Some homeowners may opt to list their homes sooner to take advantage of perceived high prices, while some potential homebuyers may choose to postpone their purchase decision believing that home prices may drop,” explained Duncan.

Information for this briefing was found via Fannie Mae and CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.