Just when you thought you were under the impression that things might, just might, be getting unimaginably worse— bam! Inflation hits an eye-watering 9.1%.

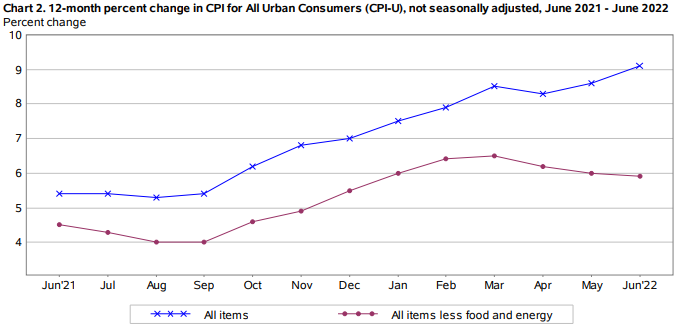

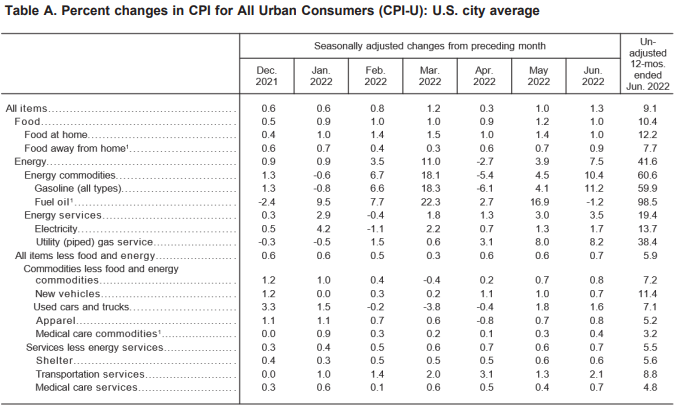

Don’t put away the tissues yet! The latest CPI print jumped a staggering 1.3% between May and June, following a 1% increase in the month prior. That’s right, over the last 12 months, the cost of goods and services rose 9.1%, marking the biggest annual gain since November 1981 and coming in significantly higher than the 8.8% increase forecast by economists. Core CPI, which does not include components such as food and energy, also shot up sharply, rising 5.9% from June 2021.

To further support the testament that the Fed is merely spinning tires in mud in its desperate game of playing catch-up with interest rates, all major components were up last month with energy, shelter, and food dominating the increase. The energy index jumped another 7.5%, accounting for almost half of June’s headline print.

Americans paid 10.4% more for food compared to the same period last year, and 5.6% more to keep a roof over their head— the highest since 1992. Gasoline meanwhile climbed a staggering 59.9% on a year over year basis.

In the interim, Americans’ real wages continued to plummet for the 15th consecutive month. Real average hourly earnings declined 1.0% from May to June for all employees, and 3.6% on a year over year basis. Combined with an average decline of 0.9% of the average workweek over the last year meanwhile means real average weekly earnings meanwhile declined 4.4% over the last 12 months.

Welcome to Jerome Powell’s America.

Information for this briefing was found via the BLS and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.