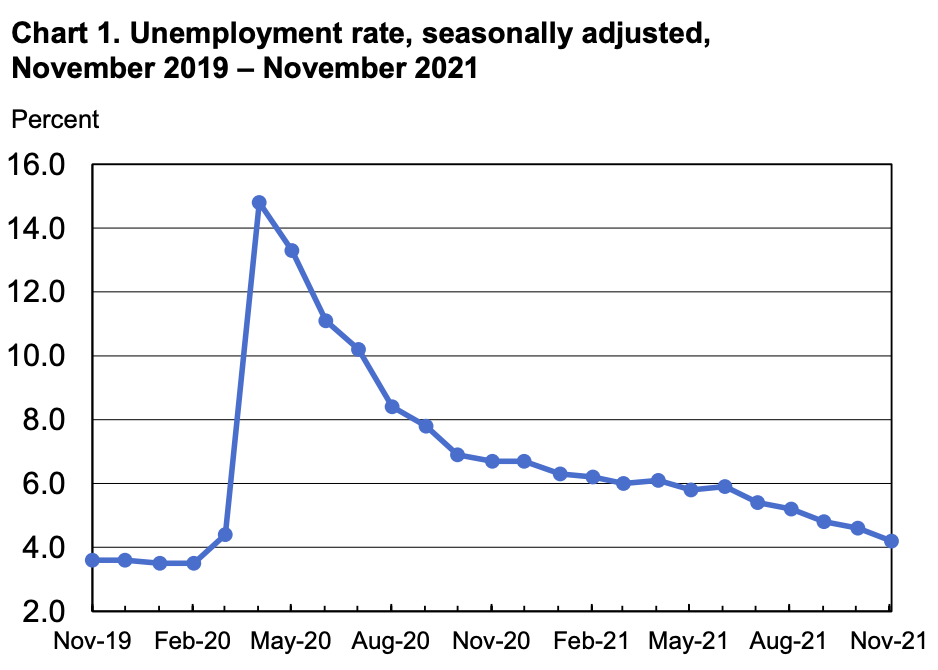

Okay, it’s official: statistics have now gone completely mad, because as the latest nonfarm payroll report shows, job growth across the US economy substantially fell short of expectations, all meanwhile the unemployment rate sharply dipped 0.4 percentage points last month.

According to data from the Bureau of Labour Statistics released on Friday, nonfarm payrolls rose a paltry 210,000 last month, significantly missing consensus estimates from economists polled by Bloomberg whom called for a payrolls increase of 550,000.

However, the BLS report also showed that the unemployment rate dropped to 4.2%, painting a bizarre and severely diverging picture of America’s labour market.

The apparent discrepancy was due to the composition of the jobs report, which consists of two surveys: the households survey and the employers survey, where the former calculates the jobless and participation rates, and the latter accounts for payroll and wage figures. Last month, the household survey showed that employment levels soared by 1.14 million, while the employers survey indicated that hiring slumped across various industries, including the auto and retail industry.

But, despite the slowdown in job growth, the labour force participation rate— which measures the number of individuals either working or looking for employment— jumped from 61.6% to 61.8% in November. Still, the figure has remained relatively unchanged since August of last year, partly due to Americans foregoing work due to childcare obligations, as well as increased retirements. However, Fed Chair Jerome Powell has indicated there is still room for improvement, for both employment levels and labour market participation.

Indeed, the latest jobs report comes just as Powell finally acknowledged that inflation is no longer transitory, and signalled that the central bank will likely phase out its ultra-dovish monetary policies ahead of previous forecasts. As such, a quicker abandonment of pandemic-related support would also mean an earlier interest rate increase, with Wall Street betting on a hike as early as next year.

Information for this briefing was found via the BLS and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.