Despite the constant stream of layoffs becoming the norm of the new year, the American labour market somehow continues to outperform even the most generous of expectations, to the awe of everyone, even the BLS itself.

Recently, the BLS reached out to me and others to help them fix their job market report methodology.

— Alf (@MacroAlf) February 3, 2023

You now see why.

These population and seasonal adjustments are a complete mess.

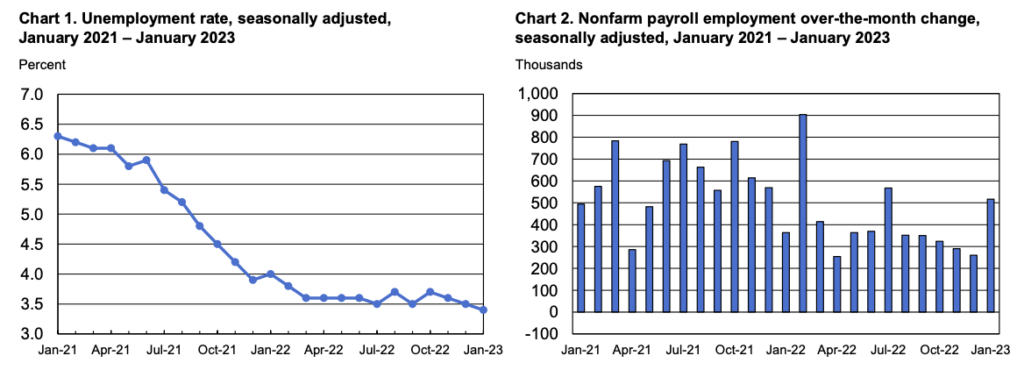

The latest BLS report showed that January nonfarm payrolls skyrocketed by 517,000 jobs, substantially surpassing December’s upwardly revised 260,000 and marking the highest print since July 2022. A total of 397,000 new services jobs contributed to last month’s increase, as did an additional 74,000 government jobs. The leisure and hospitality sector also contributed considerable gains, in the continuation of the pandemic recovery for bars and restaurants.

The most shocking aspect of January’s jobs report however was how underestimated markets’ forecasts were. Consensus estimates called for a gain of only 188,000; however, not only did the BLS’ calculations grossly exceed the forecasted figure, but the print has, for the eighth record time, consecutively surpassed expectations.

One of the most remarkable aspects of today's BLS payroll data dump is the size of the revisions applied to historical data. Not only are payrolls up in January far beyond consensus (517 vs. 185!), but *historical* payrolls are revised up by 71k in aggregate. https://t.co/iPMEBQIR9J pic.twitter.com/YagrX9OaUx

— Eric Seufert (@eric_seufert) February 3, 2023

But, even more head-scratching was the BLS’ upwardly revised Household survey, where US employment levels surged 894,000 last month, marking the largest increase since January 2022. When combined with December’s 717,000 gain, employment magically ballooned by a staggering 1.611 million within a span of two months.

Nothing seems right with the 2 BLS Series.

— Joseph Toomey (@JosephEToomey) February 3, 2023

The Household Survey could only find a gain of 69,000 Employed Persons between March and Nov. while the Payroll Survey claimed 2.9 million jobs were created.

Then suddenly, in just 2 months, the HHS finds 1.6 million suddenly employed. pic.twitter.com/EAKYoFo6Aj

So, what’s behind all of this madness? Sure enough, the BLS seasonal adjustment is to blame, because unadjusted figures show payrolls actually dipped by a staggering 2.505 million. And, here’s the real kicker— not only are mass layoffs across the country translating into unprecedented job openings, but also historically-low unemployment. According to statisticians at the BLS, the unemployment rate dipped to a record-low of 3.4% in January— the lowest jobless rate since May 1969.

Big mess in payrolls. Benchmark changes. NAICS 2022 coding. Another huge annual population control factor.

— Jeffrey P. Snider (@JeffSnider_AIP) February 3, 2023

Bottom line, though, it's another month where Est Survey says jobs are good and HH Survey shows they aren't. SSDY.

CES +517k

CPS +84k

Same planet, different world. pic.twitter.com/IRdqAhpgT4

As widely expected, reactions to the report consisted of eyebrow-raising and head-scratching. “The January jobs report showed extremely robust growth, higher than the highest estimate in the Bloomberg survey,” said Bloomberg Economics chief US economist Anna Wong. “If it seems too good to be true, that’s because it is — the gain is mostly due to seasonal factors. Still, it can’t be denied that the labor market remains tight. The Fed likely won’t place too much weight on this report in formulating policy.”

“Today’s jobs report is almost too good to be true,” said ZipRecruiter economist Julia Pollak as cited by CNBC. “Like $20 bills on the sidewalk and free lunches, falling inflation paired with falling unemployment is the stuff of economics fiction.”

Information for this story was found via the BLS and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.