Amex Exploration (TSXV: AMK) has completed an updated preliminary economic assessment for their flagship Perron gold project in Quebec. The PEa has been revised to include the latest mineral resource estimate and a refined development strategy.

“This PEA is based on our latest Mineral Resource Estimate and reflects our new vision for developing the Perron Project. Our staged approach to production and construction is both fiscally and technically prudent, minimizing permitting and technical risk, reducing upfront capital and enabling early cash flow,” commented Victor Cantore, CEO of Amex.

The refined project is said to boast a net present value of C$1.1 billion, alongside an internal rate of return of 70.1% on an after-tax basis, with a payback period of just 1,4 years based on $2,500 an ounce gold.

That estimate is based on a staged production strategy that will simplify the permitting process and accelerate the time to revenue while reducing shareholder dilution. The first phase of the project will see a 1,000 tonne per day toll milling operation occur on site using processing plants in the region. Phase one has an initial capital cost estimate of just $146.1 million, which after being offset from pre-production revenues, falls to $77.5 million.

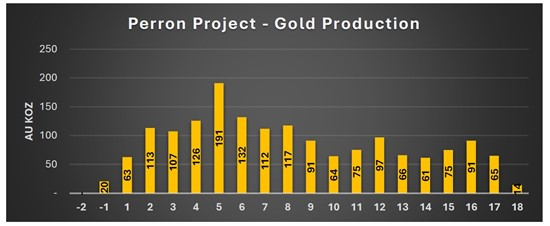

Phase one, which is expected to be in place for an estimated four years, is expected to result in average annual production of 102,000 ounces of gold at an average diluted head grade of 10.07 g/t gold. AISC under this phase meanwhile is estimated to average US$1,165 an ounce.

Phase two, which is expected to be financed from free cash flow, is expected to come online in year five. The phase will see Amex transform Perron into a 2,000 tonne per day operation, which is expected to operate for a 13 year period. Growth capital is expected to cost $191.6 million, with average annual production to move to 93,000 ounces a year based on average head grades of 4.32 g/t gold being extracted. AISC meanwhile is expected to fall to US$1,027 an ounce.

Total life of mine over the entire project is expected to be 17.5 years, with average annual production of 95,000 ounces over that time frame. A total of 1.66 million ounces of gold is expected to be extracted over the life of mine, with life of mine all in sustaining costs of US$1,061 an ounce. Sustaining capital meanwhile is to come in at $386.3 million.

“The economics of this project are incredibly strong and with gold prices at record highs, quick time to production allows us to capitalize on current market conditions. Our cost structure is one of the lowest globally and reflects the benefits of having a project with high grade, easily mined gold ounces that is surrounded by infrastructure and mining expertise,” continued Cantore.

Amex Exploration last traded at $2.83 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.