People’s Champ potstock The Green Organic Dutchman (TSX: TGOD) is set to kick off a big earnings week this coming Tuesday. The $720M enterprise value company hasn’t lost its knack for staying in the press, announcing yesterday that it has made an application for a listing on the NASDAQ, where some more developed Canadian producers like Tilray, Organigram and Cronos have gone to gain access to the US securities markets.

US investors can own stock in marijuana companies so long as they don’t grow or sell cannabis in the United States, which TGOD does not.

It is expected that TGOD’s Q1 earnings will include the first of their sales to the Canadian medical market. The company’s LA Confidential strain was well-reviewed by pancakenap in May, but questions remain about how much volume the aggressively-marketed company can produce. We’re going to look at some profiles to get an idea on what to expect. Let’s go to the charts.

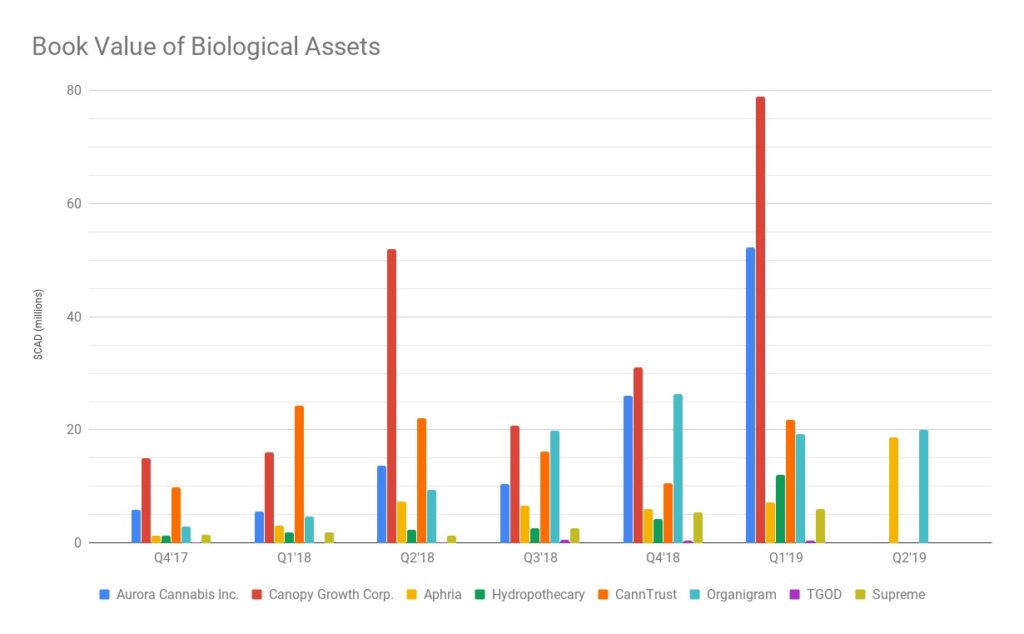

TGOD’s Biological Assets

IFRS reporting standards require that companies account for the fair value of their live plants. There is controversy over the way changes in fair value are to be accounted for on the income statement, but putting the plants on the balance sheet never draws any complaints. They give us a useful marker.

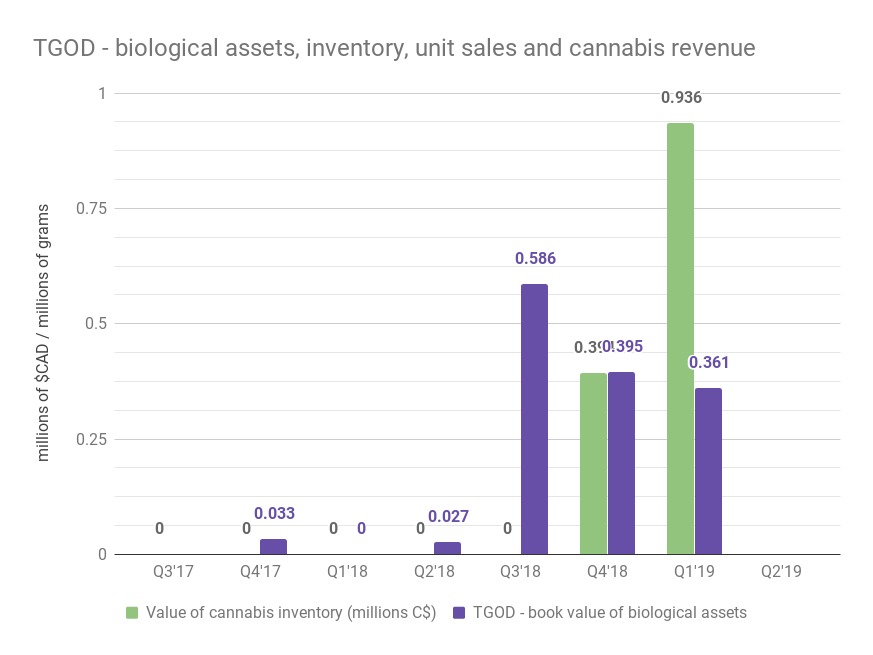

Companies differ in the way they account for their biological assets, so this is only meant to be a rough look, but it’s quickly apparent (and unsurprising) that biological assets track the general size of these companies. The plants are the heart of any cannabis operation. TGOD’s biological asset value peaked in the third quarter of 2018 at $586,000. They reported $361,000 worth of biological assets at the end of March.

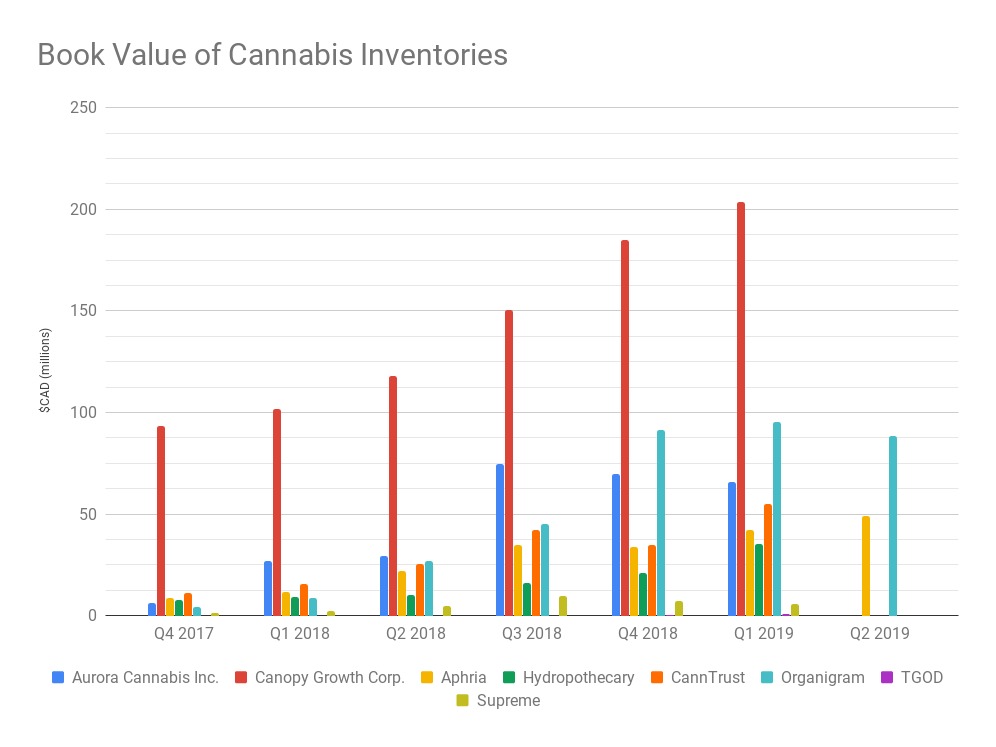

Cannabis Inventory Across the Sector

Once it comes off the plant, cannabis inventory becomes a “work in process” until it’s ready to sell to a customer, at which point it’s accounted for as “finished goods.” Not all companies break their inventory down into that kind of detail, but they all provide for a way to separate out just the cannabis inventory, and that’s what we’ve charted here. TGOD’s inventory of CBD products from their Polish hemp farm is not included.

TGOD’s inventory in March was valued at $936,000.

The noise from the different reporting habits falls out of these graphs when we look at individual companies’ biological assets and inventory side by each, quarter over quarter, along with their revenue and unit sales.

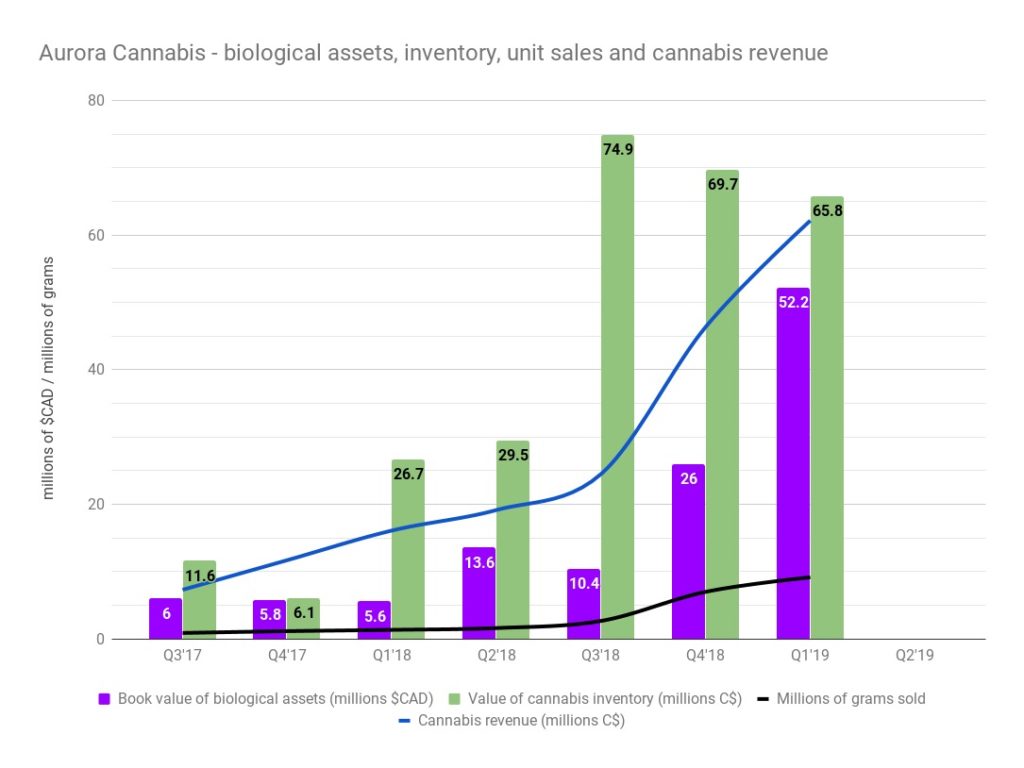

Aurora Cannabis

It’s apparent from the Aurora chart that a portion of their sales come from the wholesale market, not their facilities. Today, ACB guided for a revenue bump next quarter, giving their shares a 16% lift. They had more live plants at the end of March than ever before.

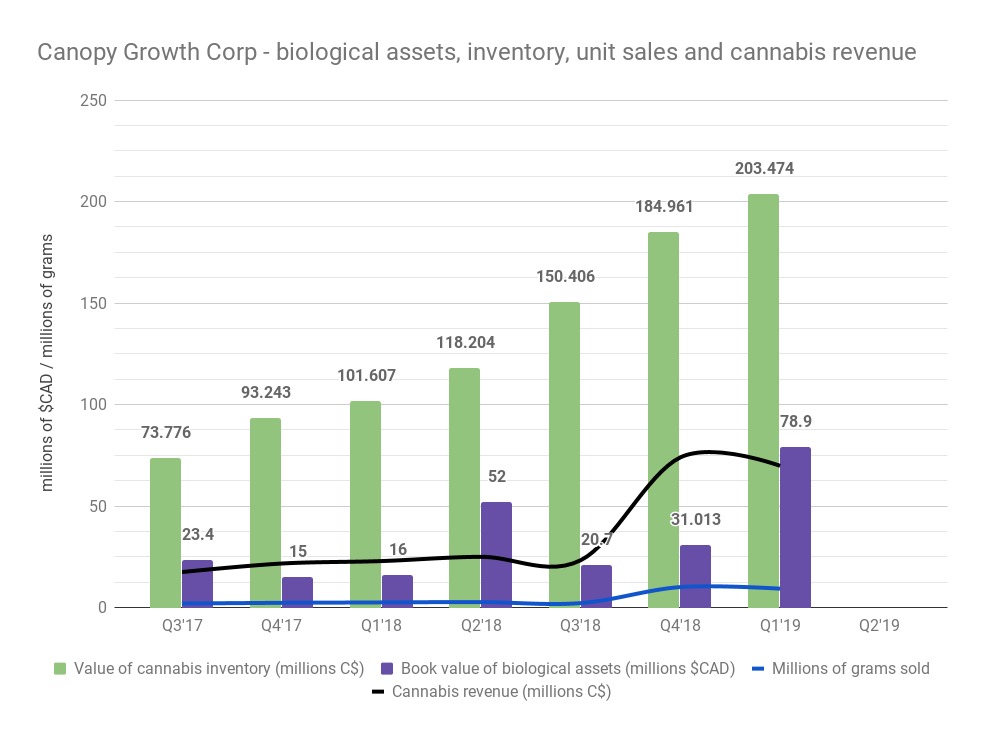

Canopy Growth

A big inventory number in Q4 didn’t help Canopy Growth beat their December unit sales this past March. They were only a few kilos ahead of rival Aurora, with the inventory still stacking, inviting whispers about whether or not it will sell.

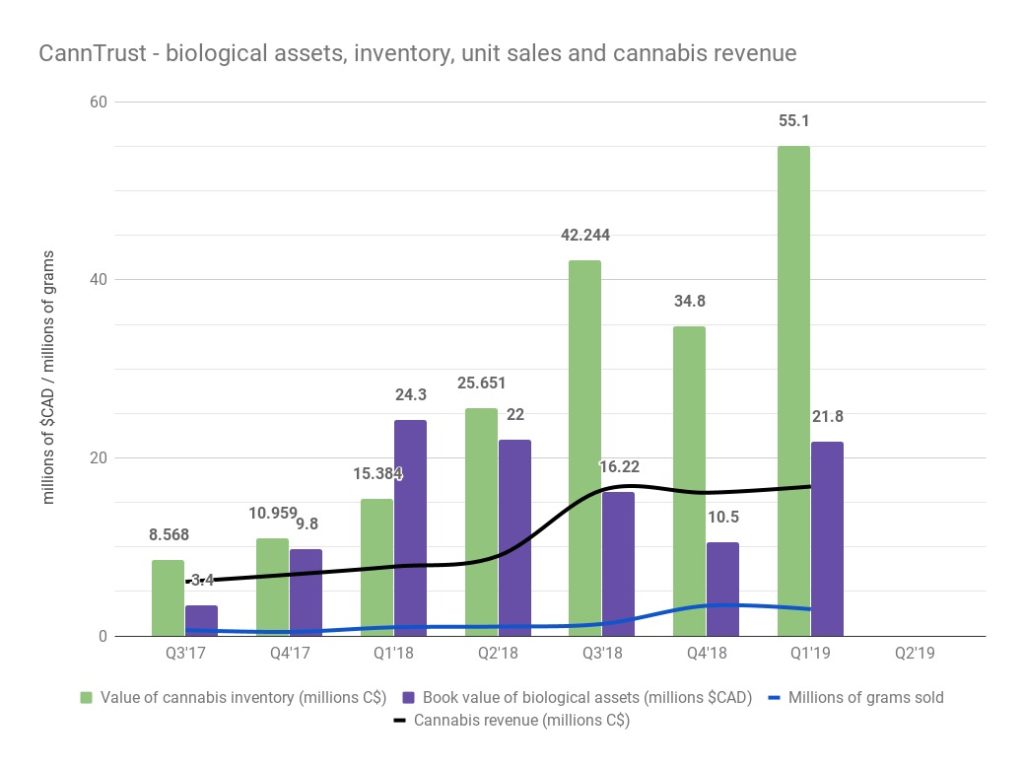

CannTrust

CannTrust Holdings is the only company whose bio assets make a steep jump, then decline three quarters in a row, while the inventory doesn’t track at all. In data analysis, it’s the trends that matter, and Canntrust showing no discernible trend makes sense, since we’ve got every reason to disbelieve their reporting as a result of their ongoing operational debacle.

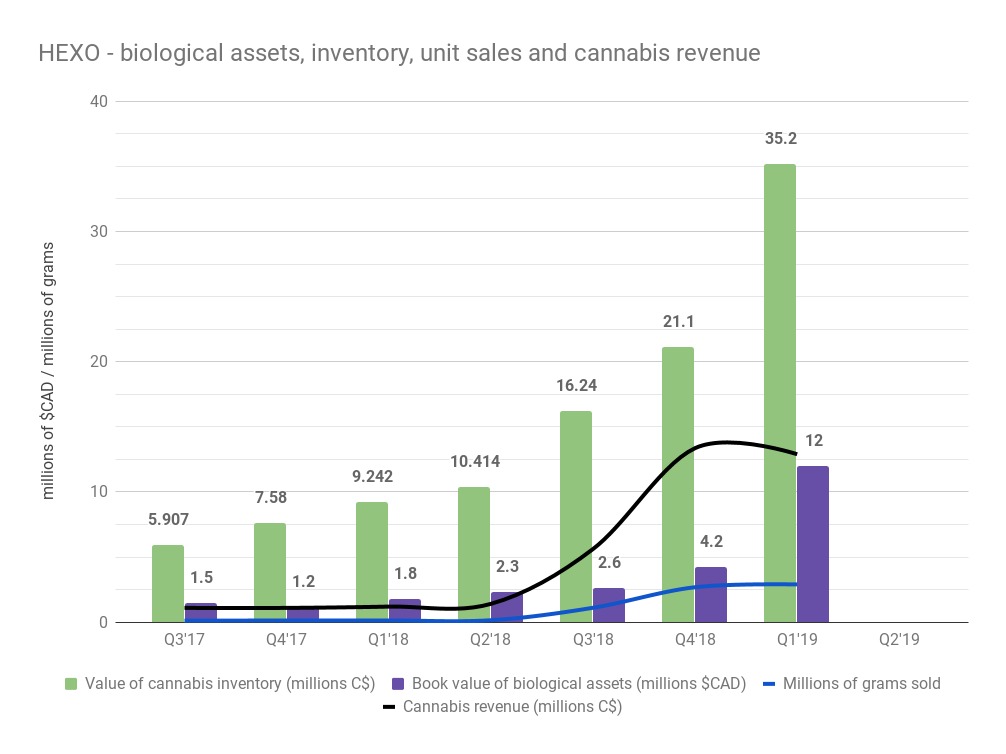

Hexo

Hexo printed a really neat profile with a NICE bump in biological assets Q1, making good use of that newly licensed 1M square foot wing out in Gatineau. It’s tempting to pencil HEXO in for a sales bump their next period.

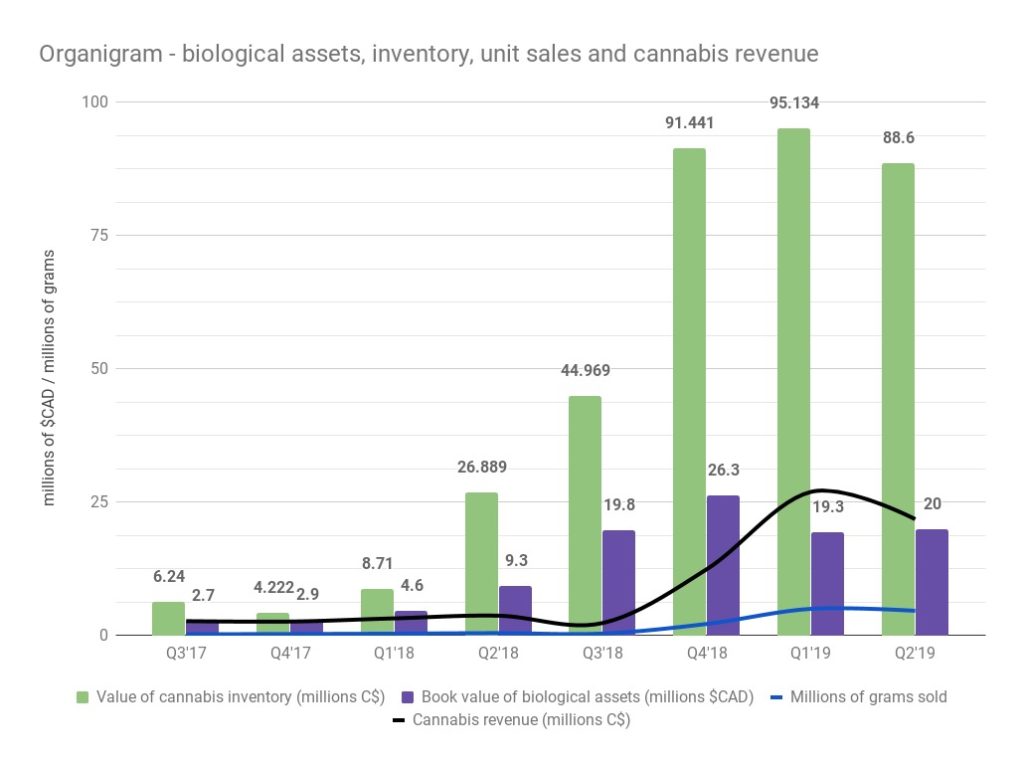

Organigram

Organigram saw a dip in sales last quarter, but CEO Greg Engen didn’t seem too worried about it. He explained that an experimental cutting technique set them back, much to the ridicule of the home and underground growing communities on twitter, but shook it off nicely. They’re going to want to show progress next quarter; two sales dips in a row would be bad news.

The Green Organic Dutchman

Obviously, The Green Organic Dutchman has a long way to go to catch up with its cultivator peers. HEXO and Organigram, the companies with valuations closest to The Dutchman, both reported biological assets numbers in line with the current quarter revenue when they started out, and about 20x their current quarter’s unit sales.

Since TGOD had $936,000 in Cannabis inventory stacked up in March, one might expect cannabis revenue to be in line with that figure. We’ll be closely watching TGOD’s balance sheet to see what they print for biological assets and cannabis inventory.

Information for this briefing was found via Sedar and The Green Organic Dutchman. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.