On November 30th, Lundin Mining (TSX: LUN) provided their long-awaited three-year production guidance for 2021 to 2023, along with operational and cash cost expenditures for 2021. They also announced they would be increasing their quarterly dividend by 50%, renewing its Normal Course Issuer Bid, and reinstating their 2020 Candalaria guidance after coming to agreeance with the two separate unions who were striking at the mine.

Lundin Mining currently has 21 analysts covering the company with a weighted 12-month price target of C$10.96. This is up from the average at the start of the month, which was C$10.30. Three analysts have strong buys. The majority, ten, have buy ratings, and eight analysts, have hold ratings.

Below you can find the most recent price target changes.

- National Bank of Canada cuts to sector perform from outperform; raises target price to C$10.25 from C$9.75

- Scotiabank cuts price target to C$9.50 from C$10

- TD Securities cuts target price to C$10 from C$10.50; cuts to hold from buy.

- BMO cuts target price to C$11.50 from C$12.50

- Canaccord Genuity cuts price target to C$10.50 from C$11; cuts to hold from buy

- Stifel GMP raises price target to C$10 from C$9.50; cuts to hold from buy.

Canaccord’s analyst Dalton Baretto headlines his commentary with, “Weak 3-year guidance sweetened by a dividend bump,” while downgrading Lundin to a hold rating and their 12-month price target to C$10.50.

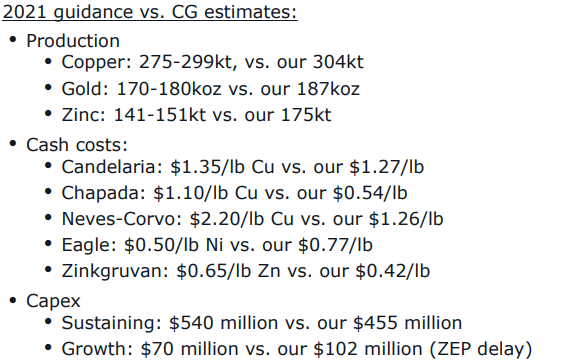

Baretto says, “LUN’s 3-year guidance was universally weak relative to our estimates. Production guidance for all three major metals (Cu, Au and Zn) was weaker than we had forecast for all three years and was also meaningfully below previous guidance.” He highlights some numbers that came in substantially worse than their estimate, such as Eagle which has a 2021 sustaining CAPEX figure that was 19% above their estimate, while their ZEP project scheduled to be commissioned in the second half of 2022 is about 2.5 years behind the original date.

Baretto adds that the 50% increase to its base dividend is “a very respectable yield of 2.3% at the current share price.”

He also states, “We have updated our estimates to reflect LUN’s 2021-2023 guidance, resulting in a 19% decline to our 2021 EBITDA estimate and an 8% decline to our overall NAV,” as the reason for downgrade on the company.

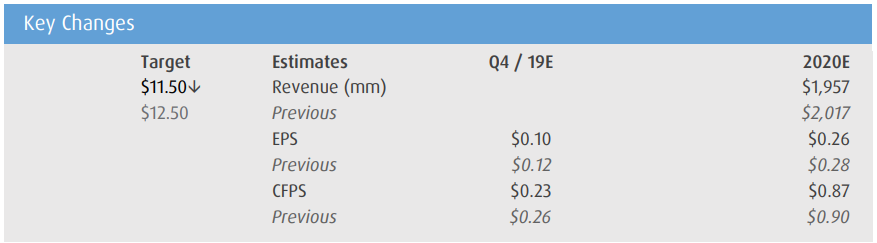

Jackie Przybylowski, BMO’s mining analyst, also downgraded their 12-month price target to C$11.50 but reiterated their outperform rating. She headlines, “Strong Dividend Underscores Longer-Term Confidence in Operations.”

She says that the reason they are lowering their price target is due to the production guidance, which was below their expectations but said, “we continue to believe that Lundin is successfully moving beyond a year of challenges and into a position of strength and confidence.” She reiterates that Lundin Mining is still their top pick and, “expect investors will again view Lundin as a defensive and conservative investment option.”

She says that increasing the companies dividend and restarting their NCIB “demonstrates that the company is confident in growing cash flows,” and believes that they will not run into any cash flow issues pertaining to these two new developments. She also commends Lundin for navigating not only the COVID-19 pandemic but also the multiple other problems that arose and said that this “makes the company’s demonstration of confidence in its operations going forward even more important, in our view.”

Onto the production guidance miss, she says that they were hopeful that the projects that were close to completion would only affect 2021 guidance, but “the guidance now shows that the Neves-Corvo Zinc Expansion Project will not ramp up to full production until H1/22.” She says that execution on multiple of Lundin’s projects, which have been delated due to COVID-19, could provide a catalyst for the stock as that would raise their guidance and specifically points out the Chapada expansion plan.

Below you can see the 2020 estimate revisions Przybylowski has made.

Ian Parkinson, Stifel GMP’s analyst headlines “Three year production outlook released – valuation looking a little stretched,” while downgrading the stock to a hold rating from a buy. Although he doesn’t go into much detail, he does say the downgrade was due to the production guidance misses.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.