Last night, Peloton Interactive (NASDAQ: PTON) announced their second-quarter financials. They reported total revenue of $1,064.8 million, a 128% increase year over year, while analysts estimated revenue to be $1,030 million. Earnings per share came in at $0.18, double the analyst estimate of $0.09. They also guided for a flurry of different metrics, including full year 2021 revenue of >$4.075 billion, profit margins of 39%, and >$300 million in EBITDA.

Shares were down about 8% in early morning trading today, as management’s third-quarter guidance nearly matches consensus estimates.

Below you can see all the analyst changes:

- Cowen and Company raises target price to $177 from $175

- JP Morgan raises target price to $200 from $145

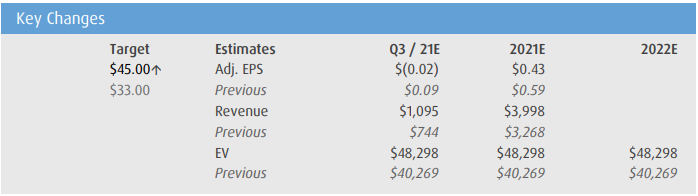

- BMO raises target price to $45 from $33

- Trust Securities raises price target to $160 from $145

- Needham raises target price to $180 from $140

- Wedbush raises target price to $162 from $160

- Rosenblatt Securities raises price target to $190 from $186

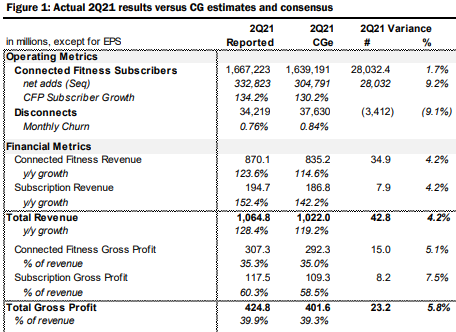

- Raymond James cuts to market perform from outperform

Canaccord’s analyst Michael Graham has many positives to say in his note he sent to investors. He says that “Record new CFP sub adds, engagement remains strong,” as Peloton saw its largest single-day workouts of 1.6 million in Q2 recently broken by their first +2 million workout day. Peloton reported 1.67 million CFP subscribers, which was 9% above Canaccord’s estimates and 7% above the consensus, while churn was 0.76%, which was better than expected.

He adds that long delivery times persist, showing a backlog of orders waiting to be filled. He notes that Peloton announced they are investing $100 million in expedited shipping and, “Peloton has grown its manufacturing capacity by 6x over the past year, with the new Shin Ji factory in Taiwan now up and running, and the company expects to produce equipment at recently acquired Precor’s NC facility before the end of the year.”

Below you can see Canaccord’s guidance versus what was reported.

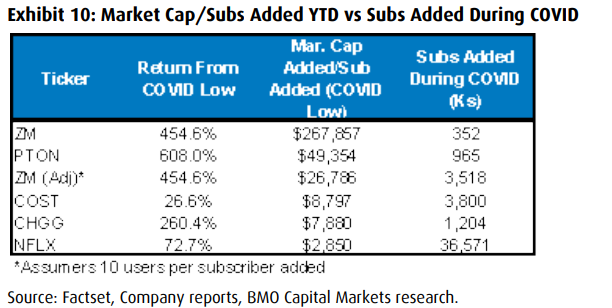

Onto what BMO Capital Markets analyst Simeon Seigal had to say about Peloton’s earnings. He writes, “2Q beat. However, beats are shrinking, and with a market cap ~22% of NFLX but less than 1% of its subscribers, investors are playing for millions of new members, not hundreds of thousands.”

He says that even though Peloton beat estimates, the margin of the beat has been dropping. For the second quarter, they beat estimates by 2%, while management guidance for the third quarter is also only a 2% beat. He writes, “Now a beat is a beat, and PTON is clearly posting strong results. However, given where shares trade, as guides and/ or beats slow, we worry share price will follow. “

Seigal sounds pretty bearish even though he has increased the price target, as he says even though at-home fitness is not a fad and here to stay, Peloton being the market leader, will have a lot of competition and that “disrupters rarely remain dominant (Nokia, Myspace, etc…)”

He adds that Peloton’s growth and market cap has been below basically all other COVID-19 winners.

Below you can see the changes Seigal has made to their 2021/2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.