The State of Crypto 2023 report from venture capital firm Andreessen Horowitz (a16z) provides a hopeful view of the sector, which has been beset by crashes and legal disputes.

The firm starts with a caveat that “emerging technologies evolve in cycles,” with the crypto space experiencing a “crypto winter” for the most part in 2022, but is bound for a recovery. It also lamented that “major infrastructure improvements like The Merge… simply don’t make headlines as often as high-profile bankruptcies, busts, and flameouts.”

“Our 2023 report aims to address the imbalance between the noise of fleeting price movements – and the data that tracks the signals that matter, including the durable progress of web3 technology. Overall, the report reflects a healthier industry than market prices may indicate, and a steady cycle of development, product launches, and ongoing innovation,” the firm prefaced in its report.

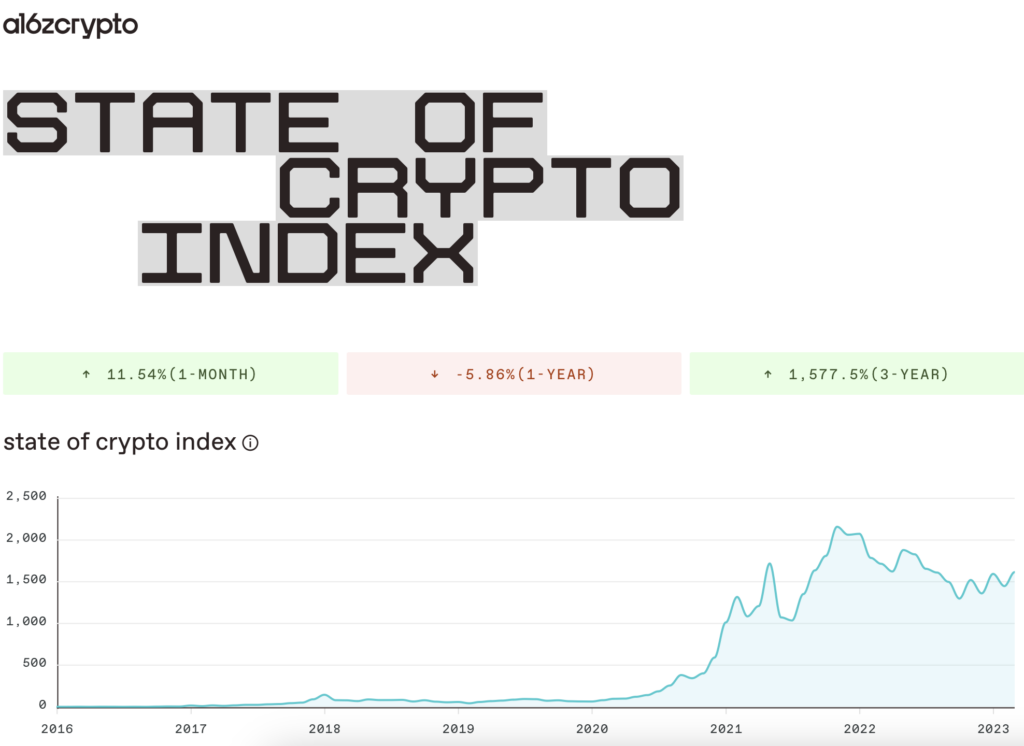

In projecting optimism–and confidence–for the crypto industry, the VC introduced a new tool to measure technical advances in the crypto industry: the State of Crypto Index. The index is meant to “track the health of the crypto industry from a technological, rather than financial, perspective,” using the weighted average monthly growth of 14 industry metrics including the number of active and interested developers, verified smart contracts, active addresses, and transaction volume.

It is unsurprising that the crypto index shows an upwards trend for the “technological” aspect of the industry, noting an over 11% jump month-on-month but a nearly 6% decline compared to last year.

Web3’s advantages over previous technical models, according to A16z, include decentralized blockchain networks, community-governed nature, lack of power concentration among corporations, and value occurring to network participants.

According to the report, Web3 usage is still in its early phases, and decentralized finance (DeFi) and non-fungible token (NFT) metrics have grown more steady after declining from record highs in 2021. Gaming has demonstrated special strength: 700 Web3 games were released last year, and games currently generate 23 times the number of on-chain transactions as DeFi.

this year, as with last, they have a slide denigrating "web2 platforms" for their take rates.

— Molly White (@molly0xFFF) April 11, 2023

this year, as with last, they list several companies they've backed (starred in 2nd pic)

with others, they've backed competitor companies in the same market, with similar biz models pic.twitter.com/ZmJDZcbg1E

The firm also highlighted more active developers, more blockchains scaled, and increased ‘zero-knowledge’ tech system activity. According to the report, over $100 billion was exchanged on decentralized exchanges in March, representing the third straight month of significant rises in trading volume.

Last month, there were over 15 million active addresses in the larger crypto business, the biggest number the firm has ever tracked and more than twice as many as in March 2021.

According to the price-innovation cycle, market downturns attract more dedicated developers to the crypto field, and the excitement generated by those projects eventually drives asset prices higher.

“Product cycles are where new things that lead to consistent and more robust growth over many years are occurring, regardless of financial cycles,” A16z Chief Technology Officer Eddy Lazzarin told CoinDesk during an interview.

Blockchain adoption is claimed to be increasing as a slew of protocols and organizations attempt to scale blockchains and enable more transactions using a variety of methodologies and technology. Last year, “Layer 2” (L2) scaling solutions accounted for 1.5% of total Ethereum fees paid. The report has noted this has risen to 7% this month.

The State of Crypto study also stated that the United States was losing its advantage in Web3. The fraction of crypto developers based in the US declined by 26% between 2018 and 2022 when compared to the rest of the globe.

“Banning new business models or technologies undermines American values and drives innovation and jobs elsewhere,” the report states. “Legal businesses and their customers deserve access to financial services and lawful protections, from banking relationships to data privacy.”

too soon? pic.twitter.com/FwVBBB0sQk

— Molly White (@molly0xFFF) April 11, 2023

The emphasis on regulation coincides with a crypto crackdown in the United States, where regulators such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have increased their scrutiny of digital asset enterprises.

Notably, the SEC sent a Wells Notice to Coinbase last month regarding its staking products, just months after Kraken was fined $30 million by the financial watchdog, forcing it to discontinue its staking-as-a-service operation entirely. A CFTC lawsuit for alleged derivatives trading rule violations looms over Binance, despite CEO Changpeng Zhao’s repeated calls for users to “ignore FUD, fake news, attacks, etc.”

The firm also tried to veer away from these legal kerfuffles and recent bankruptcies in the crypto space by differentiating “crypto casinos” and “crypto computers,” noting that the industry is advanced by the latter with tech innovation and not by the so-called crypto casinos that run on financial speculation.

"apparent chaos has underlying order"

— Molly White (@molly0xFFF) April 11, 2023

the line goes up and to the right, you see, with these metrics we've found to "measure" things like "interest" (twitter mentions) and "new ideas" (github stars) pic.twitter.com/eFkp2pqsKX

Lazzarin underlined the impact of Ethereum’s merger to proof-of-stake — the blockchain now consumes 0.001% of the energy YouTube uses annually. To emphasize the comparison, the report visually described the difference in terms of height, comparing the size of half a penny to the height of Burj Khalifa tower.

"years in the making" is a nice way to spin "delayed so many times over eight years that it became a running joke"

— Molly White (@molly0xFFF) April 11, 2023

but perhaps best of all, they display electricity consumption as… height???

— Molly White (@molly0xFFF) April 11, 2023

i quote: "PoS Ethereum

Half a penny

0.95 cm

(0.0026 TWh)

WHAT?

have you been sending your people on those ayahuasca retreats again?

The report reiterated the idea that the crypto industry is in one of its so-called cycles that “move the industry forward in technological waves,” indicating that the space “may be in the middle of the fourth such cycle since Bitcoin’s inception in 2009.”

“This is why focusing on short-term market movements – and not enough on underlying technology trends – obscures the bigger picture,” the report said.

Talking about big picture, the venture capital firm emphasized that while it’s still early in web3, “we’re no longer at the beginning.”

“Stepping back from short-term volatility reveals a more predictable pattern: a steady product cycle that is distinctly different from the financial cycles that saturate media attention,” said the firm in the report.

(cont'd.)

— Molly White (@molly0xFFF) April 11, 2023

note this page seems to be slightly out of date, but it's what they've got. pic.twitter.com/smPwfyl7UN

Information for this briefing was found via Coindesk, The Hindu, the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.