FULL DISCLOSURE: The Deep Dive is long the equity of Anfield Energy.

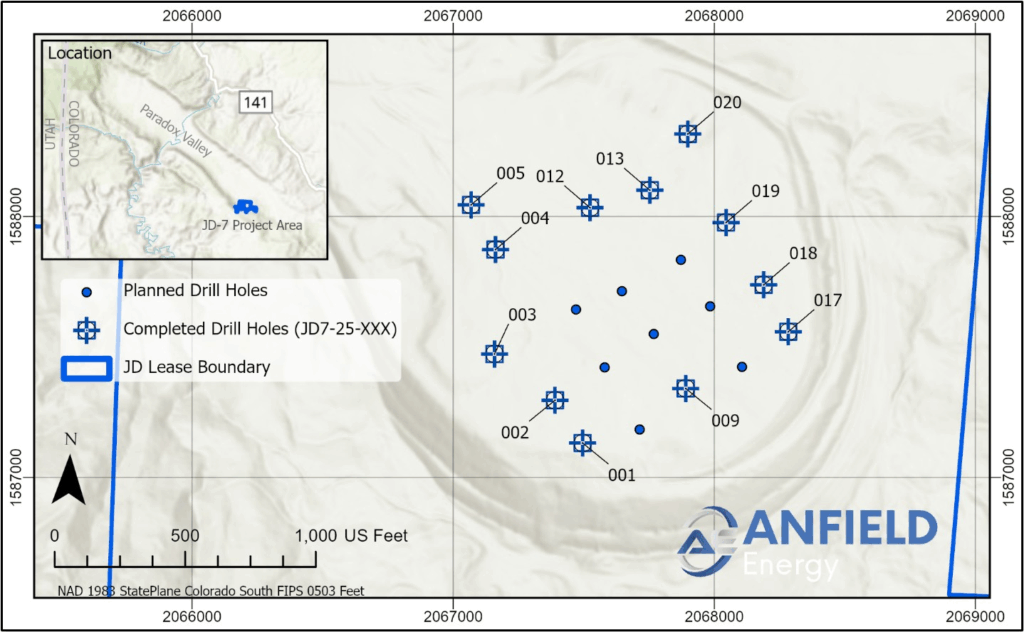

Anfield Energy (TSXV: AEC) has released the first assay results from an ongoing drill program being conducted at their JD-7 mine in Colorado. Assays this morning were released for a total of 12 holes conducted under a 20 hole, 8,000 foot program.

Highlights from the results include:

- JD7-25-004B: 0.519% eU3O8 over 17.0 ft from a depth of 149.0 ft

- JD7-25-005: 0.238% eU3O8 over 19.0 ft from a depth of 159.5 ft

- JD7-25-012: 0.162% eU3O8 over 17.0 ft from a depth of 180.0 ft

- JD7-25-019: 0.229% eU3O8 over 8.0 ft from a depth of 271.0 ft

Initial results from the program are said to be highlight encouraging, with 10 of 12 holes completed to date encountering elevated uranium mineralization about the minimum cut off grade of 200 ppm and above the minimum grade thickness of 0.2 ft. Findings to date have confirmed the presence of uranium mineralization at depths consistent with the historical dataset for the property.

“We are very pleased with the interim drill results as they both underscore the potential for resource confirmation – and possible expansion – at JD-7 and align with Anfield’s broader strategy to advance its portfolio of near-term uranium and vanadium projects toward production. The Company remains on track to complete the remaining holes in the coming weeks, with full results expected to inform future development plans, including integration into Anfield’s hub-and-spoke production model centered around the Shootaring Canyon Mill in Utah,” commented Corey Dias, CEO of Anfield Energy.

The program as a whole has four objectives, which include the collection of geologic data in multiple sandstone hosted deposits, confirming the existing pit resource, confirm the extent and location of underground uranium and vanadium resources, and identifying potential resource expansion.

Anfield Energy last traded at $13.37 on the TSX Venture.

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive is long the equity of Anfield Energy. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.