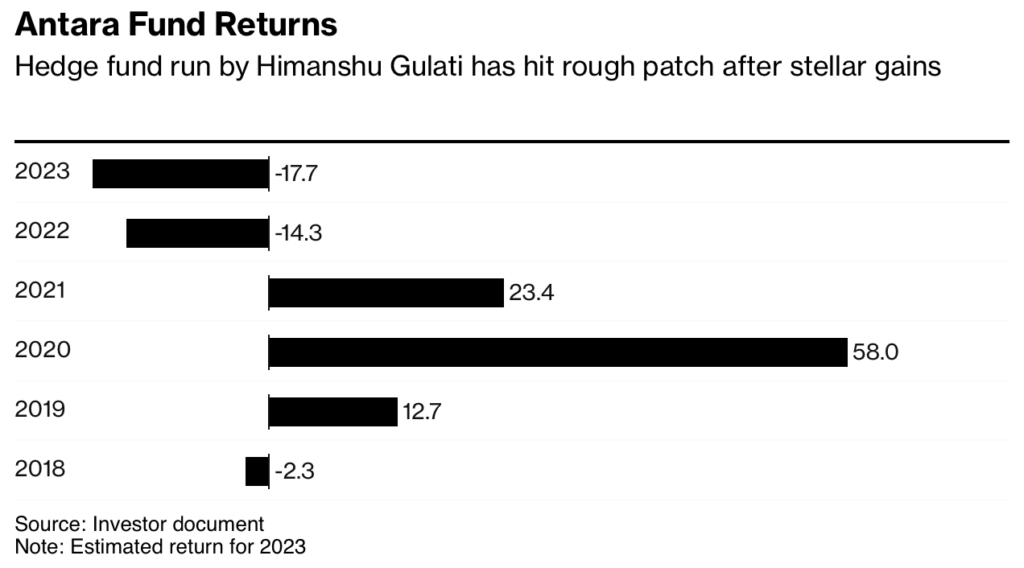

Antara Capital, a $1.3 billion hedge fund supported by Blackstone Inc., has taken measures to stem losses by freezing its hard-to-sell assets from redemptions. After enduring a 14% decline in 2022 and bracing for an anticipated 18% decrease in 2023, the firm has taken proactive measures to mitigate further financial strain.

Money that was invested in illiquid private ventures has been segregated from redemption requests since February and placed into a so-called side pocket.

Notably, the fund would have reported gains for 2023 if the private investments were excluded. Despite facing consecutive years of declining returns, Antara’s decision has garnered support from a significant majority of its investors, with over 80% consenting to the creation of the side pocket.

Hedge funds, with diverse investment mandates, had been aggressively pursuing private investments in a buoyant market before experiencing setbacks as market sentiment soured. This has led many investors to reassess the true value of such assets, resulting in markdowns of their non-public market holdings.

Antara Capital, founded by Himanshu Gulati, who previously played a role in running the distressed credit business at Man GLG, began trading in 2018. Backed by Blackstone Inc., which provided Gulati with $150 million for his new venture, Antara has faced losses for two consecutive years. However, investors who have been with the firm since its inception have recorded gains of over 50%.

The firm’s name derives from the Sanskrit word for “opportunity.” Antara has positioned itself as providing equity-like returns with credit-like downside protections.

In 2021, Gulati entered into a partnership with former Yankees star Alex Rodriguez’s investment firm, ARod Corp., to establish a special-purpose acquisition vehicle focusing on targets in sports, media, entertainment, health and wellness, and consumer technology sectors.

The concept of side pockets, though not novel in the hedge fund landscape, has gained renewed relevance in times of financial distress. Originating during the 2008 financial crisis, these segregated investment compartments offer a pragmatic approach to managing hard-to-sell assets. By isolating these assets from more liquid holdings, funds like Antara can navigate market downturns without resorting to undervalued asset sales.

During the 2008 crisis, an estimated $200 billion to $360 billion found refuge in side pockets, comprising up to 20% of the industry’s assets. While most of these side pockets have since been unwound, the enduring presence of some highlights the enduring challenges associated with managing illiquid assets in hedge fund portfolios.

Information for this story was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.