Recently, Canaccord Genuity’s Tania Gonsalves initiated coverage on Antibe Therapeutics (TSXV: ATE), a biotechnology company developing a nonsteroidal anti-inflammatory drugs (NSAIDs) using hydrogen sulfide. The technology involves linking already approved NSAIDs to a hydrogen sulfide-releasing molecule in order to create a new chemical with superior tolerability.

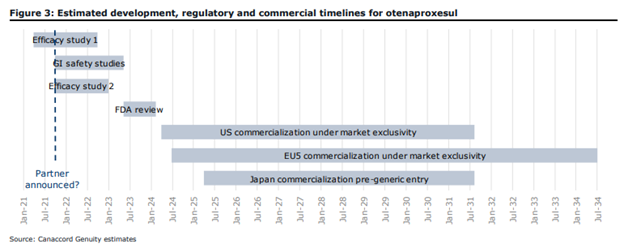

Antibe owns 100% of Citagenix, a regenerative medicine company which did $10 million in sales so far in 2020. Gonsalves comments on the tech, stting, “We believe it is on the brink of solving a 50-year-old problem – gastrointestinal (GI) safety.” The company completed its phase 2 trials and is now expecting to conduct a two-year phase 3 trial in the spring of 2021. Canaccord expects this phase three date to line up with an out-licensing deal and says, “today’s levels present an opportune entry point before this potential de-risking event that will likely send the stock up.”

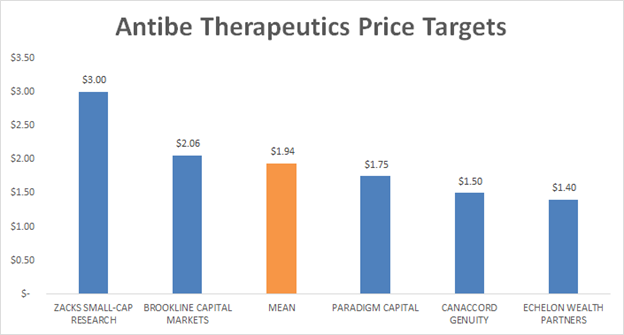

Canaccord initiated coverage on Antibe Therapeutics with a speculative buy recommendation and a C$1.50 12 month price target, or a 261% upside. They are only one of five analysts who have price targets and recommendations on Antibe Therapeutics. Canaccord’s target is currently below the mean analyst estimate of C$1.94 and just half of the highest price target of C$3, which comes from David Bautz from Zacks Small-Cap Research.

The investment thesis laid out by Gonsalves is quite clear, the global sales of NSAIDs were U$16 billion in 2019, and there are currently no drugs on the market that fully circumvent NSAIDs’ gastrointestinal risk without producing side effects of their own.

Canaccord forecasts that if or when Antibe out-licenses the commercial rights to otenaproxesul, the deal could be around US$215.0M in upfront and milestone fees, plus 15% sales royalties which is based on deals for similar drugs. The estimate also assumes it captures 24% of the patients on a prescription that sales would reach $5.2 billion in 2031.

Gonsalves says Antibe Therapeutics is “Led by the foremost experts in the field,” meaning that Dr. John Wallace pioneered the development of hydrogen sulfide for the gastrointestinal tract and founded the company back in 2009. She also notes that the management and directors together hold 12% of the fully diluted shares, which is enough to be aligned with shareholders.

Although very bullish on Antibe, Gonsalves states that their ~$35 million in cash is not enough to fund a phase 3 trial, which is budgeted at $45-$50 million. Although Antibe is seeking to partner with one or more multinational pharma companies to help fund the trial, if Antibe cannot find a partner to help fund its phase three trial and cannot raise money via equity or debt on reasonable terms, Canaccord warns it might not be able to complete its development of otenaproxesul.

Gonsalves also lists off a few other risks that could have a material adverse effect on the stock such as COVID-19 which could delay the trials, if Antibe’s product does not obtain reimbursed status, intellectual property risk, if Antibes competitive and financial position depends on its ability to obtain and enforce the patent, other intellectual property protection of its drugs, and manufacturing and product liability risks.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.