Tucked at the bottom of today’s earnings release by Aphria Inc (TSX: APHA) (NASDAQ: APHA) was the announcement that, despite a reported cash balance of C$497.2 million, the company would be conducting an at-the-market offering for gross proceeds of up to US$100 million. The distribution of such shares is to occur on both the Nasdaq and the TSX.

The program announced this morning will remain in place until December 22, 2021 at the latest, with net proceeds from the financing to fund Canadian and international expansion, working capital, and general corporate purposes. Or, as the company says, to repay indebtedness.

The distribution will be made pursuant to an agreement entered into between Aphria, Jefferies, and Canaccord Genuity, whom will be conducting the share sales on the open market.

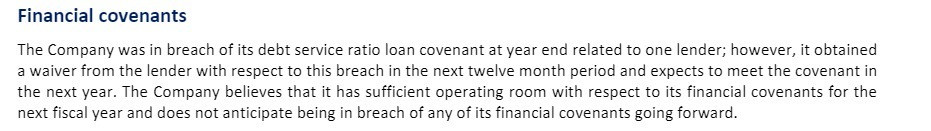

The share sale, which at current prices would result in approximately 19.23 million additional shares being added to the firms share structure, might seem odd for some. That is, however, until you come across this tidbit of text included in the financials filed this morning.

Evidently, Aphria was in breach of a debt service ratio covenant under the terms of a currently outstanding loan. Thus, despite having nearing a half billion in cash at the end of the fiscal year, the company is forced to raise additional funds to eliminate the need for waivers on the covenant. The company intends to meet the covenant “in the next year,” and our assumption is that this will be completed through the at the market offering.

This is also likely why the company repurchased $127.5 million in convertible senior notes earlier this year, at a discount of 25% to market prices, through the issuance of shares at a premium.

Despite this, the company views its liquidity risk “to be low.”

Information for this briefing was found via Sedar and Aphria Inc. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.