Earlier this week, it was announced that Aphria Inc (TSX: APHA) (NASDAQ: APHA) and Tilray Inc (NASDAQ: TLRY) would be combining to create the largest Canadian cannabis company. The proforma revenue is estimated to be C$874 million, and management indicated there would be roughly C$100 million in annual synergies that would come to fruition within 24 months of the deal closing.

Analysts have been changing their price targets and ratings to conform to the arbitrage between the shares of Aphria and Tilray. Aphria now has a 12-month average price target of C$11.10, up from C$9.13 one month ago. Two analysts have changed their rating from strong buys to hold ratings. Tilray meanwhile has seen its average analyst 12-month price target climb to U$9.21, up from U$7.77 one month ago. One analyst has raised its rating from sell to hold.

Canaccord is one of the first investment banks to develop a more in-depth scope of the deal than just their preliminary thoughts.

On the 16th, we covered initial reactions to the merger news, specifically Matt Bottomley, who wrote, “We believe this deal will further cement the combined entity as the #1 player in the Canadian sector.” Today’s note sent out to investors reiterated those same points of bolstering both their European and US distribution/footprints, but Bottomley adds some more colour.

Bottomley downgraded Aphria to a hold rating while keeping their C$11 price target. He writes, “As a result, we have left our PT unchanged, but elected to reduce our recommendation to HOLD (from SPECULATIVE BUY) as we believe APHA shareholders are already getting full value using the terms of the proposed deal.”

He first writes that management has been looking at the consolidation of cultivation and production facilities in Canada to drive cost-saving and efficiency across the platform.

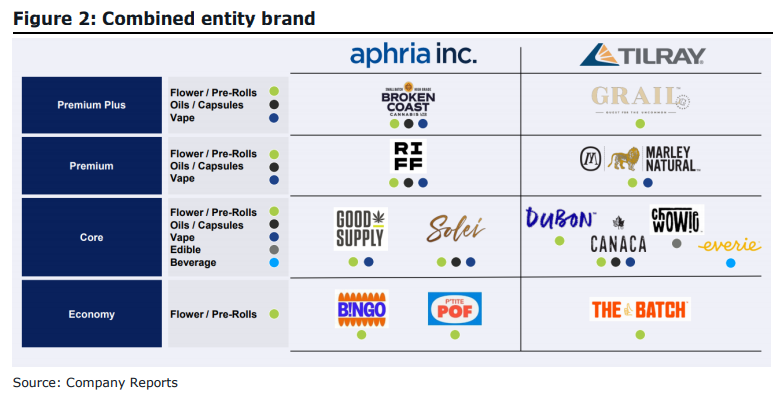

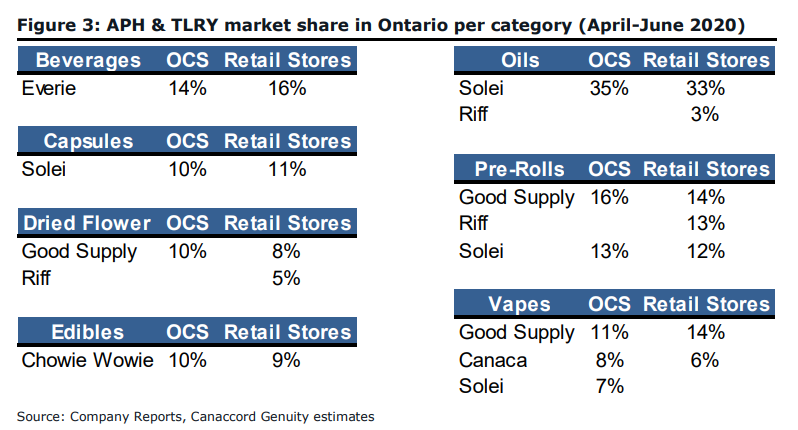

Onto brands, Bottomley writes, “We believe the proforma entity has one of the most robust product portfolios,” and the combined brands offer increased breadth and depth and caters to each type of consumer. Below you can see the combined brands and what consumers they are targeting, along with data from the latest OCS report.

Bottomley does talk about the synergies in the US, Germany, and Portugal but is a rehash of what was stated in his previous note.

Yesterday, Stifel sent out a note about the merger, and although they have the same points, W. Andrew Carter does have a somewhat negative tone. He writes, “executing this merger attracts scrutiny, in our view, given the expense of acquiring Tilray’s capabilities and assets for a roughly $1.7 billion enterprise value”.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.