Yesterday, Aphria Inc (TSX: APHA) (NASDAQ: APHA) released its fiscal first quarter results. Net revenue came in at $145.7 million, down 4.3% quarter over quarter, while EBITDA was $10 million compared to $8.6 million last quarter.

This revenue number came in below both PI and Canaccord’s estimates of $164.3 million and $159 million, respectively. EBITDA also came in just shy of their estimates, with PI forecasting $12.94 million and Canaccord forecasting $12.8 million.

The ~23% growth in their Canadian adult-use segment to $69.6 million beat both analyst forecasts. PI Financial estimated that Aphria’s Canadian adult-use would grow +15%, while Canaccord estimated the final revenue number would be $65.9 million.

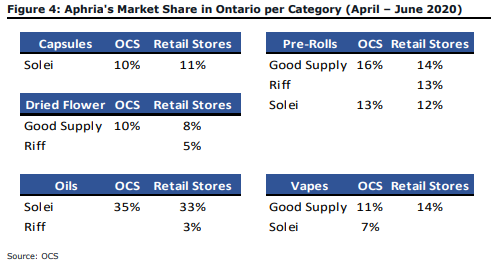

Both analysts said that this surprising growth was due to Aphria’s new value brand “Bingo”, which did over $18 million in gross sales out of the gate. This new value brand lowered Aphria’s average selling price to $4.15/gram from $5.23/gram, as Aphria held the leading market position in Ontario and Alberta for the last month of the quarter.

Only Jason Zandberg from PI Financial hits on the Canadian medical sales declining 6%. Aphria’s medical sales fell 23% year over year, with Zandberg noting this is Aphria’s 6th straight quarter of year over year declines in the segment.

Onto Aphria’s European revenue via subsidiary CC Pharma, in which revenues were down 17% quarter over quarter to $82.2 million. Zandberg says, “this European medical distribution business (noncannabis) was down due to lower elective surgeries, doctor visits and pharmacy traffic due to the COVID-19 influence.”

Aphria ended the first quarter with $400 million, which Zandberg calls “quite strong.” At the same time, Matt Bottomley of Canaccord says, “in our view, Aphria still maintains a strong balance sheet and is well funded for both organic growth and potential future M&A.”

PI Financial reiterated its Buy rating and C$10 price target on Aphria.

Zandberg is decreasing his revenue estimates for Aphria based on the lower expectations of their European business. PI now forecasts recreational cannabis revenue of $295 for the fiscal year 2021, with an overall revenue estimate of $674.2 million and $793.1 million for fiscal years 2021 and 2022. This is down from $694.5 million and $796.8 million, respectively.

Canaccord reiterated its speculative buy and C$10 price target on Aphria. Bottomley comments, “we continue to believe that Aphria remains one of the more attractive LPs on strong execution and its relative valuation. APHA currently trades at 2.8x our CY2021E EV/Rev compared to its peers at 5.0x.”

Bottomley has revised his fiscal 2021 net revenue downwards to $665.28 million compared to the previous estimate of $713.16 million.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Yes, sounds decent enough but what has been the public feedback on the value brand Bingo that appears to have propped up their revenue?