Aphria Inc (TSX: APHA) (NYSE: APHA) investors have long awaited the announcement from Health Canada that its joint venture, known as Aphria Diamond, has received licensing for cultivation. Unfortunately for shareholders, the long anticipated event has yet to arrive, with many questioning why the facility has seen such a delay in licensing relative to other cannabis growers.

Originally announced in January 2018, the Aphria Diamond facility in partnership with Double Diamond Farms, a Leamington, Ontario based greenhouse grower, is to consist of just under 32 acres of greenhouse cannabis production. The large facility is also to have provisions to double in size, with the initial footprint expected to yield the firm approximately 120,000 kilograms of cannabis on an annual basis.

The operation itself, set up as a joint venture between Double Diamond and Aphria, was expected to see sales commence by January 2019 – a date that has long since passed. With each passing week, shareholders have questioned what the drawn out delay is in relation to Health Canada, as Aphria has repeatedly maintained that the facility is complete within press releases. To give a better understanding of the situation, we’ve devised a timeline of events outlining the stage of progress at Aphria Diamond based on filings by the firm on Sedar, as well as other relevant industry developments.

Aphria Diamond: The Timeline

January 8, 2018 – Via Company News Release

- Joint venture between Double Diamond Farms and Aphria Inc, to be known as Aphria Diamond is announced.

- Facility, 1,400,000 square feet in size, is expected to produce 120,000 kilograms of cannabis upon licensing, with the potential to double the footprint for future growth on the 100-acre site.

- Aphria is to maintain 51% ownership in the joint venture, while Double Diamond holds 49% in the venture.

- Aphria Diamond, referred to as “GrowCo” is expected to require funding of “$80 – $100 million, including acquiring the property based on appraised value, plus the cost of retrofits, power co-generation facilities and other cannabis specific investments.”

- Initial funding is to come from $10 million from each party, with additional funding to be secured through traditional term debt from commercial lenders. Any shortfall in funding will be advanced by Aphria as a loan.

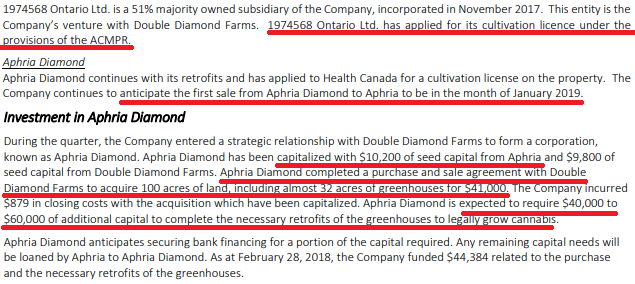

April 16, 2018 – Via Management Discussion & Analysis

- Aphria lays out the timeline and costs associated with the joint venture. Aphria mentions that they have applied for a cultivation license and expects the first sale from Aphria Diamond to Aphria would be “nn the month of January 2019.”

- Terms of the agreement indicate Aphria gave $10.2M CAD to Aphria Diamond which then bought Double Diamond Farms for $41M + $879,000 in closing costs.

- Aphria then funds Aphria Diamond with another $44.384M and indicate that they expect to need between $40-60 M in additional funding, with some to come from a bank loan.

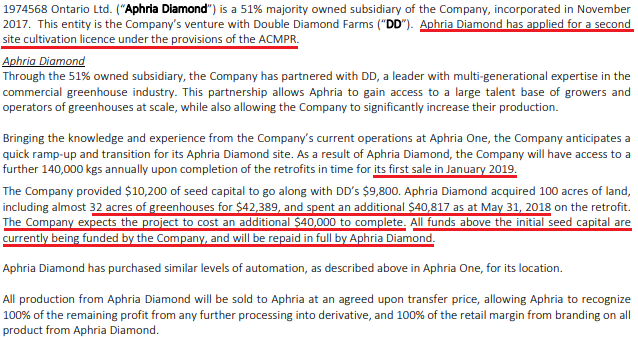

August 1, 2018 – Via Management Discussion & Analysis

- Aphria states Aphria Diamond has applied for a second cultivation license.

- Aphria once again says that Aphria Diamond will be ready and licensed in time “for its first sale in January 2019.”

- Reading the terms again, Aphria Diamond now indicates it paid $42.389M instead of the $41.879M ($41M + $0.879M). Another revised number being that Aphria expects the project to cost an additional $40M to complete – despite having already spent $40.8M on the retrofit.

- This time it scraps the point about Aphria Diamond getting a bank loan and states, “All funds above the initial seed capital ($10.2M CAD) will be funded by Aphria and will be repaid in full by Aphria Diamond.”

- They explain that all product made by Aphria Diamond will be sold to Aphria at an agreed upon transfer price, allowing Aphria to recognize 100% of the remaining profit and 100% of the branding from Aphria Diamond

October 12, 2018 – Via Management Discussion & Analysis

- Aphria reaffirms Aphria Double Diamond applied for a second cultivation license.

- The firm also reaffirms that the first sale will occur in January 2019, while increasing cannabis production estimates from 120,000 to 140,000 kilograms per annum.

- Aphria discloses that during this period a portion of the infrastructure associated with Aphria Double Diamond was delayed by a Ministry of Transportation approval, with the delay being approximately 2 months.

- Aphria has now funded an additional $70.554M and expects the additional cost to be $8M,which is relatively in line with the previous quarters MD&A statements.

January 11, 2019 – Via Management Discussion & Analysis

- Aphria Double Diamond facility is completed “as it relates to being inspection ready for Health Canada,” and Aphria has also submitted an initial license application request to Health Canada for the facility. Health Canada has not visited the facility to perform the inspections to approve Double Diamond for the license grant.

- Aphria now says that Aphria Diamond greenhouse will be completed in the company’s first quarter of the next fiscal year – meaning by the end of August 2019.

- In total Aphria has spent $75.083M in retrofits and $42.389M in initial outlay on the facility and expects an additional cost of $3.5M to complete.

April 15, 2019 – Via Management Discussion & Analysis

- Aphria reaffirms that the facility is complete as it relates to being inspection ready for Health Canada and now initial license application has been submitted to Health Canada. Text in relation to Health Canada not conducting a site visit is notably absent.

- Reaffirmation that Aphria Diamond will have its first harvest in the company’s first quarter of the next fiscal year.

- Aphria has spent $76.139M + $42.389M and expects the project to cost an additional $2.444M to complete.

May 8, 2019 – Health Canada Application Process Changes

- Health Canada changed the application process so that facilities needed to be 100% complete prior to submitting for licensing.

- This shouldn’t affect Aphria Diamond as it’s an existing application.

- Health Canada states, “With respect to existing application, Health Canada will complete a high-level review of applications currently in the queue. If the application passes this review, the Department will provide a status update letter to the applicant, indicating that it has no concerns with what is proposed in the application. Once the applicant has a completed site that meets the regulatory requirements, the Department will review the application in detail, in priority based on the original application date.”

August 1, 2019 – Via Management Discussion & Analysis

- Reaffirmation that Aphria Diamond facility is complete, and the license application was originally submitted in March 2018. Aphria is still in discussions with Health Canada on the application.

- Aphria has spent $77M + $42.389M on this facility and expects to cost an additional $4.4M to complete due to additional high-voltage lighting and electrical upgrades as well as project add-ons.

Key Takeaways

The completion of the Aphria Diamond joint venture is long overdue, and over budget. What was initially to be a venture funded largely by presumably low interest bank loans, developed into a cash incinerating exercise for Aphria and its investors. To date, Aphria has advanced approximately $109.5 million as a means of funding the joint venture, and anticipates having to advance $4.4 million more prior to final completion. The project itself is expected to be $23.78 million over budget based on high end original estimates, and $43.78 million based on low end budgets – a figure that can hit upwards of 50% of budget expansion.

Furthermore, despite the ridiculous advancements made by Aphria as a result of the firm not securing bank loans, Aphria shareholders have received no additional consideration in return. Double Diamond Farms still maintains an interest of 49% in the joint venture, despite only paying $9.8 million in initial seed capital – a figure below the initially announced $10 million. What’s more, is that Double Diamond doesn’t need to worry about finding a buyer for the product either, as Aphria has agreed to take 100% of the offtake – leaving us to wonder what exactly the firm is providing in this nearly equal joint venture.

In terms of the project itself, Aphria has been quite in regards to updating shareholders on the actual status of the facility. There’s been no indication as to why the project has been delayed by numerous months, when as late as October the firm was still indicating that they expected sales to commence in January.

What’s more, is that the Canadian market is not living up to sales projections, and Aphria just lost a major 175,000 kilogram supply agreement with Aleafia – leaving many questioning if the firm even needs the additional capacity provided by Aphria Diamond now that final licensing may actually be in sight.

Aphria closed at $5.30 US on the New York Stock Exchange yesterday, down 1.67%.

This article was jointly written by Jay, Editor of The Deep Dive, and Justin Young.

Information for this briefing was found via Sedar and Aphria Inc. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.