On April 12th, Aphria Inc (TSX: APHA) (NASDAQ: APHA) released its fiscal third quarter results. The company reported net revenues of $153.6 million, a 4.3% decrease quarter over quarter. The company reported a gross profit of $31.7 million, almost 50% of what it was last year, and a net income of negative $361 million. These numbers came in below what the general analyst consensus was.

Aphria currently has ten analysts covering the company with a weighted 12-month price target of C$18.45. This is up from the average before the results, which was C$17.72. Two analysts have strong buy ratings. Five analysts have buy ratings and three have hold ratings. The street high comes from Cantor Fitzgerald with a C$29 price target, and the lowest target comes in at C$7.40.

Here are the most recent analyst changes:

- Canaccord Genuity cuts to hold from speculative buy

- Stifel cuts target price to C$18 from C$22

- Haywood Securities cuts target price to C$20 from C$26

- PI Financial cuts to neutral from buy

- PI Financial RAISES target price to C$16 from C$11

- Cantor Fitzgerald drops target price to $29 from $32.50

Canaccord Genuity reiterates their 12-month price target of $17.50 while downgrading Aphria to hold from speculative buy. Bottomley, Canaccord’s cannabis analyst, says, “we believe the company’s quarter signals a number of red flags likely to impact most operators.”

Aphria’s $153.6 million revenue came in below Canaccord’s $162 million estimate, with Canaccord highlighting that the actual quarter-over-quarter decrease was ~13% due to netting out the Sweetwater portion of >$15 million for this quarter. Aphria’s Canadian adult-use revenue decreased 17.3% quarter over quarter, to $59.6 million. Aphria notes that COVID-19 restrictions and lower provincial purchasing lead to the decrease. Although Aphria still boasts the #1 market share in Canada, Bottomley believes that this gap is potentially narrowing after Aphria’s earnings.

Additionally, Aphria’s medical and international revenue saw a sizeable 40% decrease on a quarter-over-quarter basis to $7.8 million. Germany basically produced $0 in revenue this quarter for Aphria while last quarter it reported $5.3 million. Bottomley believes this is due to COVID-19 headwinds.

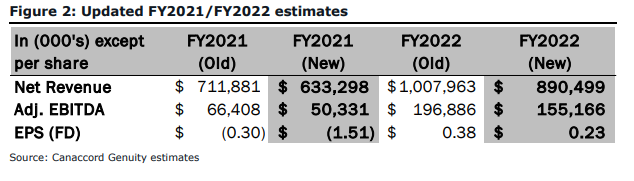

Below you can see Canccord’s new estimates that incorporate the merger between Aphria and Tilray.

Onto Haywood, they reiterated their hold rating while decreasing their 12-month price target to $20 from $26, reiterating largely what Canaccord was saying but adds that Aphria exercised “strong costly management to maintain EBITDA margins” and that the road ahead looks challenging with the renewed lockdown measures.

Haywood still sees Aphria as the leader in Canada with optionality via SweetWater as well as their international operations.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.