Earlier this week, Apple (NASDAQ: AAPL) reported their fiscal third-quarter results. The companies top-line revenue came in at $81.43 billion, growing 36.4% year over year and beating even the street-high estimate. The company’s gross profit came in at $35.25 billion, growing 55.4% year over year. Gross margins were 43.4% for the quarter and operating margin came in at 29.6%. Net income meanwhile was $21.74 billion and earnings per share came in at $1.30.

A number of analysts increased their 12-month price targets, bringing the average price target to $163.40, up from $159.98 from before the results. The street high sits at $190 from Atlantic Equities and the lowest comes in at $132. Out of the 42 analysts covering the stock, 12 have strong buy ratings, 22 have buy ratings, 7 have hold ratings and one analyst has a strong sell rating.

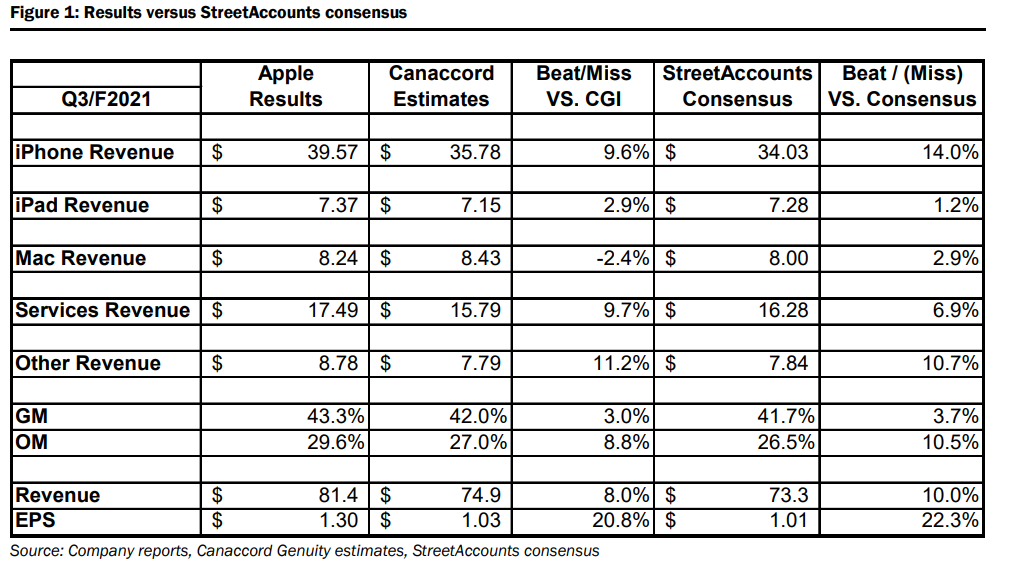

Canaccord Genuity was one of the investment banks that raised their 12-month price target to $185 from $175 and reiterated their buy rating on Apple. The company beat on iPhone, iPad, service, and other revenue but came up slightly short on Mac revenue.

iPhone revenue grew 50% year over year, beating the streets estimates due to demand for the iPhone 12. Canaccord believes that the low 5G penetration will act as a tailwind for Apple as customers trade in old phones to get newer iPhones with 5G capabilities.

Canaccord increased its fourth-quarter estimates. They are now modeling for 5% sequential growth and 32% year-over-year revenue growth. This growth is mainly due to strong iPhone demand, but Canaccord believes that the Services segment will face tougher comps and growth due to ongoing supply constraints.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.