Aritzia (TSX: ATZ) last week reported its second quarter results for fiscal 2023, for the period ending August 28, 2022. The company saw a 50.1% increase in total revenues to $525.5 million. The growth came from Aritzia’s segments of retail and eCommerce, which grew 60.1% and 33.3%, respectively. The company saw retail revenues grow to $351.6 million and eCommerce revenue grew to $173.9 million. Additionally, the company said its USA revenue grew 79.8% to $263.2 million.

The company’s gross profits saw a 41.9% increase to $220.3 million, or a margin of 41.9%, down 2.7% year over year. Aritzia attributed the margin compression to discontinued COVID relief subsidies, higher freight and distribution costs, and inventory markdowns.

SG&A saw an increase of 59.8% to $147.2 million, attributing the increase to “variable selling costs associated with the increase in revenue.” This top-line growth did not ultimately lead to a strong net income, only increasing 16.1% to $46.3 million, or diluted earnings per share of $0.40.

At the end of the quarter, the company had $65.4 million in cash and $455.1 million in inventory, an increase of 150% year over year. Part of the increase was expected as they note that last year’s inventory was artificially low due to supply chain disruptions. As a result, they have elected to order more inventory “to mitigate the risk of supply chain disruptions.”

Finally, the company increased its fiscal 2023 guidance. The company now guides for total revenues of $2.00 to $2.05 billion for the year, with gross profits to decrease by between 1% and 1.5%. They expect to open eight new boutiques and a new distribution center in the Greater Toronto Area.

Several analysts raised their 12-month price target on the company, bringing the average long-term price target to C$59.29, up from $57.43 last month. There are currently only eight analysts covering the stock, with three having strong buy ratings, four analysts have buy ratings, and the last analyst having a hold rating on the stock. The street-high price target sits at C$67 and represents an upside of about 38%.

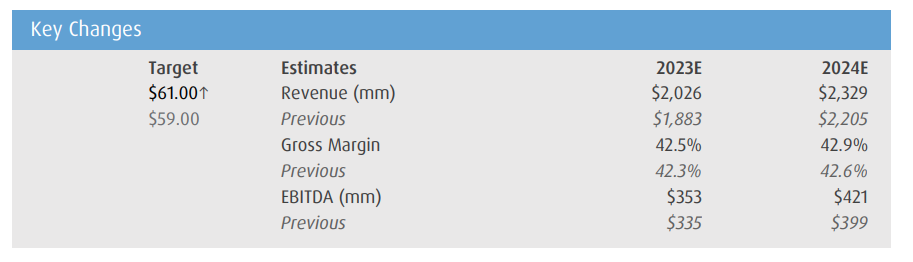

In BMO Capital Markets’ note on the results, they reiterated their outperform rating while raising their 12-month price target on the stock to C$61 from C$59, while saying that brand discovery continues to drive revenues. BMO adds that the company continues to see top-line growth come from all geographies, specifically the U.S, which is one of Aritzia’s key drivers and “presents a significant opportunity.”

As for the results, Aritzia beat all of BMO’s estimates, specifically, they were expecting adjusted earnings per share of $0.34 versus $0.44, and adjusted EBITDA of $82.6 million was above their estimate of $69.2 million.

BMO adds that thanks to the strong performance of new and existing U.S boutiques, as well as strong growth in Canada with the reopening of 34 boutiques, it has allowed the company to be in a strong position into the second half of the year. Additionally, the company’s eCommerce platform has continued to see strong growth “driven by very strong performance in the U.S. and double-digit growth in Canada.”

On the updated guidance, BMO says that they infer that the company has not seen any deterioration in consumer traffic and believes that the elevated inventory will help Aritzia hit its full-year guidance, and that they do not expect markdowns that exceed what the company was conducting pre-pandemic.

Lastly, BMO says that Aritzia’s success in the U.S continues to be their key growth engine and is currently exceeding their expectations. They write, “recent demand continues to be unprecedented, Clients are responding extremely well to Aritzia’s boutique experience, e-commerce offering, and product assortment.”

Below you can see BMO’s updated estimates.

“Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.”