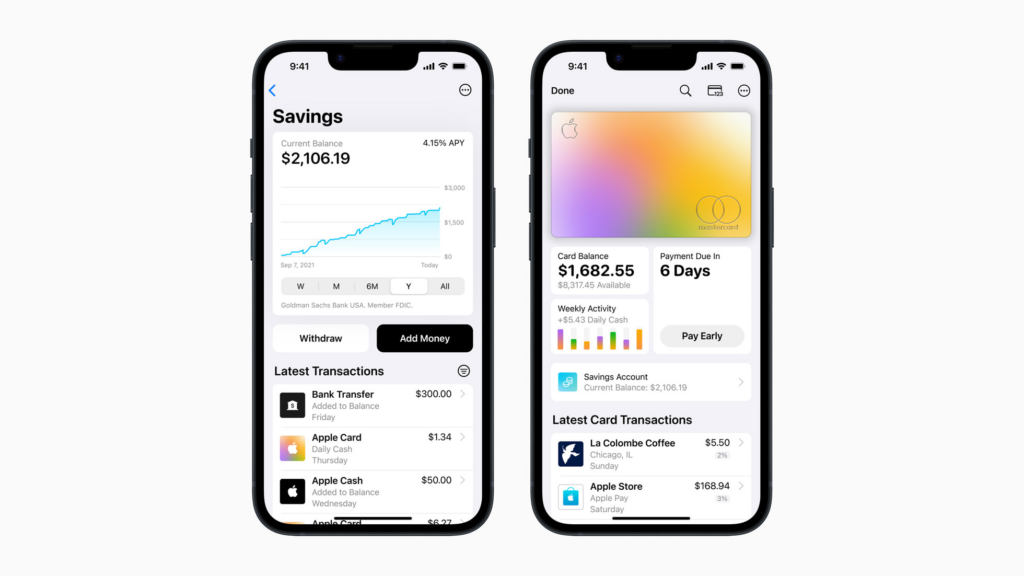

Apple Inc (Nasdaq: AAPL) has unveiled a new way for Apple Card customers to enhance their Daily Cash rewards by using a Goldman Sachs savings account.

The accounts will offer a 4.15% APY with no fees, minimum deposits, or minimum balance requirements, according to the firm. The rate is said to be “more than 10 times the national average.”

“Our goal is to build tools that help users lead healthier financial lives,” vice president of Apple Pay and Apple Wallet Jennifer Bailey said in a statement.

Apple Card users can create an account immediately from the Wallet app and use Daily Cash, the benefits earned while using the Apple Card to make purchases, to develop their savings account.

Users’ cash rewards will be immediately deposited into their high interest savings account, and they can even contribute additional funds to the account. However, cash cannot be taken immediately from the high-interest account and must be moved to a connected checking account.

Apple Card offering 4.15% on a high-yield savings account:

— Trung Phan (@TrungTPhan) April 17, 2023

• Says the rate is “more than 10x the national average”

• No fees, no minimum deposits, and no minimum balance

• FDIC for max balance of $250k pic.twitter.com/aKZK4Wf40m

The Apple Card partnership with Goldman Sachs led the banker to lose $3.03 billion from January 2020 to September 2022 on its Platform Solutions division, the collection of businesses that includes the smartphone maker’s credit card.

As of now, only residents of the United States are eligible for an Apple Card, but Canadians and others around the world have access to the company’s other banking services, most notably Apple Pay, which allows users to pay for purchases at payment terminals by linking their mobile device to a linked credit or debit account.

The new savings account will be integrated with the Apple Card, but because the Apple Card is only available to residents of the United States, Canadians will be unable to join up.

Interest rates have recently surged as central banks throughout the world hiked lending rates to control inflation. Borrowing costs have risen dramatically as a result, but savings accounts have not followed suit.

According to the Federal Deposit Insurance Corporation, the United States’ banking regulator, the average savings account at an American bank currently pays around 0.37%. Other lenders may offer better rates, but such accounts frequently have minimum deposit requirements or other restrictions.

Has Apple just outperformed the entire US banking industry? pic.twitter.com/qZGmeaNQ4A

— Satoshi Club (@esatoshiclub) April 17, 2023

The new development comes after Apple introduced Apple Pay Later, its ‘buy now, pay later’ service that will allow users to split purchases into four payments over six weeks with no interest or fees.

Information for this briefing was found via Apple, CBC, CBS, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.