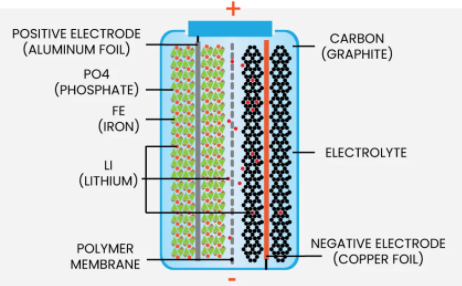

This week, market reports of Apple’s potentially producing a battery-powered electric vehicle (EV) again began to surface. In what would be the greatest threat yet to Tesla’s dominant EV market position, Apple reportedly could begin manufacturing the self-driving “Apple Car” in 2024. (Actually, a third-party manufacturing partner would likely build the vehicle.) Perhaps the most interesting feature of the rumored vehicle is its reported “monocell” battery design which has a lithium iron phosphate (LFP) chemical mixture.

Lithium Iron Phosphate Battery Features

A next-generation LFP battery could have significant advantages versus a traditional lithium-ion EV battery which has nickel as a key cathode material. First, it may have a significant cost advantage, as an LFP battery contains neither cobalt nor nickel, the two most expensive battery components. In turn, if the new design represents a step forward, lithium could be in a preferred position as a key component of future EV battery technology.

While it is obviously too early to draw a blanket conclusion based on reports of the new Apple technology, we note that junior miners of cobalt and nickel such as First Cobalt Corp. (TSXV: FCC) and Giga Metals Corporation (TSXV: GIGA) may be considered riskier than before this announcement, and lithium miners like Lithium Americas Corp. (TSX: LAC) potentially advantaged. If the new LFP chemistry proves to be a significant step forward, long-term demand for cobalt and nickel may prove lower than currently forecasted.

Second, an LFP battery could have a supercharging time advantage. Indeed, tests displayed in the early fall on China-based website 42HOW showed that a Tesla Model 3 outfitted with an LFP battery required about 42 minutes to reach a 99% total charge from a 40% level, about 32% quicker than the 62-minute time frame for a Model 3 with a nickel battery. The second largest EV manufacturer in the world aside from Tesla, China-based BYD, also utilizes LFP batteries. BYD announced its “blade” LFP battery in January 2020.

Third, media reports suggest the new LFP design would be less likely to catch fire than a traditional battery. If so, that would represent quite an advance, as cobalt (which as noted above is absent from an LFP battery) generally has a stabilizing effect on the battery and prevents cathode corrosion that could cause the battery to catch fire. Cobalt comprises about 20% of the material in the cathode in most lithium-ion batteries.

We do note LFP technology does have disadvantages which researchers must surmount, most notably that an LFP battery has a lower energy density than a nickel-manganese-cobalt battery, implying a shorter driving range. However, progress is being made in this area. When Tesla introduced its updated Model 3 in China outfitted with a new LFP battery, it announced that the range of the vehicle had been increased to 468 kilometers from 445 kilometers.

Of course, sufficient technology advances may not ultimately be made to allow an EV battery to be made without cobalt – such as an LFP battery. Indeed, if some or all of the cobalt in a battery were to be replaced, the current thinking in the engineering community is that replacement could reduce the life of the battery; and, since the warranty for an EV generally specifies that the battery retains 80% of its charge over an eight-year period, any cut in battery life could be very costly. In addition, less cobalt in the battery could increase the chance that a battery cannot cool itself sufficiently, boosting the possibility of combustion.

Conclusion

With its vast financial resources and technical expertise, Apple’s potential entry into the EV world – and the EV battery technology it may use – represents an important milepost in the EV industry. If the company indeed plans to use LFP battery chemistry, which by design includes neither nickel nor cobalt, that decision is almost certainly grounded by substantial engineering and economic studies. As a result, investors in cobalt and nickel junior miners should be mindful of the risks. On the other hand, lithium miners may very well be even further advantaged by Apple’s choices and strategy.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.