The US Treasury Department has provided proposed guidance on the new Inflation Reduction Act (IRA) electric car provisions, primarily on how a unit could qualify for the $7,500 credit.

Since the Inflation Reduction Act was passed, at least $45 billion in private-sector investment in the US clean vehicle and battery supply chain has been announced.

In a nutshell, the new rules provide that for a vehicle to be eligible for the credit, they must meet sourcing requirements for both the vehicle’s critical minerals and battery components. For vehicles that only meet one of the two conditions, half of the credit–or $3,750–is available.

Vehicles must have its final assembly in North America and not exceed a Manufacturers Suggested Retail Price of $80,000 for a van, pickup truck, or sport utility vehicle, or $55,000 for any other vehicle.

To qualify for the first half, 50% of the vehicle’s battery components must be manufactured or assembled in North America, with the percentage increasing by 10% every year until 100% in 2029.

For the other half of the credit, 40% of the critical minerals contained in the battery vehicle “must be extracted or processed in the United States or a country with which the United States has a free trade agreement,” or be recycled in North America. The percentage share also increases by 10% every year until 80% in 2027.

However, the Notice of Proposed Rulemaking (NPRM) also set guidelines for defining which set of countries the United States has a free trade agreement with since it wasn’t clear in statute. This opened up the EV tax credits for countries with “newly negotiated critical minerals agreements.”

“Agreements would be considered based on whether they reduce or eliminate trade barriers on a preferential basis, commit the parties to refrain from imposing new trade barriers, establish high-standard disciplines in key areas affecting trade, and reduce or eliminate restrictions on exports or commit the parties to refrain from imposing such restrictions on exports, including for trade in the critical minerals contained in electric vehicle batteries,” the Treasury Department said.

This comes as welcome news for countries that have no clear-cut free trade agreement with the US. For instance, Japan initially wouldn’t have been part of the list. But, under the new standards, vehicles with battery critical minerals sourced in Japan may now qualify, especially since Washington DC and Tokyo announced a critical minerals trade agreement to strengthen supply chains in a sector dominated by China.

The EU, which was initially concerned that EU-based energy and auto businesses would be shut out or forced to relocate to the US, is currently negotiating a similar accord as the transatlantic partners seek a solution to end their feud over Washington’s subsidy plans.

Aside from Japan, the NPRM also included Australia, Bahrain, Canada, Chile, Colombia, Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Israel, Jordan, Korea, Mexico, Morocco, Nicaragua, Oman, Panama, Peru, and Singapore.

The new rules are set to be in motion by April 18.

But some vehicles will now qualify for only half of the credit

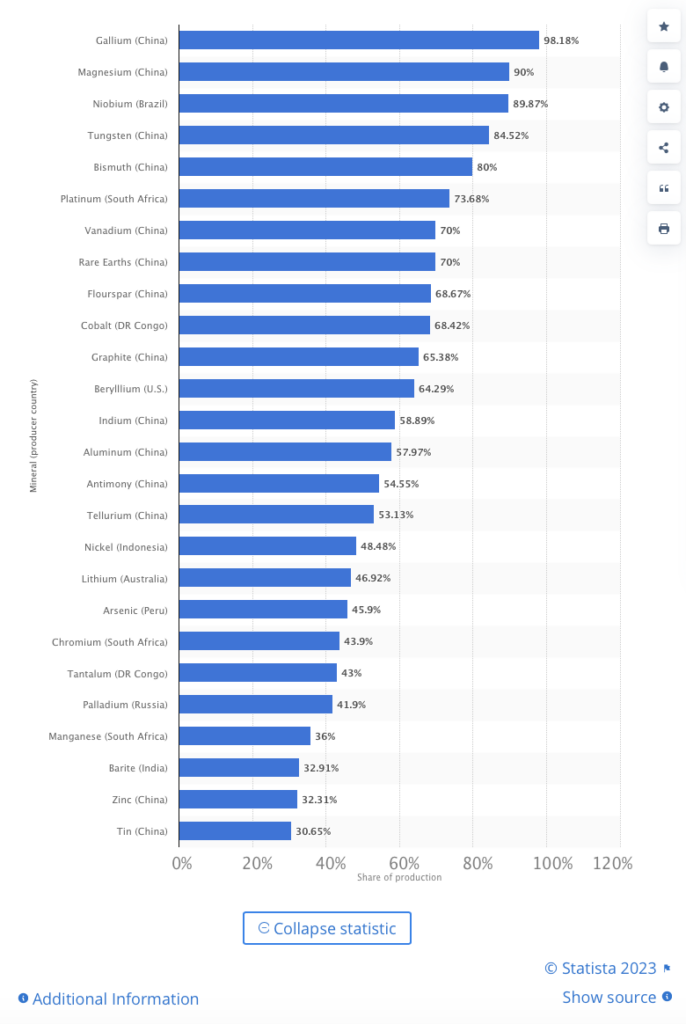

China dominates global supply chains for products such as EV batteries and solar panels, and the restrictions aim to shift US battery production and supply chains away from China.

According to the IRA, qualifying clean vehicles may not have battery components made by a “foreign entity of concern” beginning in 2024, and essential minerals harvested, processed, or recycled by such an entity beginning in 2025.

However, this means that some vehicles by automakers that used to qualify for the full tax credit will now only be eligible for half of it.

For Ford, only the F-150 Lightning pickup truck and the Lincoln Aviator Grand Touring remain qualified for the $7,500 incentive. The credits for the other cars now receiving them – Ford Mustang Mach-E, Ford E-Transit, Ford Escape Plug-In Hybrid, and Lincoln Corsair Grand Touring – will be reduced to $3,750.

Stellantis claims that of its three plug-in hybrid electric models, the Chrysler Pacifica plug-in hybrid will be eligible for $7,500 in tax credits, while the Jeep Grand Cherokee 4xe and Jeep Wrangler 4xe would only be eligible for $3,750.

As a result of the guidance, Tesla also announced last week that the Model 3 rear-wheel drive credit will be lowered.

Following the new guidelines, US Senator Joe Manchin said it “completely ignores the intent” of the IRA in bringing manufacturing back to America.

“American tax dollars should not be used to support manufacturing jobs overseas,” he said.

Manchin initially made this point at the start of the year, planning to introduce a new set of legislation that would give clarity to the original law, and stop the Treasury’s interpretation from moving ahead.

Rare earth elements and minerals such as lithium are becoming increasingly significant due to their application in renewable energy technologies, but the United States will likely confront supply shortfalls when it comes to meeting expected demand for EVs.

Information for this story was found via Reuters, Barron’s, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.