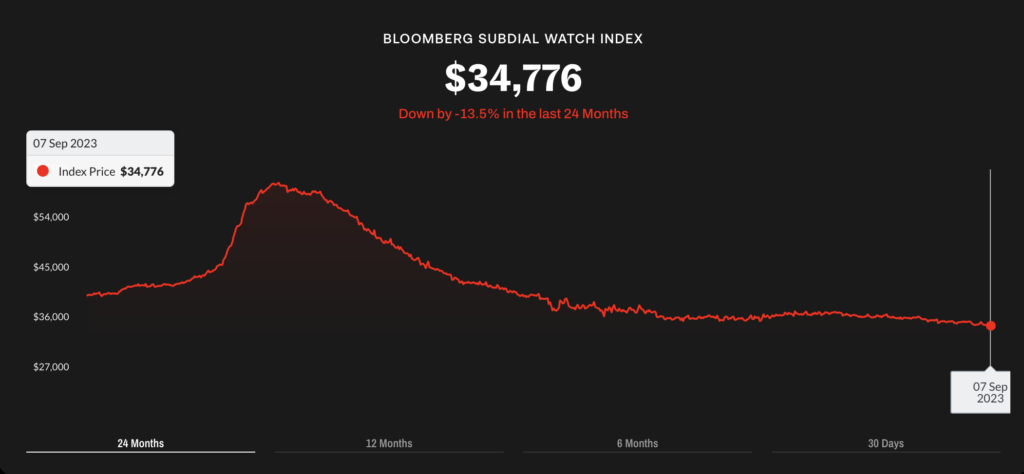

In 2022, the Rolex resale market peaked at an average price of over $60,000 as more people were getting more money and wanted something to show for it. These days, prices in the secondhand market are at a two-year low. Insiders are calling the price drop a “happy, healthy correction” following a rapid and unsustainable price escalation.

Read: The Rolex Index Is Still Falling: Economic Uncertainties Impact Demand

But X user Jason G. points out something a little less happy: the “wanna-be-rich,” or those who were earning high incomes in 2022, are going broke and dumping their assets, many for less than what they paid for in this inflationary environment.

In other words, the meme stock era of luxury gear has come to a screeching halt, and there’s no bottom yet in sight.

🚨The rich are dumping assets.

— Jason G. (@jasongofficial) September 12, 2023

From Rolex's and Audemars, to G-Wagons and Lamborghinis. The luxury markets are getting flooded with people trying to sell, and the price drops are shocking.

Is this the sign of a recession? Or are bag holders panicking? Watch the video below to… pic.twitter.com/HXQqquhmzy

Jason G. also pulls up charts on luxury cars showing the same trends in the resale and leasing markets — with a Mercedez-Benz G63 listing for as much as over $86,000 less than the original price. Auto loan delinquency numbers support this insight, as current figures are about to hit 2008 recession levels.

🚨🤯 The luxury market is getting crushed. A sign of what’s to come?

— Jason G. (@jasongofficial) September 14, 2023

After my last video, I got obsessed with looking at the luxury market and the current values. After digging in, it’s worse than I thought.

Take a look at the price drops on these cars and watches. It’s… pic.twitter.com/5Pd2a9cVqF

A recent study from the New York Federal Reserve Bank found that many of those struggling to make their car payments are young adults, with nearly 4.6% of under 30 auto loan borrowers in “serious delinquency” — which means they’ve missed at least 90 days or three months of payments.

Read: Americans Can’t Afford Their Cars Anymore

Jason G. talks about people in commission-based businesses like realtors, lawyers, and mortgage officers, but could some of these under-30s also be the kids who made big bucks trading crypto and NFTs, only to watch the landscape (and all their money) fall into the void with the likes of Do Kwon Do and Sam Bankman-Fried?

What does this market correction mean for the broader markets especially as there seems so be no end yet on the horizon?

Information for this story was found via Bloomberg, X, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.