Highly shorted stock meets high interest from retail investors: Bed Bath & Beyond Inc. (NASDAQ: BBBY) appears to be the next in line for the meme stock short squeeze. And it seems to be moving in that direction.

Bed Bath & Beyond | LFG! 🚀 🙌 💎 $BBBY

— Wall Street Silver (@WallStreetSilv) August 17, 2022

Reddit r/WallStreetBets is going nuts about the short squeeze on Bed Bath & Beyond and it is glorious to watch. The meme stocks are back.

🔊music pic.twitter.com/i9zRHKzTtW

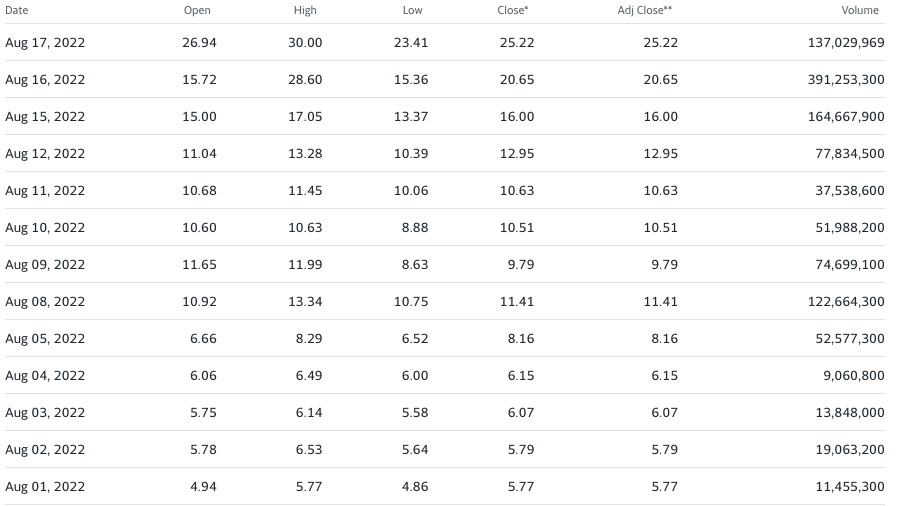

The retailer’s socks rallied once again today–which seems to be a daily phenomenon just this past week. The share price is expected to breach the year-to-date high achieved back in March 2022. But beyond that, the company’s shares have seen trading activity rapidly soar to levels never seen before since the firm went public in 1992. The volatility has pushed the stock to be halted for a time today.

JUST IN: Bed Bath & Beyond $BBBY stock has been halted for market "volatility."

— Watcher.Guru (@WatcherGuru) August 17, 2022

Out of its 80 million outstanding shares, around 86.9% is float. Approximately 29 million shares are short positions, double of what the level was back in March 2022.

Adding a nice short-squeeze touch is billionaire activist investor Ryan Cohen’s huge stake in the company. The Canadian investor is known for his involvement in the GameStop short squeeze. Data shows that he owns around 7.8 million shares in the company and has call options expiring in January 2023 at US$60 to US$80 call prices.

JUST IN:@ryancohen, $GME chair, disclosed he is still in his call options for $BBBY today.

— unusual_whales (@unusual_whales) August 16, 2022

He bought Jan 20th 2023 calls on April 21, 2022.

He bought:

– $BBBY $60 calls

– $BBBY $75 calls

– $BBBY $80 calls$BBBY is currently trading at $16.

At least her cart is full 🌝

— Ryan Cohen (@ryancohen) August 12, 2022

Many predictions put the share price to reach triple digits, higher than the historical high of US$80.50 per share back in 2013.

Jim Cramer: “Sell equity!”

Another staple to this possible meme stock short squeeze story is CNBC host Jim Cramer. The controversial pundit has drummed up his attack on the company, urging CEO Sue Gove to sell shares to address the firm’s cash problem.

How is it possible after GameStop that short sellers didn't take profits in Bed Bath? Didn't anyone notice that almost half of the float is sold short? How can they do such a stupid thing? They need an equity offering or a default or they might be boxed

— Jim Cramer (@jimcramer) August 16, 2022

For Cramer, short sellers “are getting crushed,” and Gove has to take action–as he repeatedly reiterated in his “memo tweets” to the retailer’s CEO.

Short sellers in so many of these small caps are getting crushed now. It's not just BBBY, Meanwhile the ceo of Bed Bath says nothing!

— Jim Cramer (@jimcramer) August 16, 2022

memo to Sue Gove: you want to save Bed Bath & Beyond? ($BBBY) Go to your board today and ask for authorization to sell 20 million shares…. That will buy you the time and the credit you need for the holidays

— Jim Cramer (@jimcramer) August 16, 2022

Memo to Sue Gove, Bed Bath & Beyond CEO. You must know your balance sheet is so weak that you run the risk of not getting seasonal inventory. You should be fired if you don't offer equity right here to solve your problems and give you time.

— Jim Cramer (@jimcramer) August 16, 2022

Maybe Gove figured out that BBBY is up because of the squeeze NOT the merch and will sell 20 million shares.

— Jim Cramer (@jimcramer) August 16, 2022

I often find CEOs are obtuse to the stock market. So i will explain it real easy: Bed Bath needs money. It can raise money at a price higher than where it sold a lot of stock, Now is the time. Sell or die.

— Jim Cramer (@jimcramer) August 16, 2022

$BBBY 65 million shares and 390 million shares traded. Is this mindless manipulation to break the shorts? I think the company's viability is in question but it has the ultimate opportunity to sell stock at least with an ATM.. How can they be so obtuse?

— Jim Cramer (@jimcramer) August 16, 2022

His fixation on the company didn’t stop with just tweets. The TV host has appeared on shows to talk about the squeeze on the firm’s short stocks, highlighting his frustration on what’s happening with the company.

“Obviously the company should be selling stock, I think they’re completely paralyzed,” said Cramer in a CNBC show. “I’m gonna give them free legal advice, given the fact that I actually know the law here: they can sell!”

"What's going on with $BBBY? Obviously the company should be selling stock, I think they're completely paralyzed," says @jimcramer. "I'm gonna give them free legal advice, given the fact that I actually know the law here: they can sell!" pic.twitter.com/j75SdgiYLS

— Squawk Box (@SquawkCNBC) August 17, 2022

But no matter how fixated he seems to be on the retailer’s stocks, Cramer maintained that he is “neutral on it.”

Told Truth on Bed Bath.. I am neutral on it but short-term not as positive about the market

— Jim Cramer (@jimcramer) August 17, 2022

I am focused on Bed Bath because it is so obviously being manipulated but no one knows who is a member of the group that is doing the manipulation and i do NOT subpoena power, darn it

— Jim Cramer (@jimcramer) August 17, 2022

The cash problem

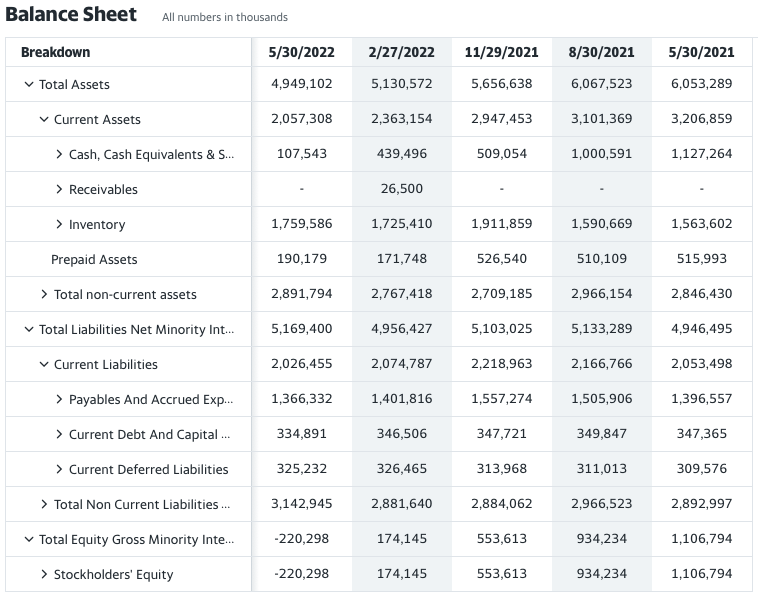

But unlike other meme stocks rally before, Bed Bath & Beyond is in a precarious financial position. The firm recorded dwindling revenue and widening net losses. These lead to the firm posting a weaker cash position for the quarter–recording a negative free cash flow of US$488.4 million as of last quarter.

All this contributed to constant cash burn throughout the past year, with the firm ending with US$107.5 million in cash from last year’s balance of US$1.13 billion.

Given the firm’s liquidity problem, selling equity at these elevated share prices would probably be a logical choice–as Cramer puts repeatedly. But as previous meme stocks rallies have shown, the interest and activity are mostly stemming from the “movement” of the retail investors.

The questions now: how long can the short squeeze go? Could this rally help the company’s cash situation? And by then, would Cramer be past beyond his fixation on Bed Bath & Beyond?

Bed Bath & Beyond last traded at US$25.10 on the Nasdaq.

Information for this briefing was found via Seeking Alpha and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.