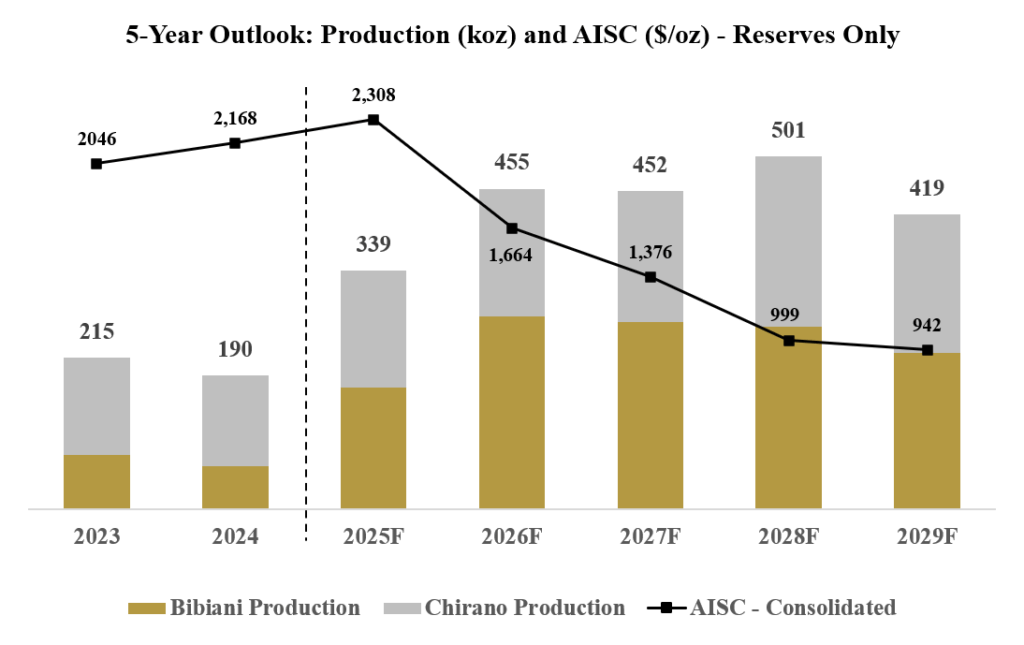

Asante Gold (CSE: ASE) has released a new five year outlook for its operation in Ghana, while claiming it will surpass the 500,000 ounce a year mark in 2028. The outlook follows updated mineral reserves being reported for the Chirano mine.

On a combined basis, production from Asante’s Bibiani and Chirano mines is expected to hit 455,000 ounces in 2026, before growing to 500,000 ounces in 2028. Over the next five years, cumulative production is expected to total 2.2 million ounces, delivering unlevered free cash flow of $2.1 billion, a figure that assumes $3,000 an ounce gold.

At the same time, Asante is claiming that the cost of mining those ounces is to decline, with AISC expected to be $1,375 an ounce by 2027 before falling to sub-$1,000 an ounce by 2028. Asante last week reported an AISC of $2,168 an ounce for FY2025, with the fourth quarter specifically containing an AISC of $2,610 an ounce.

For calendar 2025, the company has guided to 339,000 ounces of production on a combined basis, at an all in sustaining cost of $2,308 an ounce.

Rapid production growth is expected to occur at Bibiani, following the expansion of the main pit, increased fleet availability and the completion of a sulphide treatment plant this year. Underground operations are also expected to begin generating ounces in 2026, leading to further growth, with production expected to move from 172,000 ounces in 2025 to 259,000 ounces in 2028.

Chirano production is also expected to grow, moving from 167,000 ounces this year to 242,000 ounces by 2028. That growth is based on an optimized production profile, while expanding reserves have extended the life of mine by one year to 2029, with the addition of 242,100 ounces to reserves.

Asante meanwhile is advancing talks for a financing package, which is expected to be released in the coming weeks. The package remains subject to the receipt of credit commitments, however the package is expected to be released in Q2 2025. Near term liquidity meanwhile is expected to be bolstered by a $100 million advance on a gold pre-pay facility with Fujairah, alongside increased production from Bibiani versus the prior quarter.

Asante Gold last traded at $1.02 on the CSE.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.