On June 23rd, Ascot Resources (TSX: AOT) provided investors with a series of updates. In the first update, they talk about their advancement on a number of projects and say that construction has been “significantly advanced” for many of their projects, and have constructed the new water treatment plant clarifier foundation, the Big Missouri water discharge pipeline, and portal establishment and initial underground mine development at the Big Missouri deposit.

Though the second update is focused on the company’s ability to find financing in order “to avoid putting certain work packages on hold,” and note that this financing needs to be completed before the end of June. In the release, they note that though the company has been working with a number of potential financing partners, discussions are ongoing but there has been no positive update and the financing is still hung.

As a result, the company will start to decelerate various construction activities and place certain work packages on hold. They say, “the deceleration of project construction will provide more time for mine plan and sequencing optimization.” In the same paragraph, they say that the target for the first gold pour will be delayed from the first quarter of 2023 to “between late 2023 and early 2024.”

Ascot notes that the company “has a limited weather window to conduct certain outdoor construction activities,” and that due to the company not finding financing, the company will be delayed on a number of activities until the next weather window.

Lastly, the company says that it has drilled 12 holes in the Sebakwe Zone under their exploration program, and while assays are still pending “early visual indications are encouraging for the continued growth of the Sebakwe Zone.” They say that the drill hole P22-2393 intersected a “significant amount” of coarse and visible gold at a depth of 316 metres.

There are currently 5 analysts covering Ascot Resources, with an average 12-month price target of C$1.19 or an upside of about 180%. Out of the 5 analysts, 3 have buy ratings while the other 2 analysts have hold ratings on the stock. The street high price target sits at C$1.60 and represents an upside of about 275%.

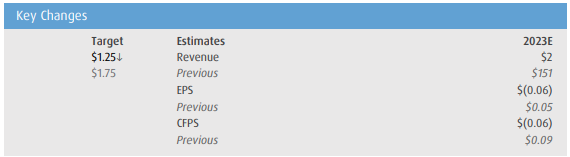

In BMO’s note on the news, they reiterate their outperform rating but lower their 12-month price target from C$1.75 to C$1.25, saying that their overall tone of the news is negative. They say that they are lowering their price target due to the delays that the firm had to put in place due to not getting financing done in June.

Due to the current environment of higher rates and higher bouts of inflation, BMO now assumes that the company will get a US$60 million 5-year revolver loan by the fourth quarter of this year. Though they were optimistic that this revolver was going to be offered by Sprott at an interest rate of 8.5%, they now expect that the rate will be 11%. They also expect that Ascot will look to get a US$60 million stream agreement at the same time, commenting, “Our assumed stream agreement is for 4% of gold sales at an ongoing price of US$600/oz.”

Below you can see BMO’s updated estimates on Ascot.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.