Last night, Aurora Cannabis (TSX: ACB) (NYSE: ACB) reported its second quarter 2020 earnings. They announced that revenue came in at $67.6 million, which is flat year over year. They also reported adjusted EBITDA, excluding provisions and termination costs, of $12.1 million, which is $53.1 million better than last year.

Here are the most recent analyst changes:

- ATB Capital Markets raises target price to C$13 from C$10.50

- MKM Partners cuts to sell rating

- Stifel raises target price to C$7.8 from C$6.5

- Canaccord Genuity raises target price to C$14 from C$11

Aurora Cannabis currently has 13 analysts covering the company with a weighted 12-month price target of C$12.20. This is up slightly from the average before the results, which was C$11.95. Ten analysts have hold ratings, while one analyst has a sell rating and two have strong sell ratings on Aurora.

From our coverage of Canaccord’s second quarter preview on Aurora, you would know that Aurora’s numbers were slightly below their C$69.5 million estimates. Bottomley, Canaccord’s analyst writes, “Within its top line, the company saw a nice bump in its net medical cannabis sales, which increased by ~16% to C$38.9M.” This growth was attributed to an increase in shipments to Germany and Cantek.

Onto Canadian market share, Bottomley writes, “Aurora experienced a notable step back in its Canadian adult-use sales, which decreased by ~17% QoQ to C$28.6M.” This undeniably shows that Aurora has lost market share in their value flower segment. Bottomley work’s out that they now believe that their market share is roughly 7%, which puts them at #3 in total market share.

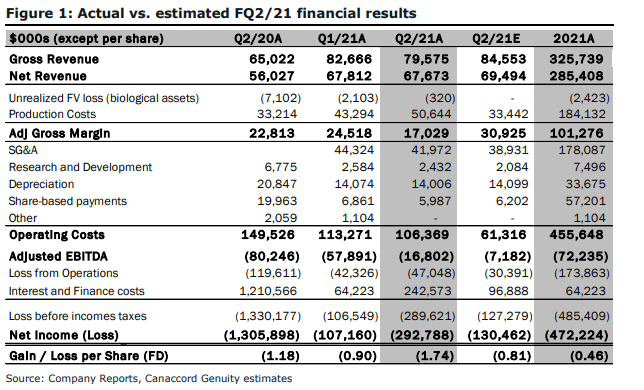

Below you can see how earnings lined up against Canaccord’s estimates.

Bottomley then discusses Aurora scaling back their production with the closure of Aurora Sun and the move to a 25% utilization rate at its Aurora Sky facility. He writes, “The company now plans to supplement its internal demand for biomass (predominantly for more value-focused offerings) by conducting spot purchases through external wholesale markets that have witnessed pricing pressure for over a year.”

He then goes onto talk about Aurora’s balance sheet. He writes, “Although we believe this is more than sufficient to fund current operating losses and strategic initiatives, ACB’s FD share count has increased by ~23% over the prior quarter, representing a fairly steep cost of capital (in our view).”

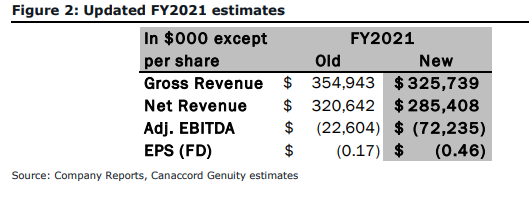

Below you can see Canaccord’s estimate changes for fiscal 2021.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.