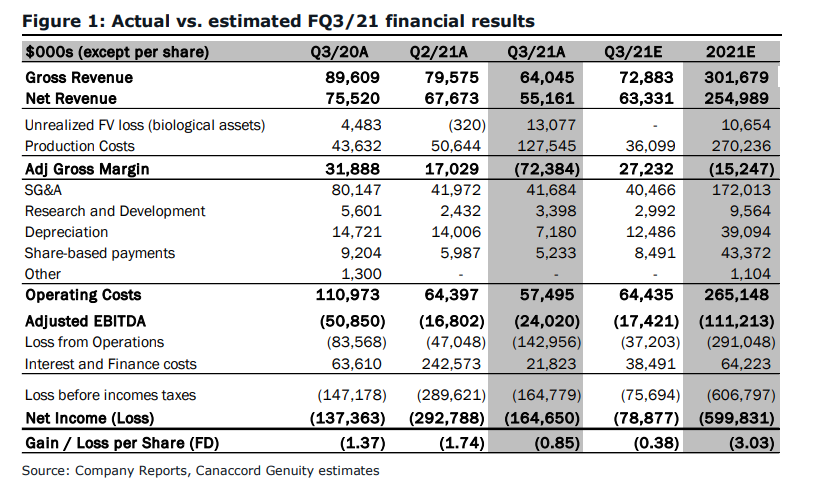

Aurora Cannabis (TSX: ACB) (NYSE: ACB) reported earnings for their fiscal third-quarter earnings on May 13th. The company reported revenues of $55.2 million, a 16.5% decrease sequentially and a 25% decrease year over year. Below the top line, the company reported a negative $72.4 million in gross profits, with earnings per share coming in at negative $0.85 for the quarter. All these numbers came in below the analyst consensus.

Many analysts have reduced their 12-month price after Aurora’s earnings, pushing the 12-month mean price target down to C$11.08 from C$12.58. The company currently has 13 analysts covering it, with five analysts having a hold rating, another five having sell ratings and three having strong sell ratings. ATB Capital, Cowen, MKM Partners, and Piper Sandler all reduced their 12-month price target on Aurora.

In Canaccord’s note to investors, they also cut their 12-month price target in half to C$7 and downgraded the stock to a sell rating from hold. Matt Bottomley headlines, “A sizable miss while Cdn adult-use sales continue steep decline (down ~37% QoQ).” Bottomley lowered their outlook on Aurora as Aurora continues to lose market share in the Canadian adult-use market, while increasing the execution risks associated with their long-term forecasts.

Aurora reported revenue of $55.2 this quarter, which came in below Canaccord’s estimates of $63.3 million which was on the lower end of analysts’ expectations. Adult-use sales had a 17% decline during this quarter which Bottomley notes is 50% lower than what the company was making 6 months ago. Domestic recreational sales dropped 37% quarter over quarter.

Management and Canaccord both agree that the primary reason for the drop in revenues is due to COVID-19 headwinds as well as them trying to right-size their SKUs. Not all is bad though, Aurora still has a number 1 market share in the medical market and remains one of the largest cannabis exporters out of Canada.

Bottomley says that the large cash position that Aurora has (C$470 million) comes with “no small cost,” with Aurora ballooning their shares outstanding by 63% year to date which doesn’t seem to stop as Aurora has now also announced another U$300 million ATM facility.

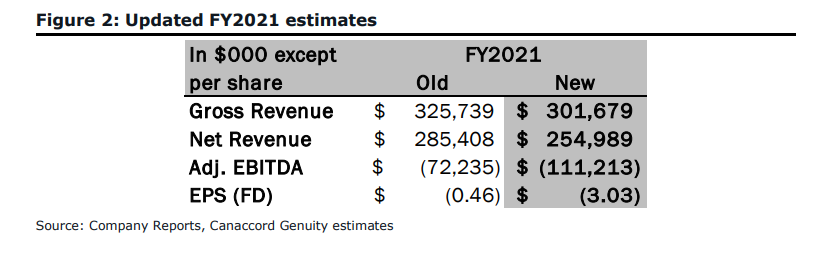

Below you can see the updated 2021 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.