Earlier this week, Aurora Cannabis (TSX: ACB) (NYSE: ACB) reported their fourth-quarter financials, after having released preliminary data two weeks prior on September 9. Preliminary figures had provided guidance in terms of revenue, margins, SG&A, and significant write downs that were expected to hit the fourth quarter financials. Aurora reported fourth-quarter total net revenue of $72.1 million, while posting a loss of $1.9 billion. More significantly, the company posted a full fiscal year loss of $3.31 billion, compared to revenues of just $278.9 million

Fourth quarter net cannabis revenue hit $67.5 million. The break down consisted of medical cannabis net revenue of $32.2 million, and consumer cannabis net revenue of $35.3 million. Aurora also provided first-quarter guidance and expected net cannabis revenue to come in at C$60-C$64 million.

Thus far, seven analysts have cut their 12-month price targets, as outlined below.

- Piper Sandler cuts target price to $8 from $10

- Cowen and Company cuts target price to C$10 from C$11

- MKM Partners cuts fair value estimate to C$9 from C$18

- Canaccord Genuity cuts target price to C$8.50 from C$10

- ATB Capital Markets cuts price target to C$10.25 from C$11.30

- PI Financial cuts price target to C$10 from C$12

- CIBC cuts price target to C$12 from C$20

Before we start on this long list of price cuts, lets emphasize that Canaccord’s analyst Matt Bottomley cut Aurora’s price target from C$21 to C$10 just two days prior to cutting it further to C$8.50. He reiterated his hold recommendation on the stock in the note he sent out yesterday morning.

Bottomley headlines his latest note with, “FQ4/20 review: In line with guidance, with declining revenues expected again next quarter.” He attributed net revenues being down roughly 5% to Aurora switching focus on their lower-priced value segment, which comprised of approximately 62% of Aurora’s dried flower sales compared to approximately 35% in the third quarter. It was also the main reason as to why the average net selling price per gram declined 22% this quarter and said that the C$72.1 million was at the higher end of the range guided by management.

The Canaccord analyst says that there was 7% growth in Aurora’s adjusted gross margin to 50%, which puts Aurora at the higher end of the range compared to its peers. This was mainly attributed to the 27% decrease in its cash production costs. Even though Aurora decreased its quarterly OPEX costs by 14% to C$67.7 million, which resulted in an adjusted EBITDA loss of C$34.6 million, it was above Canaccord’s estimated C$27 million loss. Still, Bottomley says, “however, with a further >35% reduction in its opex expected next quarter, we believe ACB is likely on pace to meet its objective of reaching positive adj. EBITDA by FQ2/21.”

Bottomley comments further that, “we believe it is clear that the steepness of these impairments indicates poor historical capital allocation on the part of management in relation to CAPEX, working capital and M&A,” referring to the $1.822 billion in write-offs that Aurora did this quarter. He says that the first-quarter guidance that was released likely “indicates further market share reductions for ACB in the near term as the company continues to right-size its ops,” as net cannabis revenue is supposed to drop 14% quarter over quarter.

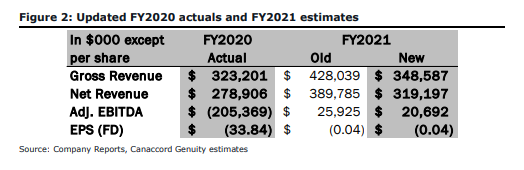

Bottomley has updated his fiscal year 2021 estimates due to both this quarter’s numbers and the management guided numbers for the first quarter of 2021. You can see the full estimate change below.

Bottomley also expects Aurora to be hitting the at-the-market financing and the equity shelf as the C$162 million of cash on hand is not enough even after raising U$48 million from the ATM and another U$34 million from sales of marketable securities this quarter. Operational and capital expenditures were close to C$100m this quarter, which he says “Aurora will still need to rely heavily on the ~US$183M left on its ATM facility and $60M allowed through its shelf filing to fund its ops. As a result, we expect ACB to continue seeing moderate dilution in the interim as it looks to right the ship.”

John Zamparo of CIBC Capital Markets also had much to say about the blowout quarter. In his note yesterday, he reiterates his neutral recommendation and cut his 12-month price target to C$12 from C$20. The note, which he titles, “Zig When Others Zag: From Value To Premium,” says that based on management’s comments, Aurora wants to start to de-emphasize the value category and increase its focus on the premium/high margin category, which includes vapour, pre-rolls and concentrates from current premium brands such as Whistler and San Rafael. Zamparo says that the new CEO’s CPG background, “lends credibility to this strategy and the necessary execution improvements.” John worries that management has set the near term expectations too high as management guided towards C$60-C$64 million in revenue. A 30% quarter over quarter improvement is needed to meet the positive EBITDA guide he says.

Zamparo also adds that during this quarter, Aurora lost its #1 rank of national share because, “it did not fully participate in category growth for gummies, vapour, and pre-rolls, while significant competition showed up in value flower.” Now that Aurora has lost their #1 ranking, they plan on launching new SKU’s and pivot to leverage their existing premium brands, which is a strategy that Zamparo endorses but says, “will take time, in our view, and we forecast that it will take until FQ3 to see these gains.”

Just like everyone else, John states that the “Balance Sheet Still Top Of Mind,” as Aurora has C$110 million of term debt due mid-2021 and another C$460 million in convertible debt due early 2024. Zamparo sees no immediate concern but believes that the balance sheet likely, “prevents the company from contemplating ambitious plans following potential U.S. legalization.”

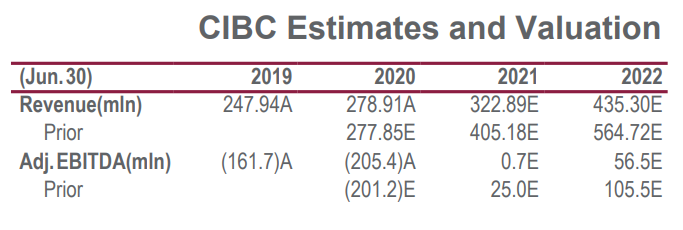

Zamparo also revised his 2021 and 2022 fiscal year revenue and adjusted EBITDA forecasts, which you can find below. In the note, he shows the revised quarterly estimates for the fiscal year 2021. The most interesting thing is that he is now forecasting Aurora to not hit $100 million revenue per quarter in fiscal 2021, while his prior estimate said that Aurora would hit a +$100 million revenue quarter by the third quarter and then go up to $121.97 million in the fourth quarter. Zamparo now estimates that the fourth quarter will be just shy of $100 million in revenues at $98 million.

Onto Jason Zandberg’s of PI Financial note, where Aurora saw a reiteration of PI’s neutral rating and a cut to the 12-month price target to $10 from $12. Zandberg headlines the note, “New Stated Focus on Premium Products.” He states that if Aurora wants to accomplish positive EBITDA, revenue has to grow 17%, while gross margins have to increase to 55%. He believes this scenario is possible only if the company can “achieve its stated goal of moving to the premium end of the market (thus improving gross margins) but still must demonstrate a healthy growth rate similar to the overall market (industry grew by 16% in Q2).”

Zandberg now estimates revenue to be $314 million and $551.7 million in fiscal 2021 and 2022, compared to his previous estimates of $356.8 million for 2021. He also expects Aurora to have EBITDA of $10.9 million in fiscal 2021, growing to $137.8 million in fiscal 2022.

The last analyst note to cover is Andrew Carter of Stifel. In his note, he reiterated his C$10.50 price target and a hold recommendation on the company. He comments, “We come away from Aurora’s F4Q20 results with our outlook largely in-tact. Results were in-line with the recent business update.” He believes that that the company is taking a conservative approach, “with implied shipment declines well beyond the weakness telegraphed by Headset with the company clearly mindful of the need to rebuild credibility with all stakeholders.”

Carter is sticking with his C$458 million revenue forecast for fiscal 2022 still. It’s stated that his estimates assume Aurora’s consumer business will keep up with the growth of the overall Canadian market, but adjusts the first quarter revenue estimate to C$62 million, down from C$74 million, based on management guidance.

Stifel also believes that the medical business will continue to see steady growth as the first quarter will include a full quarter of Reliva sales. It’s estimated that consumer sales will be down 25% based on the headset trends, which suggests consumption is down low double-digits to mid-teens.

Finally, Carter then goes onto say, “we believe the reduced balance sheet risk added near-term flexibility is underappreciated with the debt a key risk we outlined following F3Q20 earnings.” Aurora has reduced its debt by over C$50 million this quarter and will have time to deal with the sizeable convertible debt that is coming due in 2024.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.