Tomorrow after market close Aurora Cannabis (TSX: ACB) (NYSE: ACB) will be reporting their fiscal fourth quarter financials for the period ending June 30th. This will be the first reporting hosted by the newly appointed CEO, Miguel Martin. Aurora said they expect to see a ~6% sequential decline in its overall revenues and up to a C$1.8 billion write-downs in goodwill and intangibles in recent news.

Matt Bottomley from Canaccord commented on the event, stating, “although we expect a rather discouraging print, on the whole, we believe ACB is likely not alone, as we think flat to declining revenues could be more of an industry-wide trend for Canadian operators as the overall macro climate for licensed producers remains challenged.” The commentary was provided in a note this morning where they cut Aurora’s 12-month price target by more than 50% from C$21 to C$10 and reiterated their Hold rating on the stock.

In the note titled “FQ4/20 preview: ACB expects declining revenues and material impairment charges,” Bottomley expects net cannabis sales to be C$68.7 million, down 1.3% quarter over quarter, while medical revenue will make up C$28.2 million and be up 4.7% quarter over quarter. Consumer revenue is estimated to be C$35.8 million, or down 7.3% quarter over quarter, and international revenue is estimated to be C$4.5 million, up 12.5% quarter over quarter. On top of this, Bottomley expects that Aurora will make C$5.3 million in ancillary and service revenue, which means Aurora’s top-line revenue is estimated to be C$74 million for the fourth quarter.

Canaccord notes that management has guided adjusted gross margins to come in at 46% to 50%, which at the midpoint of 48% represents a quarter over quarter improvement by about 6% and would make Aurora have one of the higher adjusted gross margins in the Canadian sector to date.

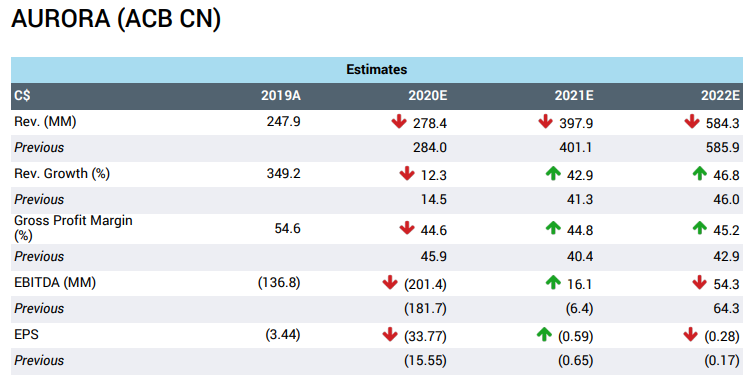

With such a deep price target cut, it naturally means that the analyst has gutted their estimates, discount rate, or terminal value. With no surprise, Bottomley has done that exact thing with Aurora. Bottomley first changed his market share percent for Aurora from 18.5% to 16% and increased the discount rate from 14% to 16% citing management outlook and “our view of the overall challenged macro climate of the Canadian landscape.” They have also lowered their fiscal year 2021 revenue and adjusted EBITDA estimates. They now forecast C$390 million in revenue, down from C$430 million and C$26 million in adjusted EBITDA instead of C$40 million previously.

Jefferies analyst Owen Bennett has also slashed Aurora’s 12-month price target from C$14 to C$8.70, while upgrading their recommendation to a Hold. Bennett says, “while progress on costs has been impressive, and we increase our outer year EBITDA estimates to reflect this, near-term liquidity risks remain, especially if the company is to continue to invest behind its top-line strength as it should.” Bennett expects Aurora to use up the rest of its ATM and will also likely seek further raises.

Jefferies has slashed their fiscal year 2020 estimate but has upgraded every estimate except revenue for 2021. He says that the longer-term estimates “see support from SG&A” as per the company’s words, the run rate is in the low C$40 million and with management guided additional C$10 million in savings starting in the second half of 2021 it shows that they are moving in the right direction cost-wise. Bennett says, “the problem for ACB has been its sizeable cost base, and not only the liquidity issues that come with this, but also communication around this which has damaged its credibility”.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.