Aurora Cannabis (TSX: ACB) reported on late Tuesday its financial results for fiscal Q4 2022 ended June 30, 2022. The firm recorded quarterly revenue of $50.2 million, marginally down from Q3 2022’s $50.4 million and down from Q4 2021’s $54.8 million.

The firm ended with a net loss of $618.8 million, down from the net loss of $134.0 million last year. The quarterly loss is heavily driven by non-cash impairment charges of $505.1 million due to write down in goodwill, intangibles assets and property, plant and equipment.

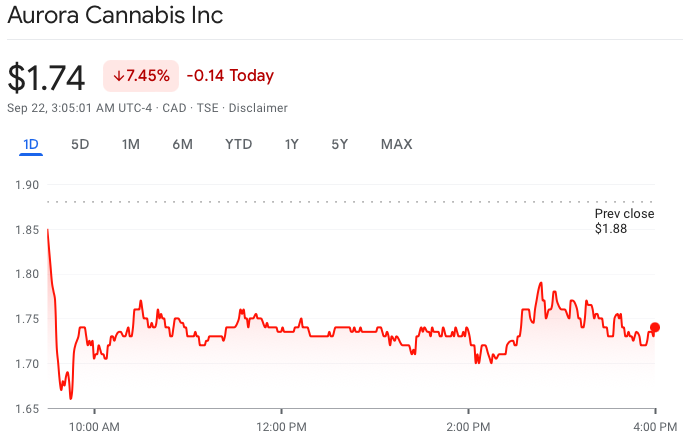

The firm’s shares plummeted by 7.5% on the day following the financial results.

In terms of operations, the firm saw the average net selling price of dried cannabis come down to $5.10 from $5.41 last quarter and $5.11 last year. This was offset by an increase in volume, selling 13,130 kilograms for the quarter, up from last quarter’s 9,722 kilograms and last year’s 11,346 kilograms.

CEO Miguel Martin defended the results, saying the firm, “[continues] to enhance the long-term value of [its] differentiated global cannabis business by quickly identifying highly profitable growth opportunities, deploying capital in a disciplined manner, and continuing to rationalize our cost structure.” The company further touts the 35.4% increase in its international medical cannabis net revenue segment.

Further down, adjusted gross margin came down to 47% from last quarter and last year’s 54%. Adjusted EBITDA losses narrowed to $12.9 million, down from last quarter’s $11.4 million loss but up from previous quarter’s $21.8 million loss.

“We continue to expect a positive adjusted EBITDA run rate by December 31, 2022 and remain on track with our previously announced cost saving targets of up to $170 million in annualized savings,” Martin added.

The cannabis firm ended the fiscal quarter with $488.8 million in cash from $480.6 million at the beginning of the period. The cash influx was a result of raised proceeds from its equity financing conducted in June amounting to approximately US$172.5 million, partially offset by repurchasing $155.3 million in convertible debt.

The company also noted that fiscal 2023 will only comprise three quarters as it shifts to a new fiscal year end on March 31, 2023.

Aurora Cannabis last traded at $1.67 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.