Terry Booth’s Thursday departure from the C suite at Aurora Cannabis (TSX: ACB) (NYSE: ACB) took the form of a controlled implosion at the center of the cannabis business. It doubled as a layoff announcement that, in contrast to Sundial, HEXO and Tilray’s layoff announcements, which framed the components as normal-course-of-business necessary evils, Aurora took the opportunity to acknowledge what the market had been telling them for the better part of the trailing 12 months: this isn’t going to work as a functional business.

By announcing that they would be unwinding leverage and cutting SG&A costs while they dial back the build-out, Aurora was able to create the appearance of a company who believes in the value of what was left over when the smoke cleared and, arguably, got the market believing right along with it.

In the context of a CEO resignation, write down of 24% of the goodwill line, and guidance for a 30% revenue cut, with no guidance for margin and a promise to cut SG&A, all happening at the same time, a 15% fall in the stock price almost seems like a win. Newly appointed Interim CEO Michael Singer looks hyper-competent coming out of the gate by getting it all out of the way in a single news announcement, then immediately burying that announcement with another announcement about new independent directors. Take the medicine, move the story along.

But no amount of austerity or re-structuring is going to make Aurora behave like a functional business. Aurora is a leveraged collection of assets, listed together as a single entity. There are no economies of scale to be gained by their aggregation, and their operators are in the midst of a come-to-Jesus moment about the cost of their administration.

Aurora’s cultivation facilities and the licenses that come with them are the original assets that were leveraged to build this mess, and the tiny window this release gave us into their output did not look encouraging. Our Galaxy Brain post pointed out that a marked lag in product quality at Aurora was hurting revenue, and would continue to hurt sales. Guidance for $54 million in cannabis revenue, including a $12 million provision for returns, seems to be a confirmation that these cultivation assets aren’t yet producing a product that moves consistently in this market or regulatory environment. Odds are long that they’ll be figuring it out in an environment where half the team has been cut and the other half is wondering if they’re next.

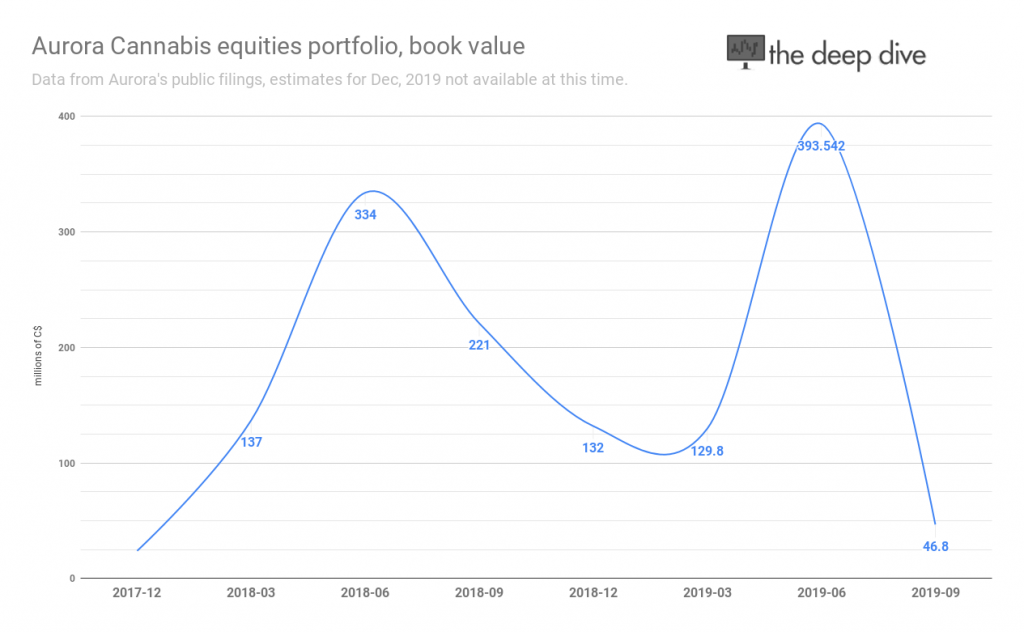

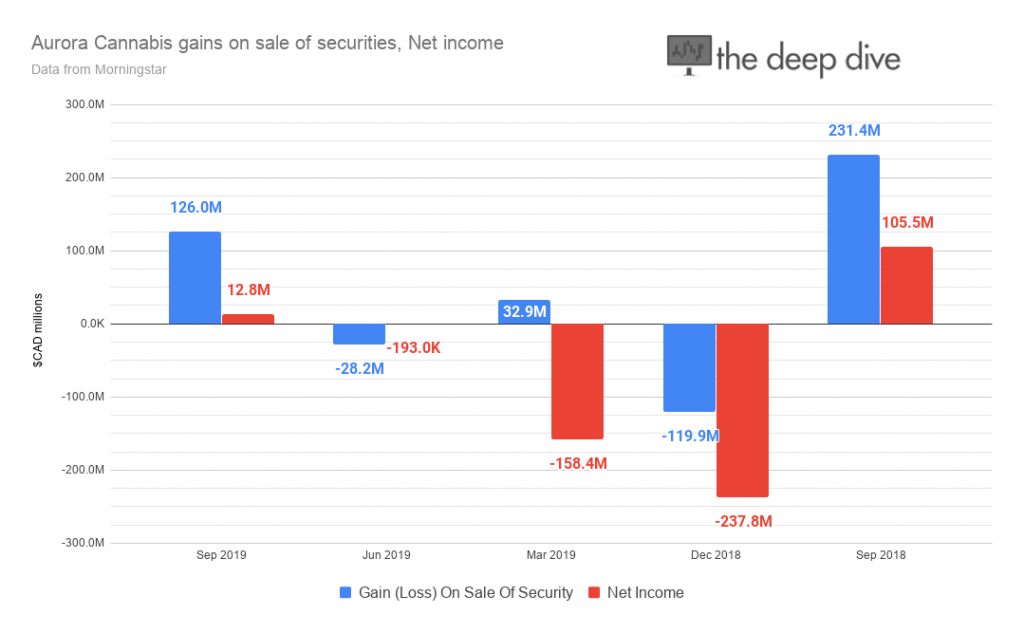

The assets that surround the cultivation assets were best used through the wholesale transfer of their amplified value to the company’s balance sheet, and the company knew it. Terry Booth’s Aurora chose to report their equities portfolio through fair value to profit or loss method, essentially marking the value of their portfolio to market quarterly, living by that sword until eventually being wounded by it. Singer is projecting an earnest attempt to stop the bleeding, but there’s no way of knowing if it’s genuine. Surely, he’d like to put the company in a position that could facilitate it’s sale to the one entity rich enough and dumb enough to buy it.

As yet, nobody has been able to confirm twitter buzz about the province of Alberta using government resources to take ownership of or otherwise bail out Aurora, but The Bruiser had Booth’s retirement before anyone, so it ought to be considered. Besides: administrations that campaign on being business friendly have a strong predilection towards board room socialism that benefits businesses in their own jurisdictions.

To Edmonton constituents, Aurora isn’t an enormous monstrosity created by banking interests and raw, stupid greed. They’re job creators! And Jason Kenney’s government has to spend all that money they’re going to save with the healthcare overhaul somewhere.

Information for this briefing was found via Sedar and Aurora Cannabis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Galaxy Brain: Aurora Charting a Course through the Cannabis Supply Glut

For this weekend’s special piece, Deep Dive author Matthew Cox breaks down the Health Canada...