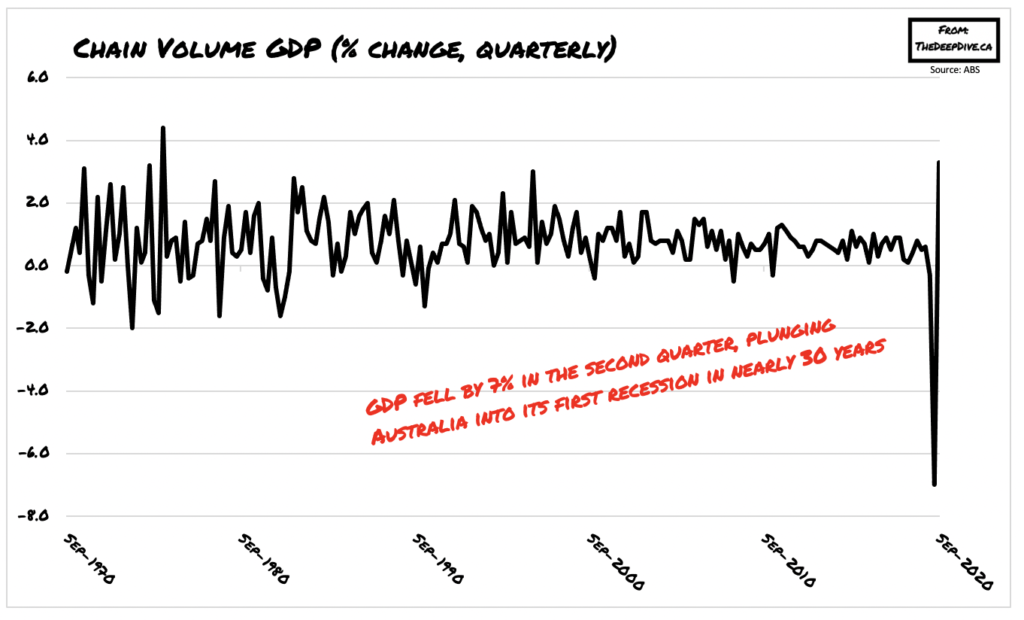

The coronavirus pandemic has brought on unprecedented economic contractions across many major economies, especially Australia’s. The country plunged into a recession not seen in nearly 30 years in the second quarter of 2020, and now it appears that any optimism of reaching those pre-pandemic growth levels is dwindling – and fast.

According to a Capital Economics research note seen by CNBC, Australia’s economy has been left so ravaged by the coronavirus pandemic that its current trade tensions with China may be the final blow for the country’s prospects of reaching pre-pandemic GDP growth. China, which is Australia’s largest trading partner, accounted for 17.6% and 39.4% of goods and services exports, respectively, between 2019 and 2020. According to Capital Economics though, Australia’s exports to the communist country could decline significantly if Beijing decides to pile on additional tariffs.

Some of Australia’s goods and services that are currently on the ‘chopping block’ account for nearly a quarter of the country’s exports to China, translating to 1.8% of its economic output. However, that figure could increase substantially to as high as 2.8% if China decides to target other Australian products in the near future. In fact, some of the tariffs imposed by Beijing have been so detrimental to Australia, that Canberra launched a World Trade Organization probe in December in response to China’s trade levies that exceeded 80% last spring.

Tensions between the two countries have been escalating in recent years, especially after Canberra banned Huawei and ZTE from rolling out its 5G technology in the country. Then, the relationship soured even further after Australia initiated an international probe into the origins of the coronavirus outbreak, which in turn prompted accusations from China alleging that Australian lawmakers were only acting on behalf of Washington.

According to Capital Economics though, further restrictions by Beijing could very well come including exports of gold, alumina, and other numerous smaller items. While Australia may be able to redirect some of its Chinese-bound exports to other countries, the intensifying trade war will likely hinder any future economic prospects of reaching pre-virus expansion once the pandemic subsides. That being said, Capital Economics predicts that Australia’s GDP could be deprived of its pre-pandemic trajectory by as much as 1.5% by the end of 2022. And in the event of additional trade restrictions, that gap could widen even further.

Information for this briefing was found via CNBC and the Australian Bureau of Statistics. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.