Australian consumer prices soared by the most in over three decades as food and energy costs skyrocket.

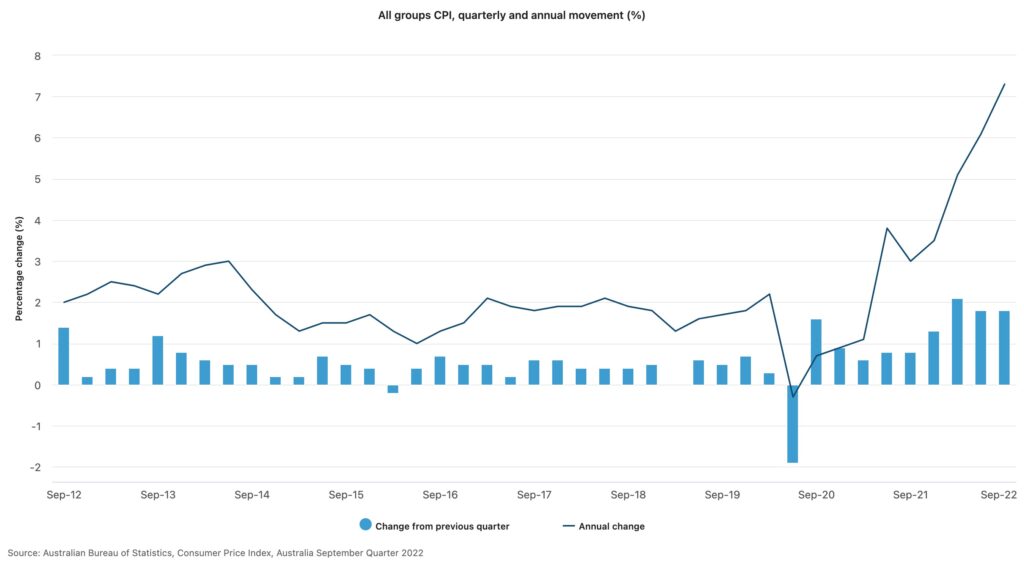

Latest data from the Australian Bureau of Statistics showed consumer prices jumped 1.8% in the last quarter, and were up 7.3% year-over-year in September, marking the largest annual increase since 1990. The surge in CPI exceeded forecasts calling for a quarterly print of 1.6%, largely due to out-of-control food and energy costs, as well as new home purchases. The report showed that natural gas and other households fuels costs skyrocketed nearly 11% between July and September, while the price of food was up 9% from one year ago.

“Whether it’s food, whether it’s electricity, whether it’s rent, inflation is public enemy number one. Inflation is the dragon we need to slay,” said Australia Treasurer Jim Chalmers, as cited by SBS News. Despite the alarming rise in consumer prices, The Australian government refused to include additional cost of living relief measures in the latest budget, insisting that such spending would be detrimental to the country’s economic wellbeing.

“What the budget has done is to provide responsible economic management at the right time. It’s aimed at making sure that we protect the Australian economy and protect the Australian people from the sort of experience that we’re seeing overseas,” said Prime Minister Anthony Albanese. “We haven’t played short-term politics with this, what we’ve done is put in place measures that will grow the economy that will make it more resilient, while providing cost of living relief in a way that doesn’t put upward pressure on inflation and damage the economy.”

Still, Australia’s inflation problem is expected to get even worse this quarter. Not only is recent flooding across the eastern part of the country going to drive food costs higher in the immediate term, but economists are now predicting the CPI figure will reach an annualized 8% come the fourth quarter. “The stronger-than-expected rise in consumer prices is consistent with our forecast that the Reserve Bank of Australia will hike rates more aggressively than most anticipate,” said Capital Economics senior economist Marcel Thieliant, as quoted by Reuters.

The RBA has raised rates for six straight months to combat surging price pressures, with policy makers expecting inflation in Australia to reach 7.75% this year before subsiding to around 4% in 2023 and 3% come 2024.

Information for this briefing was found via the ABS and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.