In a Hail Mary attempt to save face in what is turning out to be one of the Fed’s worst policy blunders, Chairman Jerome Powell admitted that interest rates need to increase at a more rapid pace in a wishful thinking attempt to bring inflation near 2% within the next three years.

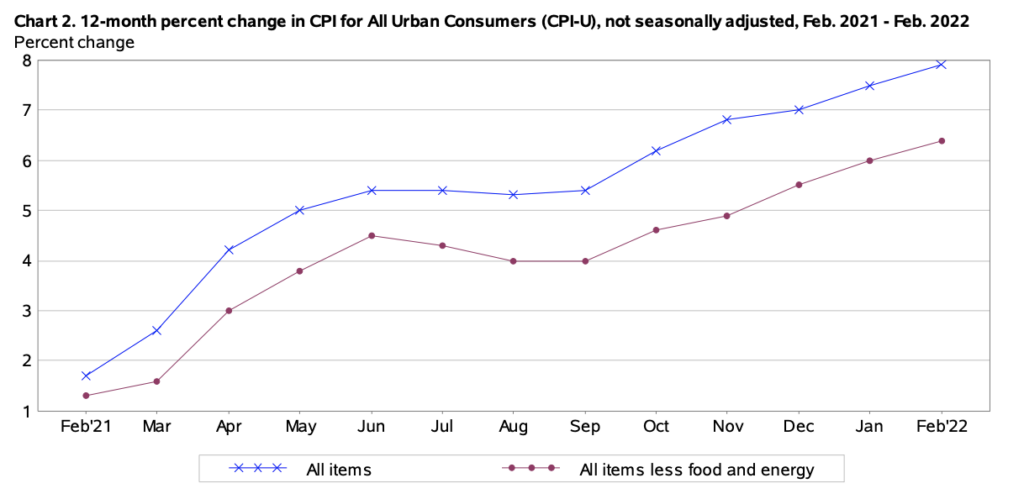

With respect to a strong rebound in the labour market and surging inflation, “there is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level,” Powell acknowledged in his speech at the Annual Economic Policy Conference of the National Association for Business Economics on Monday. The Federal Reserve last week raised the benchmark range by 25 basis points to 0.25%- 0.5%, in an attempt to curb an annual inflation rate of 7.9%— a level not witnessed in 40 years.

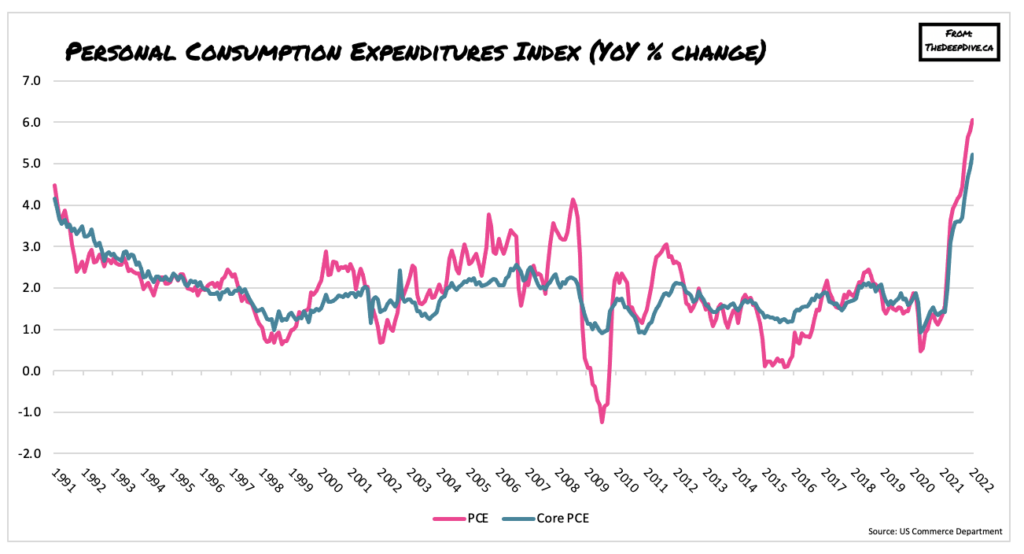

Meanwhile, the 12-month core PCE index— the central bank’s preferred inflation gauge— hit 5.2% in January, marking the highest level since April 1983. “I believe that [our] policy actions and those to come will help bring inflation down near 2% over the next three years,” Powell reassured, adding that the central bank may even consider a larger rate increase during any of the upcoming policy meetings, such as 50 basis points even.

Atlanta Fed President Raphael Bostic reiterated Powell’s stance, agreeing that “we need to get as quickly as we can to neutral.” Bostic is expecting at least six rate hikes throughout the remainder of the year, followed by another two increases in 2023, before borrowing costs sit at 2.25%. However, such a task may not be that easy to accomplish, given that much of the new inflationary pressures are no longer necessarily stemming from ultra-accommodative monetary policies.

The inflation problem over the past two years was exasperated by pandemic-related supply chain disruptions, high demand for goods and services, and raw material shortages; however, the latest Ukraine crisis threatens to cast an even darker shadow over global markets, and send inflation levels much higher. “Russia’s invasion of Ukraine may have significant effects on the world economy and the US economy,” said Powell on Monday. “There is a lot of uncertainty in the world and in the economy today,” added Bostic.

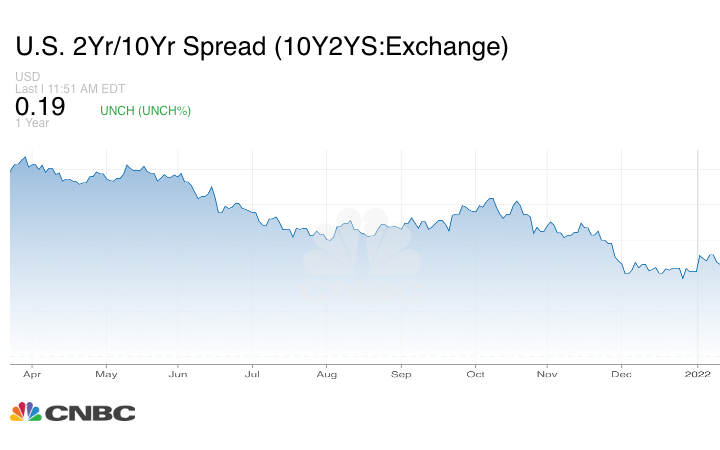

Indeed, both Powell and Bostic are right with respect to the uncertainty surrounding the mounting conflict in eastern Europe, but it doesn’t take an economist to realize that the most likely impending scenario is another recession. The spread between the 2-year and 10-year yield continues to inch narrower, and if there is anything that history tells us, its that yield curve inversions have accurately predicted all recessions in the past 60 years.

Don’t raise rates fast enough and inflation spirals even higher, raise rates too fast and risk sending the economy into an abrupt recession. It appears the Fed is caught between a rock and a hard place— but that is just the beginning of the headache. The inflation problem isn’t just going to disappear overnight with each 25 basis point increase in borrowing costs— if anything, it will keep getting much, much worse.

#inflation defeated 👍🏻 #Fed #jeromepowell pic.twitter.com/D84P7qeczI

— RD ₿TC (@RD_btc) March 17, 2022

The problem is, the US economy is hooked on a life support of cheap borrowing costs, and raising rates— even just incrementally, will likely spark a withdrawal, because markets and consumers are addicted to borrowing and spending money. So, not only is the economy going to face rising prices but also higher interest rates, and when no one is borrowing or spending money, the economy comes to an abrupt halt. What is Powell going to do then?

Information for this briefing was found via CNBC and Twitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.