The S&P 500 Index is down around 5% since late November 2022 and 20% from its all-time high in early January 2022. Nevertheless, the index is holding up well on a valuation basis. Based on consensus, bottom-up analysts’ 2023E earnings estimates of around US$232.50 (which, if achieved, would be the highest level of Index earnings ever), the market trades at a 16.5x forward earnings multiple. If one were instead to utilize JPMorgan’s recent US$205 projection for 2023 S&P 500 Index earnings, the forward multiple jumps to nearly 19x. Neither figure represents a discounted ratio even though interest rates have risen markedly over the last nine months.

Clearly investors are pricing in either no recession in 2023 or just a mild, short downturn. However, various pieces of anecdotal evidence, including auto loan delinquency data (see below), seem to argue against such an optimistic scenario.

This morning I discovered something *extremely* alarming happening in the car market, specifically in auto lending.

— CarDealershipGuy (@GuyDealership) December 16, 2022

I'm now convinced that there is a massive wave of car repossessions coming in 2023.

Here's what I discovered (and what no one knows):

According to NBC News, Generation Z (those born after 1994) and millennials (those born between 1980 and 1994) currently have auto loan past-due rates of 2.21% and 2.14%, respectively. These figures are markedly higher than the 1.75% and 1.66% rates, also respectively, before the COVID pandemic.

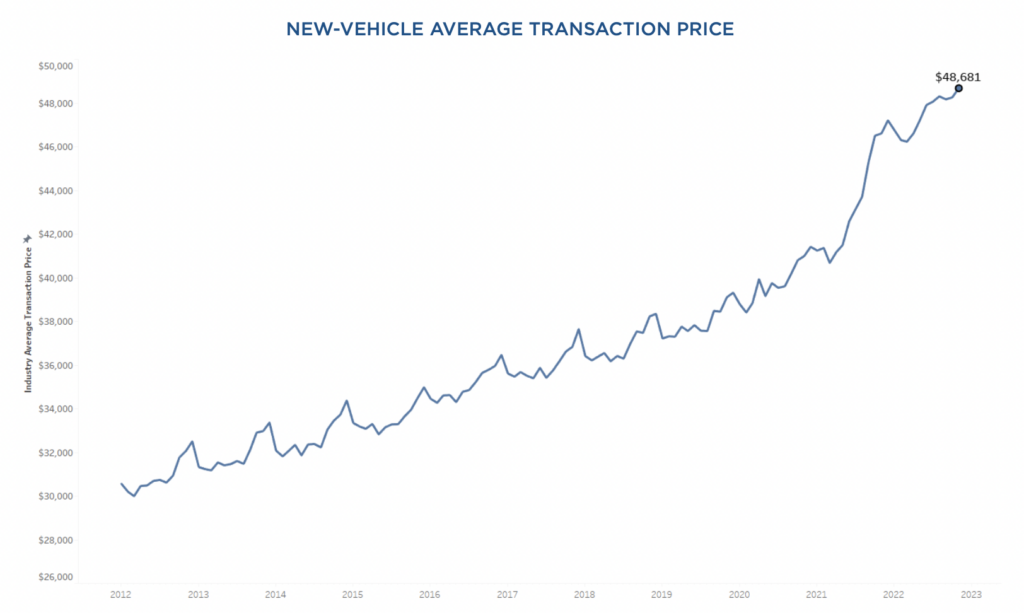

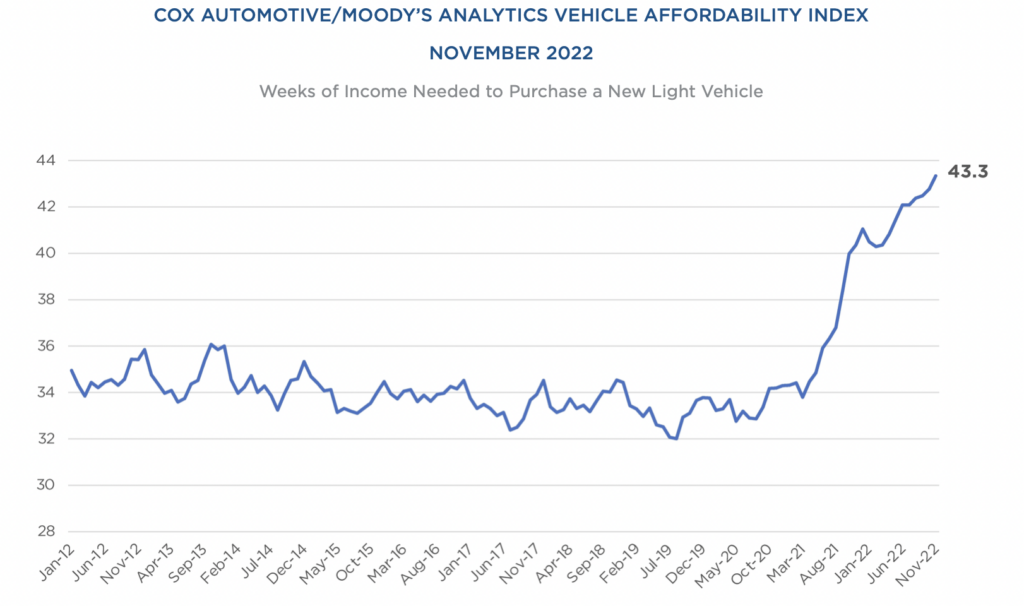

A big factor in all this has been consumers’ willingness to stretch their budgets to buy a vehicle and, of course, banks/finance companies’ willingness to provide the necessary funding. Now, as auto loan rates reach 20-year highs and car prices reach all-time peaks, vehicle affordability is becoming an obstacle for many consumers.

The median number of weeks of income required to purchase a new car has jumped to an astounding 43.3 weeks, per Cox Automotive/Moody’s Analytics. As recently as the spring of 2021, a consumer only had to lay out about 34 weeks of pay to buy a new vehicle. Furthermore, weeks of income required to buy had oscillated around this 34-week figure since at least 2012 before exploding higher beginning in mid-2021.

Related to all this is the substantial increase in the typical monthly payment associated with the purchase of a new car. As vehicle prices and interest rates have risen, that monthly payment is now around US$762. Average payments were just US$576 in 2020, 25% less than current levels.

Given these extraordinary movements over the last two years in new car-related outlays, it would not be surprising to see some adjustments. However, these adjustments could have decidedly negative implications for the economy.

Information for this briefing was found via the links provided and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.