The number of auto loan accounts considered severely delinquent has reached an all-time high in 2023, marking problematic symptoms in the embattled automotive industry.

In a Q1 2023 Industry Insights and Sales Forecast Call held by Cox Automotive, it was reported that the severe account delinquency rate (nonpaying loan accounts beyond sixty days) has surpassed a record high set in 2009. Analysts at the firm also noted that the rate of delinquencies are surpassing the surge of the heating interest rate environment.

*AUTO LOANS*

— Hedgeye (@Hedgeye) March 27, 2023

Severe account delinquencies reach record high. Data is from Cox Automotive and released today.

Probably nothing. pic.twitter.com/apPGgMk2NI

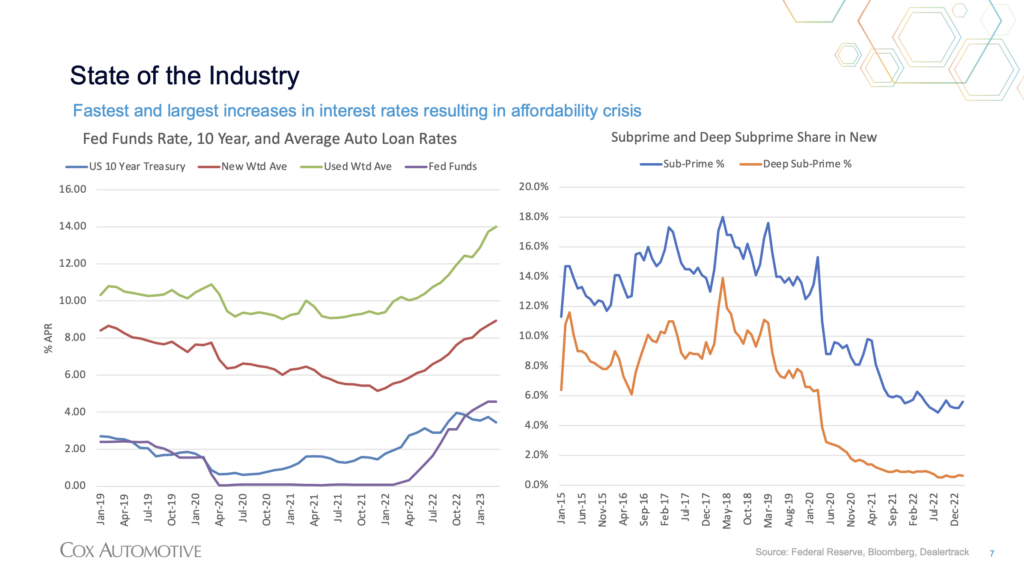

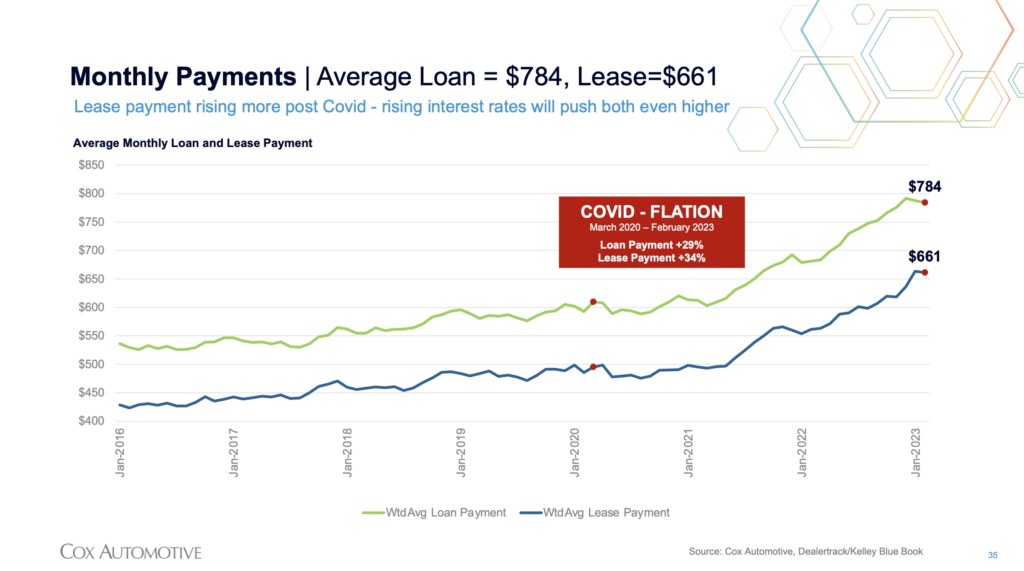

One of the reasons stems from the “fastest and largest increase in interest rates” which is causing a so-called affordability crisis. The firm noted that weighted average auto loan rates for new and used vehicles are at its highest at around 9% and 14%, respectively, coinciding with the rate hikes.

The affordability crisis is prominent in subprime and deep subprime borrowers, as their respective share in new vehicle purchases are at an all-time low.

Last week, the Federal Reserve hiked the fund rate another 25 basis points, bringing it to a range between 4.75% to 5%.

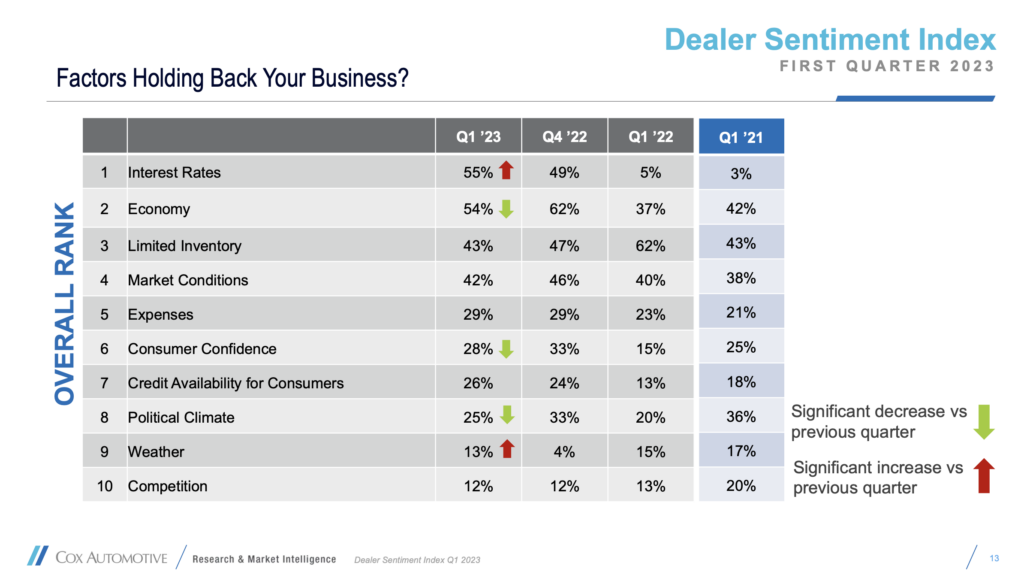

This also prompted auto dealers to put interest rates at the top of their list of factors they believe are holding back their business.

READ: Economic Headwinds? Subprime Auto Lender Shuts Its Doors With No Warning

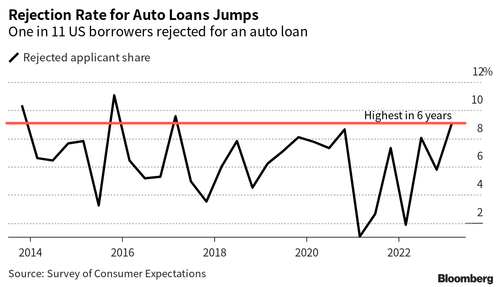

This comes after a new Federal Reserve Bank of New York survey showed that the auto loan denial rate increased to 9.1% in February, a six-year high, up from 5.8% in October.

The findings demonstrate how rising interest rates are limiting consumer borrowing in certain crucial areas, in accordance with the Fed’s goal of moderating inflation. Yet in recent days, the collapse of three American banks has stoked fears of a worsening credit crisis that risks sending the country into a catastrophe.

READ: Auto Loan Delinquency Trends Look Troubling

New vs. used

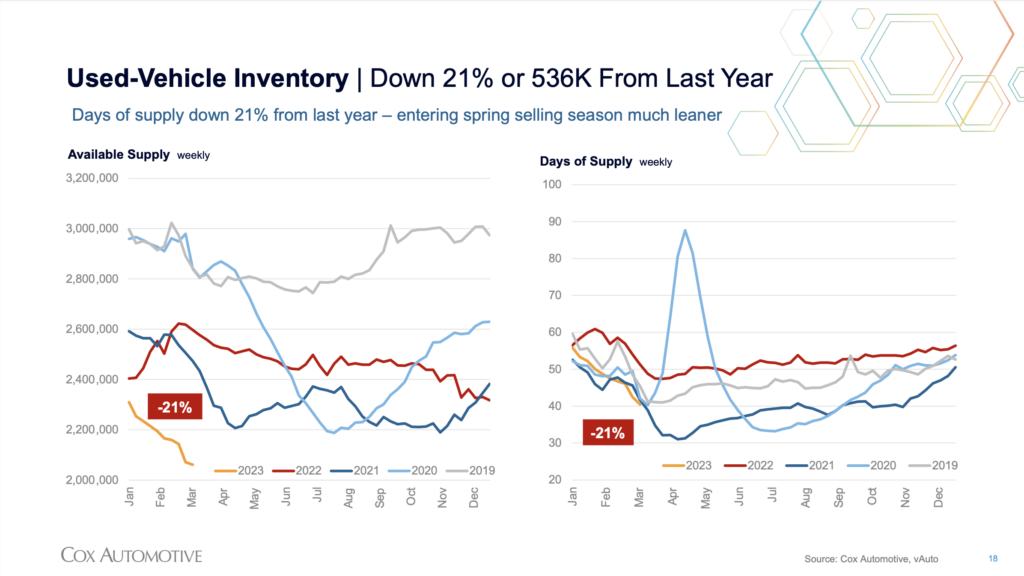

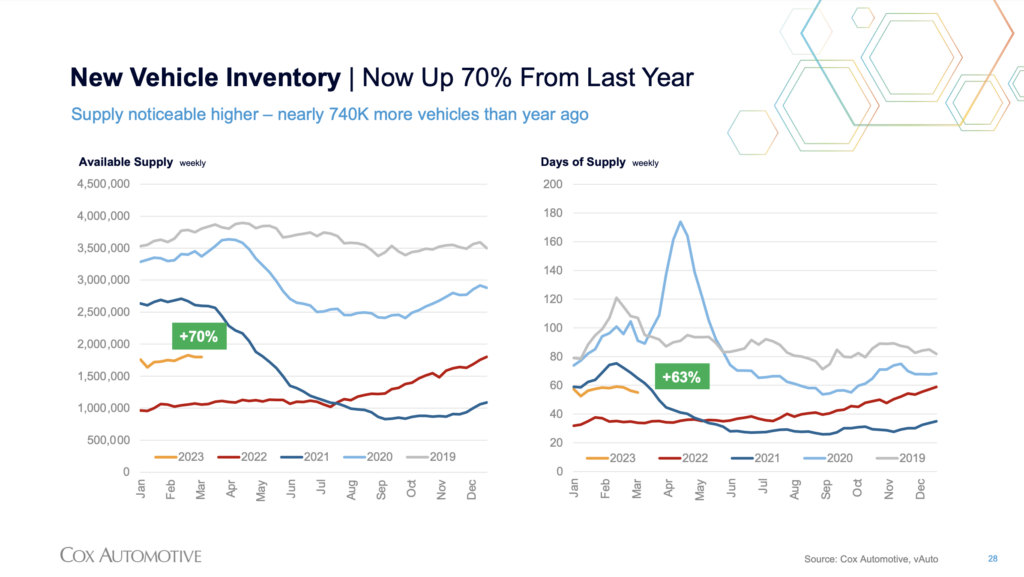

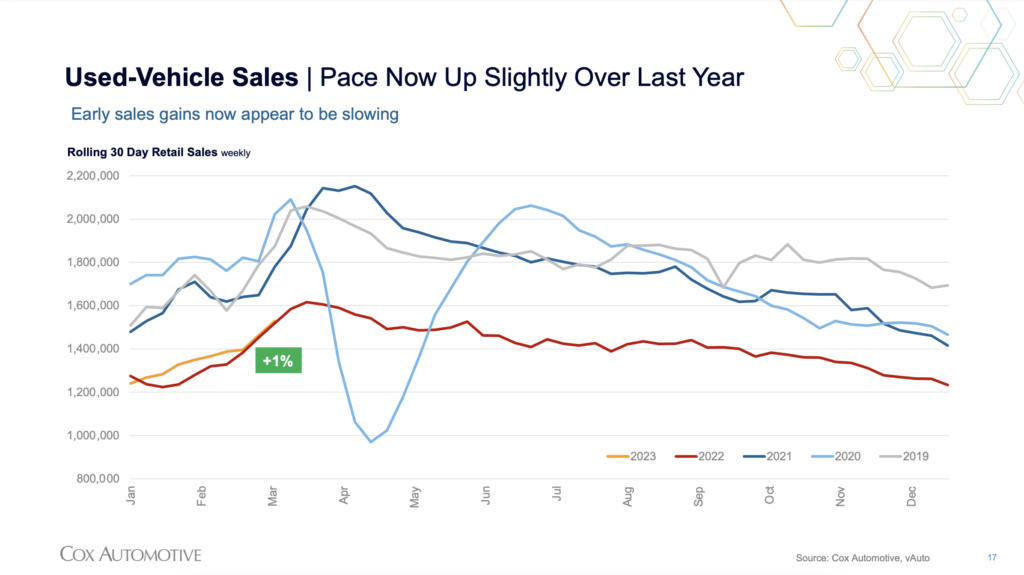

Cox Automotive noted a 21% decline in used vehicle inventory over the last year–and the lowest level in the past four years. This compares to a 70% increase in new vehicle inventory over the prior year.

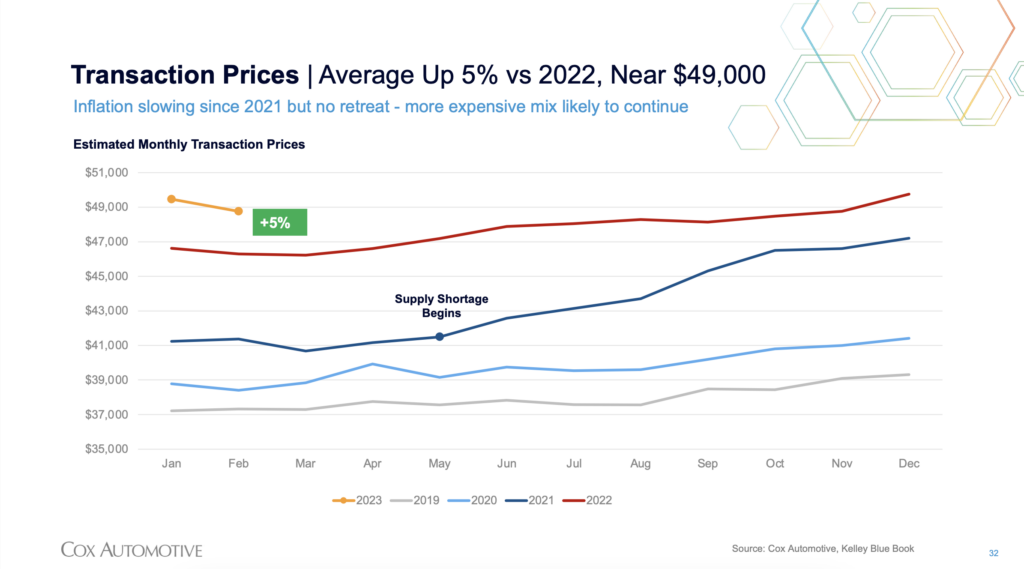

The hiking rates have also expectedly pushed monthly payments upwards, landing at the highest figure in the past seven years. Average transaction prices have also risen by 5% over last year.

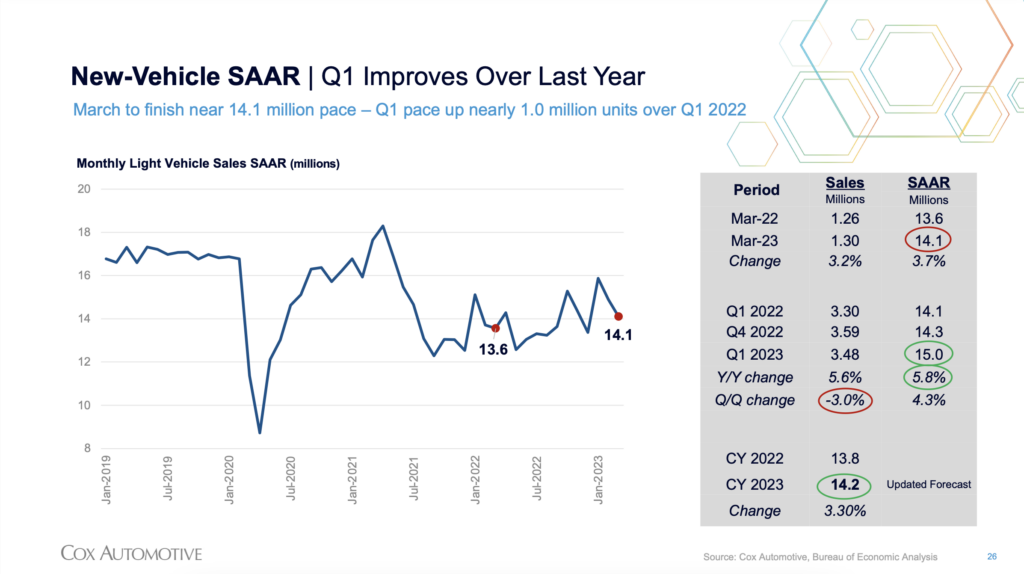

But despite this, automotive sales seems to be improving from last year, albeit at a slower pace. The seasonally adjusted annual rate for new vehicle sales increased by 3.7% over last year while used vehicle sales improved at least 1% over the prior period.

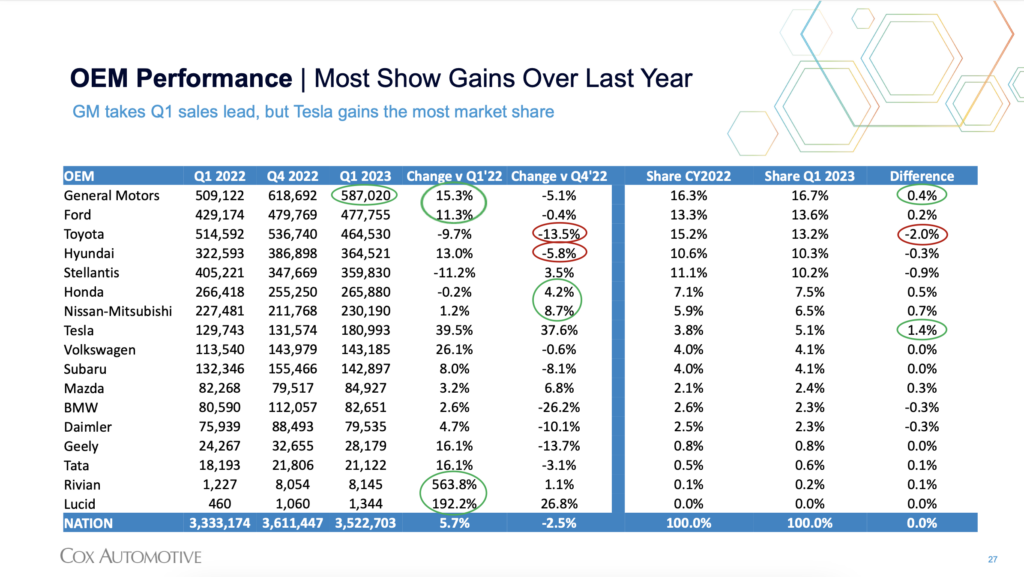

In terms of automakers, General Motors continue to lead the pack with the highest sales while Tesla has seen the highest improvement in vehicle unit sales amongst major automakers.

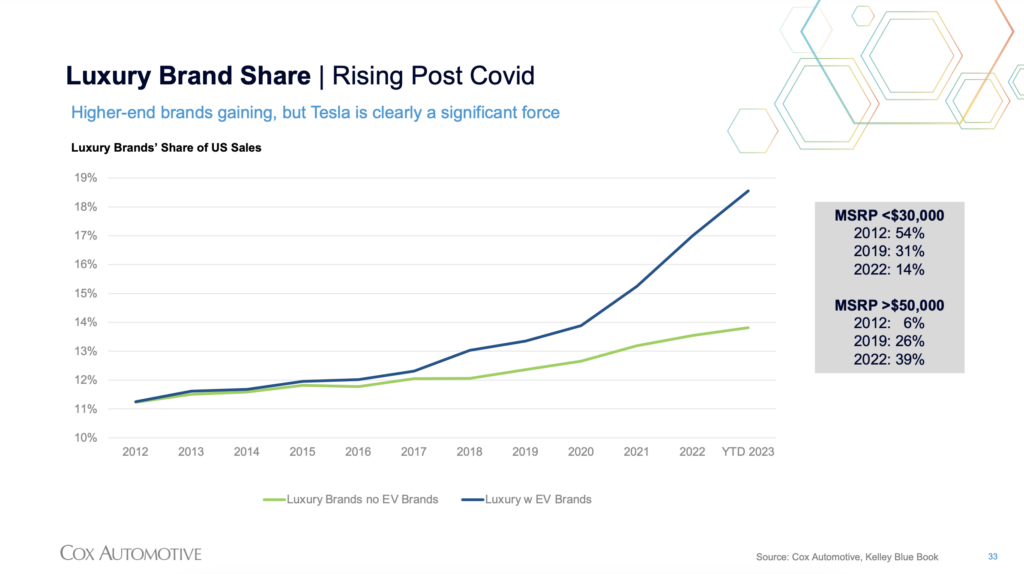

Luxury brand market share has also seen its highest increase in 2023, led by carmakers offering electric vehicles like Tesla.

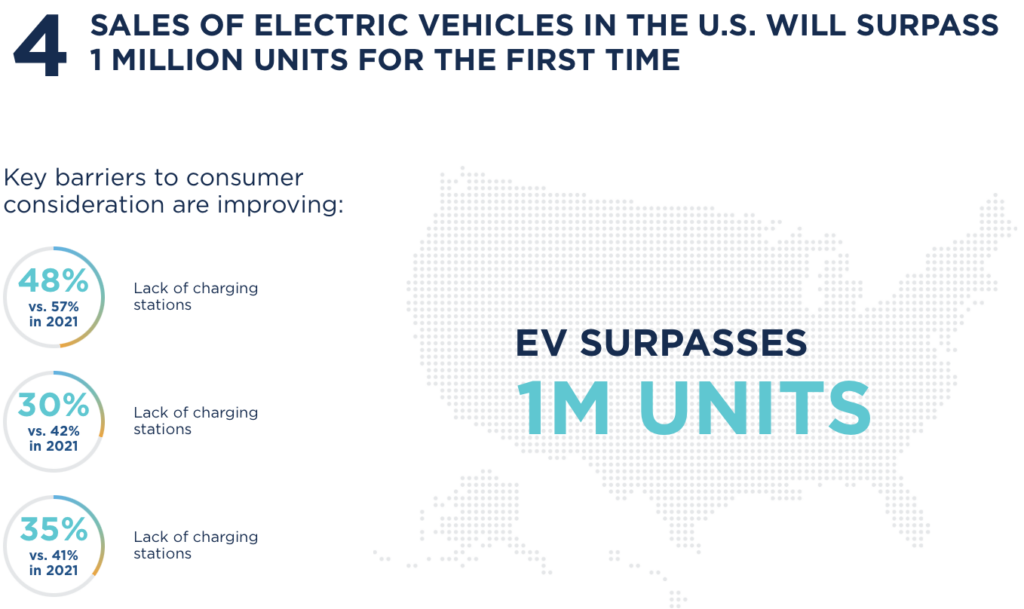

Relatedly, Cox Automotive included in their predictions for the rest of 2023 that electric vehicle sales will surpass 1 million for the first time in the US.

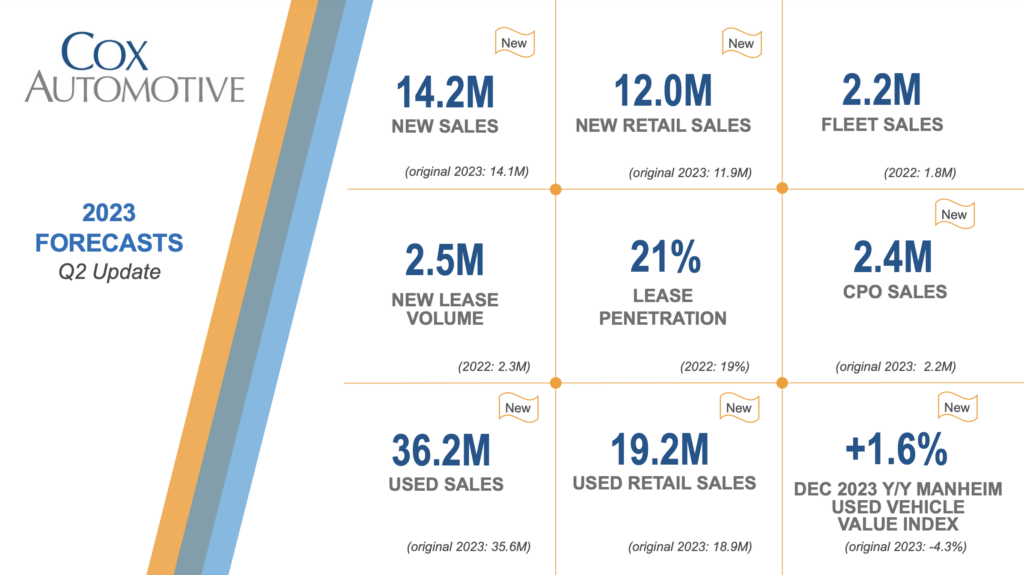

Despite the challenges, the outlook for the automotive industry ends on a positive note. The firm revised their guidance for the industry upwards, forecasting new vehicle sales to land at 14.2 million units and used vehicle sales to end at 36.2 million units.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.