This morning Canaccord upgraded Ayr Strategies’ (CSE: AYR.A) twelve month price target to C$45 from the prior target of C$40, while reiterating their speculative buy rating on the company. This follows Ayr announcing that they had closed their upsized US$110 million 12.5% senior secured debt financing, and the announcement that they had completed the exercise of three million warrants for U$25 million in proceeds.

Ayr Strategies currently has five analysts covering the company with a weighted 12-month price target of C$36.50. This is up from the average at the start of October, which was C$21.70. One analyst has a strong buy rating, while the other four have buy ratings.

Matt Bottomley, Canaccord’s cannabis analyst headlines, “Well-positioned for a catalyst-rich 2021.” Bottomley is updating their analysis of Ayr after multiple attractive M&A initiatives were announced, which will expand their footprint from Massachusetts and Nevada to higher growth states such as Pennsylvania, Arizona, and Ohio.

He then goes onto say that after last months strong third-quarter results, “we believe 2021 is chock-full of positive catalysts for the company, highlighted by the doubling of its retail footprint in Massachusetts (in addition to commencement of the adult-use contribution), and the entrance into Pennsylvania (the fastest growing medical market in the US) and Arizona (which legalized recreational cannabis via ballot initiative during the November presidential election).”

Bottomley believes that Ayr’s competitive positioning will only grow in the coming years and start to compete on fundamentals and exposure with many of the “household” leading cannabis names. Furthermore, Bottomley highlights that Ayr is well-capitalized after closing $135 million in proceeds and points to Ayr’s operational cash flow run rate of over $50 million.

He adds that Ayr’s five retail stores in Nevada have a run rate of over U$110 million, which puts the company in the running for being the market leader “in what is historically the largest tourist market in the US.”

Bottomley then projects that Ayr’s Massachusetts exposure will see sizeable upside next year and them entering Pennsylvania and Arizona provides the company, “with attractive exposure to two of the three best existing medical markets in the US to date.”

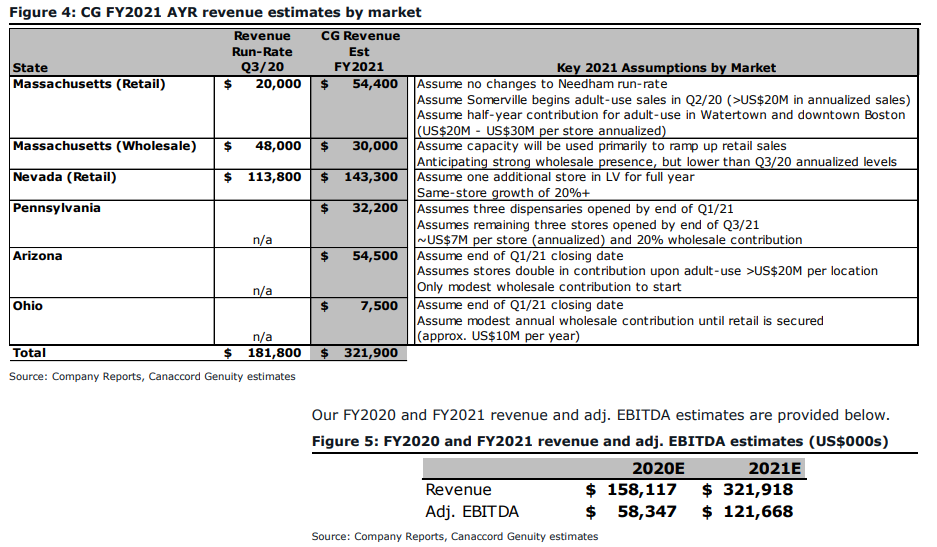

Below you can see Canaccord’s full-year 2021 revenue breakdown by state and its full-year 2020 and 2021 revenue and adjusted EBITDA forecasts.

Bottomley then ends the note by saying, “AYR currently trades at ~8.1x our 2021 EV/EBITDA, a discount to the overall MSO average of 11.7x and the larger-cap MSOs at ~15.5x,” and given the catalysts for the company in 2021, attractive growth profile and strong balance sheet, they would remain buyers at the current levels.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.